- Japan

- /

- Semiconductors

- /

- TSE:6920

How Investors Are Reacting To Lasertec (TSE:6920) Unveiling Its High-Throughput A200 HiT Tool

Reviewed by Sasha Jovanovic

- In recent news, Bernstein upgraded Lasertec Corp. to Market Perform after the company introduced its A200 HiT tool, which triples throughput compared to prior models and addresses production bottlenecks for major semiconductor clients such as TSMC.

- This technological advancement is expected to significantly expand Lasertec’s addressable market, as it directly tackles adoption challenges in wafer fab inspection processes.

- We'll explore how Lasertec's breakthrough with the A200 HiT tool could reshape the company's investment narrative and future prospects.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Lasertec's Investment Narrative?

For anyone considering Lasertec as an investment, the big picture often centers around the company’s role as a technology enabler in advanced semiconductor manufacturing, specifically through inspection systems vital for clients like TSMC. The recent Bernstein upgrade and headline-making launch of the A200 HiT tool have introduced a new catalyst that could materially influence sentiment and the company’s near-term prospects. With its threefold improvement in throughput, the A200 HiT directly addresses production bottlenecks and might help expand Lasertec’s customer base or deepen existing relationships. This reduction in technical risk could change the near-term outlook, particularly where adoption uncertainty had previously weighed on the story. At the same time, rapid valuation expansion and the still relatively inexperienced board and management bring to the forefront risks associated with execution and governance. The impact of the new tool on financials and guidance will be closely watched, as the company must prove its innovation translates into sustained profit growth.

Yet, even as the pipeline looks promising, execution risks on sales targets and governance changes remain important to watch.

Exploring Other Perspectives

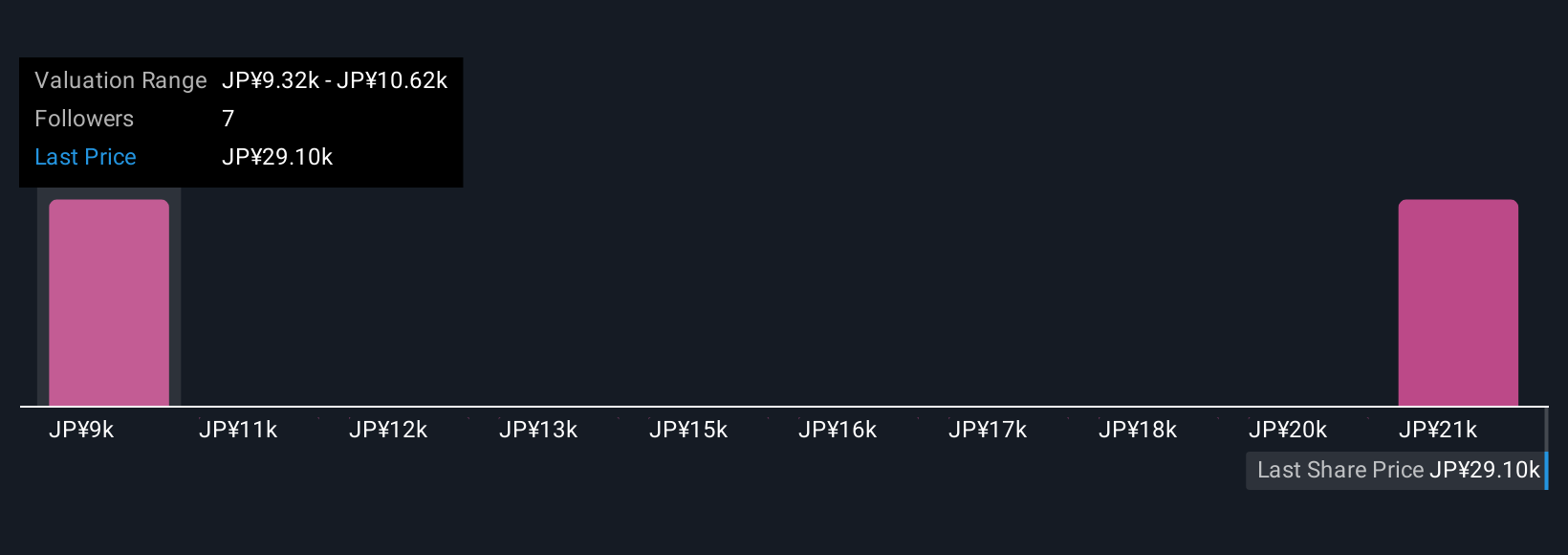

Explore 3 other fair value estimates on Lasertec - why the stock might be worth as much as ¥21212!

Build Your Own Lasertec Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lasertec research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lasertec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lasertec's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives