- Japan

- /

- Semiconductors

- /

- TSE:6920

Lasertec (TSE:6920) Sees 14% Share Price Rise Over Last Quarter

Reviewed by Simply Wall St

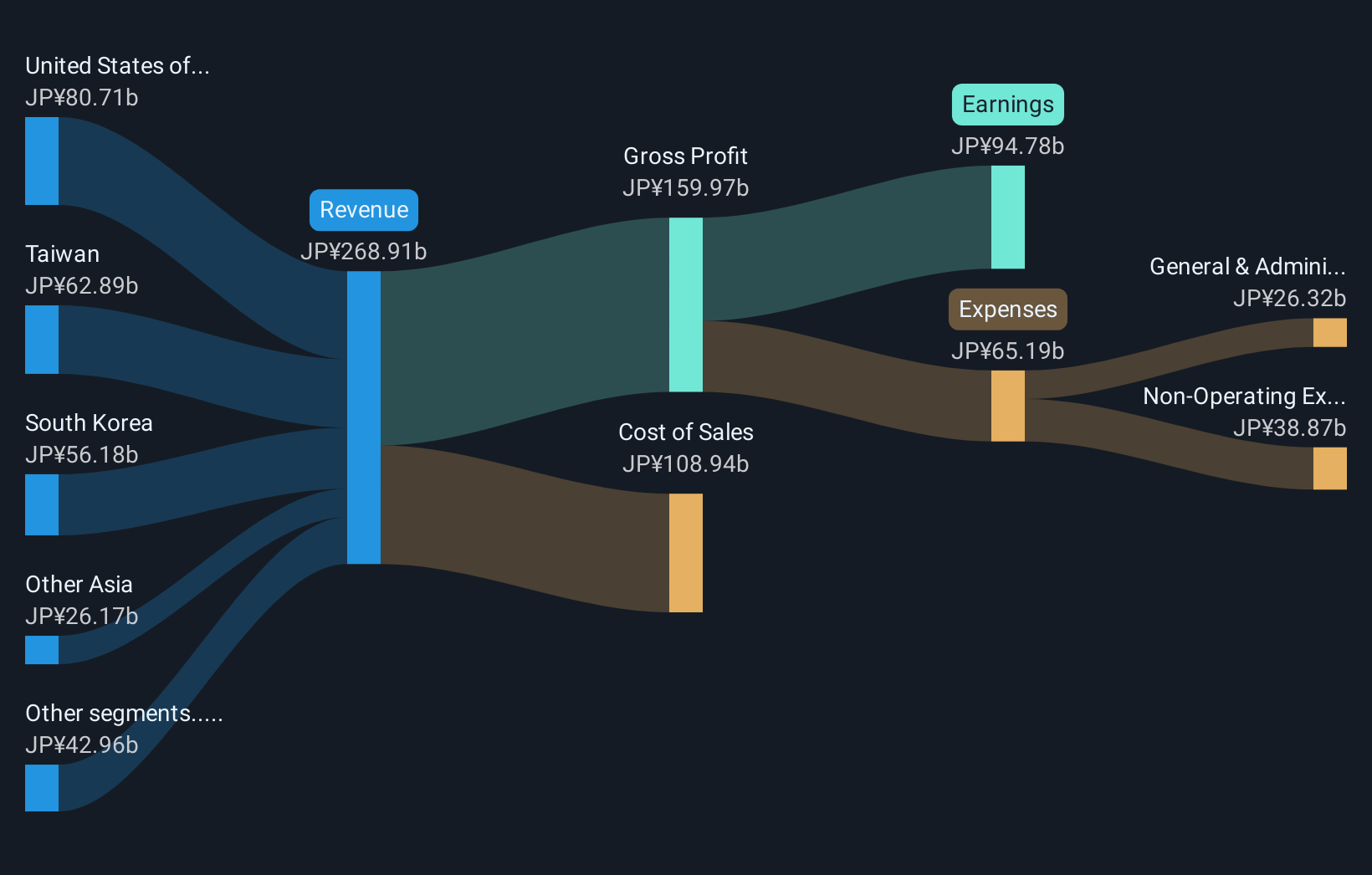

Lasertec (TSE:6920) saw a 14% rise in its share price over the last quarter, a period marked by significant developments, including the announcement of an increased final dividend for 2025 and guidance for future dividends. The company's share repurchase program aimed at enhancing corporate value was another contributing factor to investor optimism. Additionally, securing a new client investment from Canatu Plc to bolster its semiconductor capabilities further strengthened market confidence. These company-specific developments occurred against the backdrop of a general market upswing, where the Dow Jones and other major indices reached record highs, bolstered by expectations of potential interest rate cuts.

Over the past five years, Lasertec's shares have shown a significant increase of 100.45%, which provides a compelling backdrop against which to evaluate the company's recent activities. While this long-term growth is impressive, it's important to note that over the past year, Lasertec underperformed compared to the JP Semiconductor industry, which managed a 17% return. This underperformance could reflect specific challenges or sector dynamics affecting Lasertec during that period.

Recent developments, such as the rally in share prices, increased dividend announcements, and share repurchase initiatives, could bolster revenue and earnings forecasts. These actions might enhance investor confidence and contribute positively to the company's financial outlook. Despite the recent price increase, Lasertec’s share price at ¥16,600 lags behind the consensus price target of ¥17,491.07, suggesting that there is potential room for appreciation. However, caution is necessary, as forecasting shifts in price and earnings always involves some uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives