- Japan

- /

- Semiconductors

- /

- TSE:6920

Lasertec (TSE:6920): Reviewing Valuation After New 2026 Financial Projections Boost Investor Optimism

Reviewed by Simply Wall St

Lasertec (TSE:6920) just released its financial projections for the year ending June 2026, giving investors an early look at what the company expects in terms of revenue and profitability for the coming period.

See our latest analysis for Lasertec.

Lasertec’s latest guidance sparked strong momentum, with the 1-week share price return hitting an impressive 40.6% and a 30-day return of 53.8% as investors digested upbeat forecasts and the recently announced share buyback proposal. Looking at the bigger picture, the 1-year total shareholder return stands at 56.8%. The remarkable 5-year total return of 245.9% speaks to steady, long-term value creation for holders.

If Lasertec’s rally has you thinking broader, it could be worthwhile to explore fast growing stocks with high insider ownership.

Yet with shares surging well ahead of analyst targets and fundamentals growing at a slower pace, investors may wonder if Lasertec is overlooked by the market or if its future potential has already been factored into today’s lofty share price.

Price-to-Earnings of 29.2x: Is it justified?

Lasertec’s current price-to-earnings (P/E) ratio sits at 29.2x, which positions the stock above both its industry average and the estimated fair value multiple. This suggests investors are paying a premium based on expectations for future growth.

The price-to-earnings multiple reflects how much investors are willing to pay for each yen of earnings generated by the company. In high-growth sectors like semiconductors, higher valuations are sometimes explained by expectations of sustained profit expansion and market leadership.

For Lasertec, while earnings have grown briskly in recent years, the present P/E ratio is expensive compared to the JP Semiconductor industry average of 19.9x and the fair P/E estimate of 25.6x. This places the valuation at a high level that implies the market anticipates better profitability or growth than its sector peers, or it is rewarding the stock’s strong momentum.

Explore the SWS fair ratio for Lasertec

Result: Price-to-Earnings of 29.2x (OVERVALUED)

However, slower revenue and net income growth compared to share price gains could challenge the sustainability of Lasertec’s premium valuation in the near term.

Find out about the key risks to this Lasertec narrative.

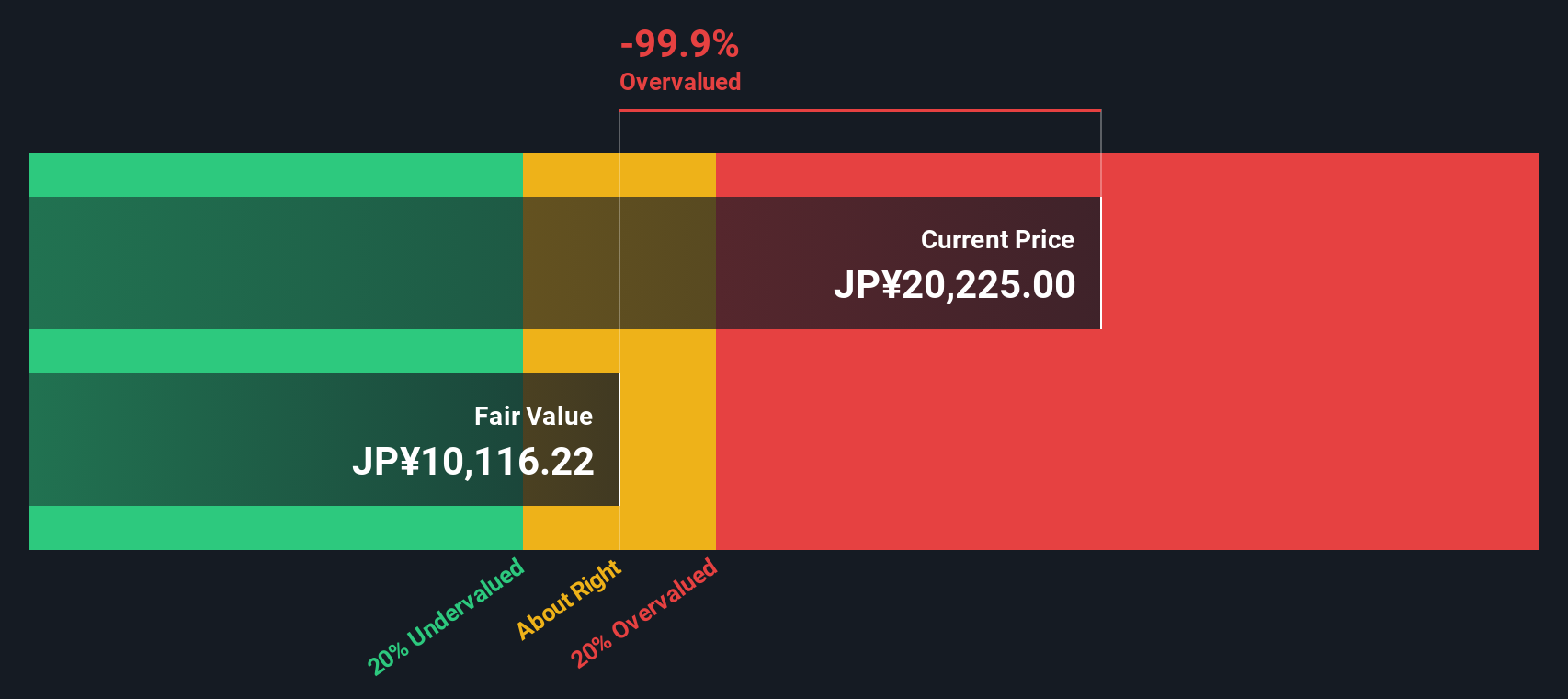

Another View: What Does the SWS DCF Model Say?

While the market’s price-to-earnings approach suggests optimism, our DCF model takes a different perspective. According to this cash flow-based valuation, Lasertec is trading far above its estimated fair value. This raises questions about whether market enthusiasm has run ahead of fundamentals. Will the price hold up if growth expectations aren’t met?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lasertec for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 841 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lasertec Narrative

If you see things differently or prefer to draw your own conclusions from the numbers, you can build a unique view in just a few minutes. So why not Do it your way.

A great starting point for your Lasertec research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let smart opportunities pass you by when forward-thinking stocks could be adding value to your portfolio. The key is targeting trends with real momentum.

- Turbocharge your search for reliable yield by checking out these 18 dividend stocks with yields > 3% that consistently deliver over 3% returns.

- Ride the wave of healthcare innovation and find breakthroughs backed by strong financials with these 33 healthcare AI stocks.

- Catch the digital future early by positioning yourself at the forefront with these 82 cryptocurrency and blockchain stocks shaping tomorrow’s payments and technology frameworks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives