- Japan

- /

- Semiconductors

- /

- TSE:6920

Lasertec (TSE:6920) Margin Expansion Challenges Cautious Growth Narratives in Latest Earnings

Reviewed by Simply Wall St

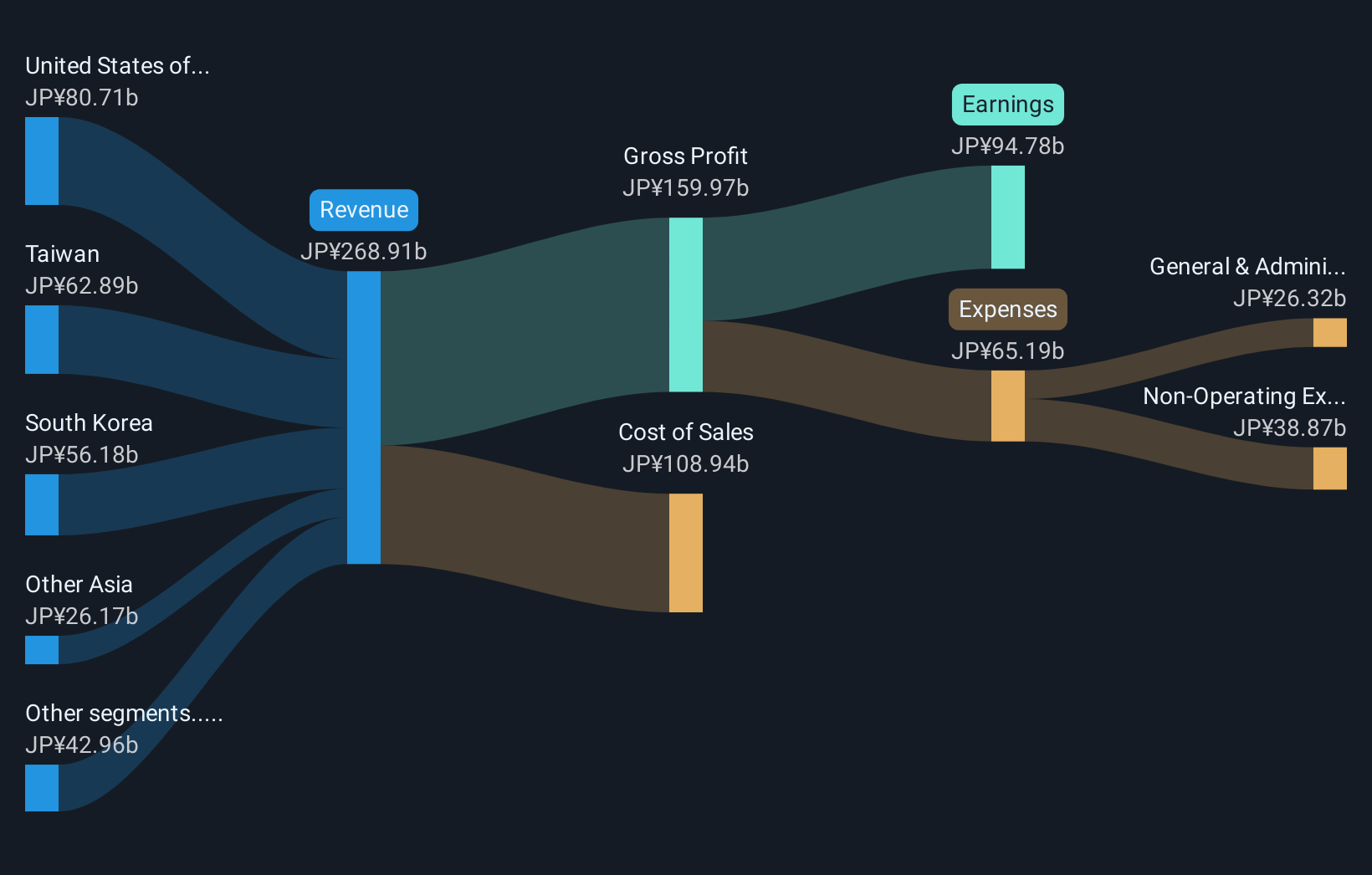

Lasertec (TSE:6920) delivered earnings growth of 57.2% in the past year, far outpacing its 5-year average earnings growth rate of 37.3% per year. Net profit margins expanded to 35.2%, up from 29.7% the previous year, marking a substantial leap in profitability. While Lasertec’s history of strong earnings and widening margins supports optimism, more moderate forward growth forecasts and higher-than-industry-average valuation may temper investor enthusiasm as they review the latest numbers.

See our full analysis for Lasertec.The next section sets these headline figures against the most popular narratives in the market, highlighting where consensus is supported and where fresh questions could emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Sustains Despite Growth Cooling

- Revenue is forecast to expand at just 3.2% per year, a notably slower pace compared to the 5-year average annual earnings growth rate of 37.3%. However, net profit margins have reached 35.2%, underscoring resilience in profitability even as top-line momentum moderates.

- Key arguments focus on Lasertec’s ability to leverage high-margin, niche semiconductor technology to offset sector cyclicality and slower sales growth.

- The company's role in advanced EUV lithography equipment supports premium pricing and margin retention. The margin increase provides tangible evidence for this advantage.

- What is surprising is that, despite a sharp decrease in forecast growth rates, margin strength so far continues to challenge critics who expect profit quality to erode as demand normalizes.

Valuation Premium Widens Versus Industry

- Lasertec is trading at a price-to-earnings (P/E) ratio of 27, positioned well below its direct peer average of 39.4 but significantly above the Japanese semiconductor industry average of 19.7. The current share price of 28,410 has risen above fair value signals such as the DCF fair value of 9,911.36.

- The prevailing perspective recognizes Lasertec’s sector leadership as justification for its valuation premium, but also flags downside risk tied to high multiples.

- Trading at nearly three times its estimated DCF fair value puts heavy reliance on continued margin and technology leadership. Any disappointment on growth or sector sentiment could rapidly challenge this premium.

- While peer comparisons show Lasertec as more reasonable than some global rivals, the large gap to industry norms and intrinsic value raises caution for new buyers expecting easy upside from current levels.

Share Price Volatility Flags a Near-Term Risk

- Share price stability has emerged as a principal risk, with market participants wary of sharp moves in sector stocks over the past three months, especially given concerns about cyclical downturns and reliance on a few large customers.

- Analysis highlights a tension between strong long-term profitability trends and shorter-term volatility, as robust earnings history does not always shield a stock from swings triggered by external macro or sector shocks.

- Bears argue heightened valuation increases sensitivity to bad news and cite the risk of sector pullbacks combined with Lasertec’s concentrated customer exposure as potential sources of sharp share price corrections.

- Meanwhile, ongoing momentum in high-performance computing and EUV inspection could act as a buffer, but investors must weigh this against the clear pattern of recent price swings.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Lasertec's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Lasertec’s rich valuation and increased short-term volatility highlight uncertainty for investors hoping for reliable upside at current price levels.

If you want to target opportunities with more attractive entry points, use these 831 undervalued stocks based on cash flows to discover stocks that appear undervalued based on their cash flows right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives