Stock Analysis

- Japan

- /

- Semiconductors

- /

- TSE:6920

High Insider Ownership Growth Stocks On The Japanese Exchange May 2024

Reviewed by Simply Wall St

As of May 2024, the Japanese market has shown resilience amid global economic fluctuations, with recent data indicating a recovery in manufacturing activity. However, the broader indices like the Nikkei 225 and TOPIX have faced slight declines, tracking international trends and domestic monetary policy adjustments. In this context, examining growth companies with high insider ownership on the Japanese exchange could offer valuable insights into firms that potentially have enhanced stability and commitment from those most intimately aware of their operations.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.4% | 27.2% |

| Hottolink (TSE:3680) | 27% | 57.3% |

| Micronics Japan (TSE:6871) | 15.3% | 39.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 35.4% | 44.6% |

| ExaWizards (TSE:4259) | 24.8% | 80.2% |

| Money Forward (TSE:3994) | 21.4% | 63.5% |

| Medley (TSE:4480) | 34% | 24.4% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

| Soracom (TSE:147A) | 17.2% | 59.1% |

| freee K.K (TSE:4478) | 24% | 82.7% |

Underneath we present a selection of stocks filtered out by our screen.

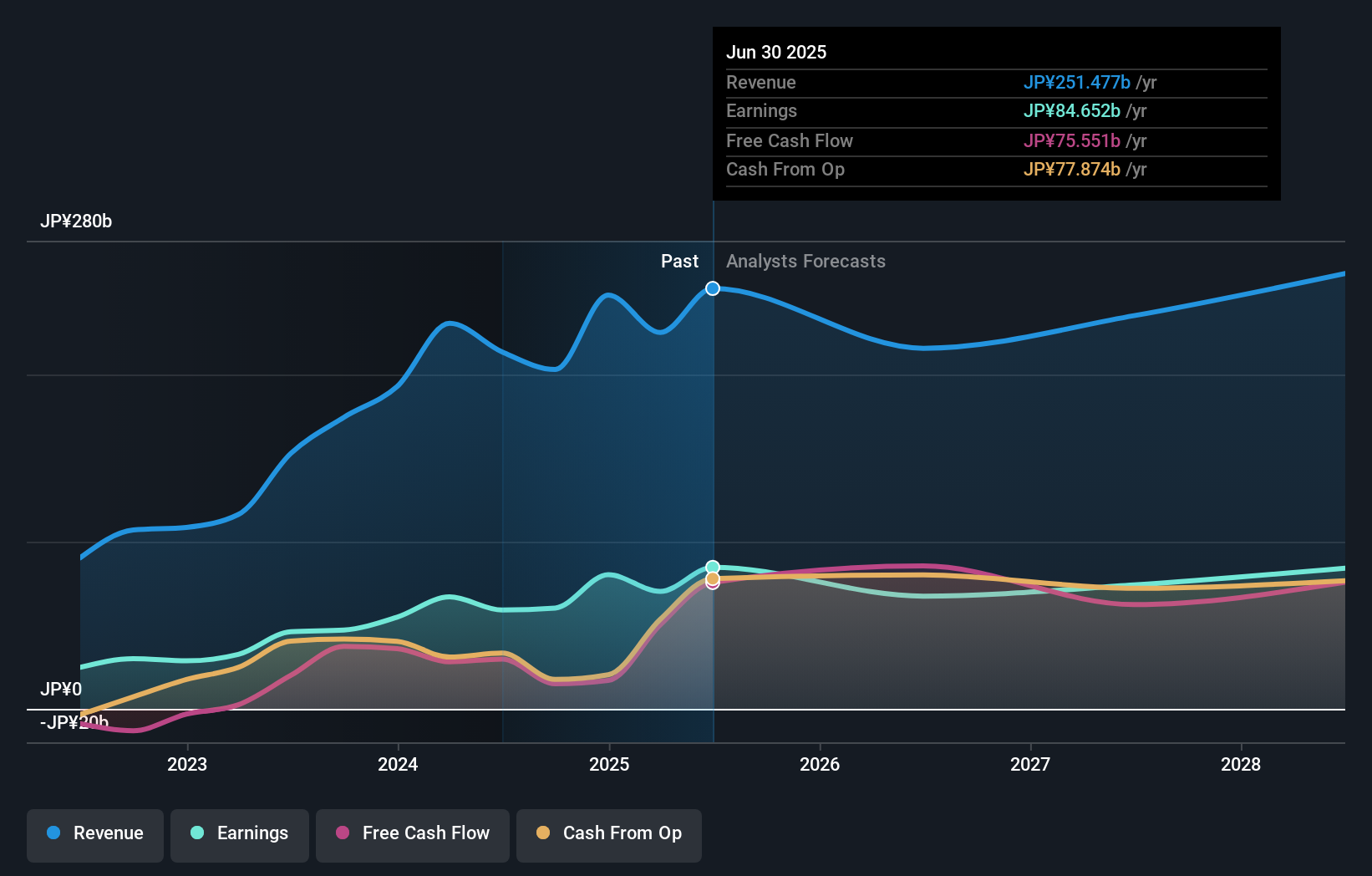

PeptiDream (TSE:4587)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PeptiDream Inc. is a biopharmaceutical company focused on the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics, with a market capitalization of approximately ¥250.99 billion.

Operations: The company generates revenue through its biopharmaceutical activities, focusing on the development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics.

Insider Ownership: 26.1%

Earnings Growth Forecast: 24.7% p.a.

PeptiDream, a Japanese biotech firm, recently revised its 2024 earnings guidance upwards significantly due to robust operational performance, projecting an operating profit of JPY 20.1 billion. This optimism is bolstered by a lucrative expansion in its collaboration with Novartis, involving an upfront payment of US$180 million and potential future payments up to US$2.71 billion based on milestone achievements. Despite these positive developments, PeptiDream's profit margins have declined from the previous year and the company's share price remains highly volatile.

- Get an in-depth perspective on PeptiDream's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that PeptiDream's current price could be inflated.

Mimaki Engineering (TSE:6638)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mimaki Engineering Co., Ltd. is a company based in Japan that specializes in developing, manufacturing, and selling computer devices and software both domestically and internationally, with a market capitalization of approximately ¥50.94 billion.

Operations: Mimaki Engineering generates revenue from various geographical segments, with ¥62.31 billion from Japan/Asia/Oceania, ¥21.49 billion from North/Latin America, and ¥24.29 billion from Europe/Middle East/Africa.

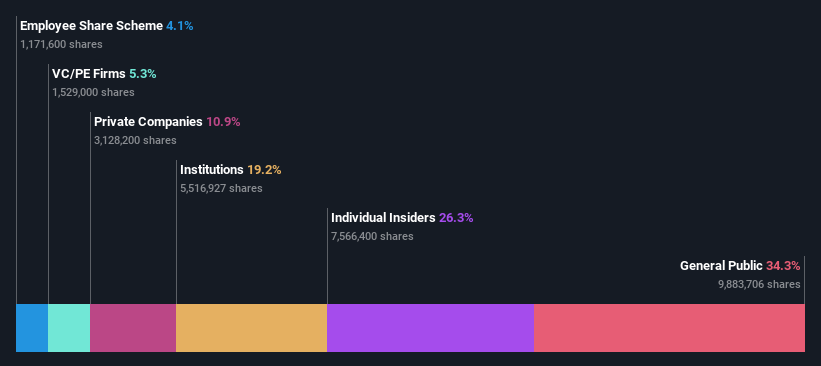

Insider Ownership: 26.3%

Earnings Growth Forecast: 20.2% p.a.

Mimaki Engineering, a Japanese company with high insider ownership, is poised for significant growth with earnings expected to increase by 20.23% annually. Despite a volatile share price and an unstable dividend track record, the firm forecasts robust sales and profit growth in its recent guidance for 2025, projecting net sales of JPY 80.8 billion and a profit of JPY 4 billion. Trading at 48.2% below estimated fair value suggests potential undervaluation relative to its peers.

- Delve into the full analysis future growth report here for a deeper understanding of Mimaki Engineering.

- Our comprehensive valuation report raises the possibility that Mimaki Engineering is priced lower than what may be justified by its financials.

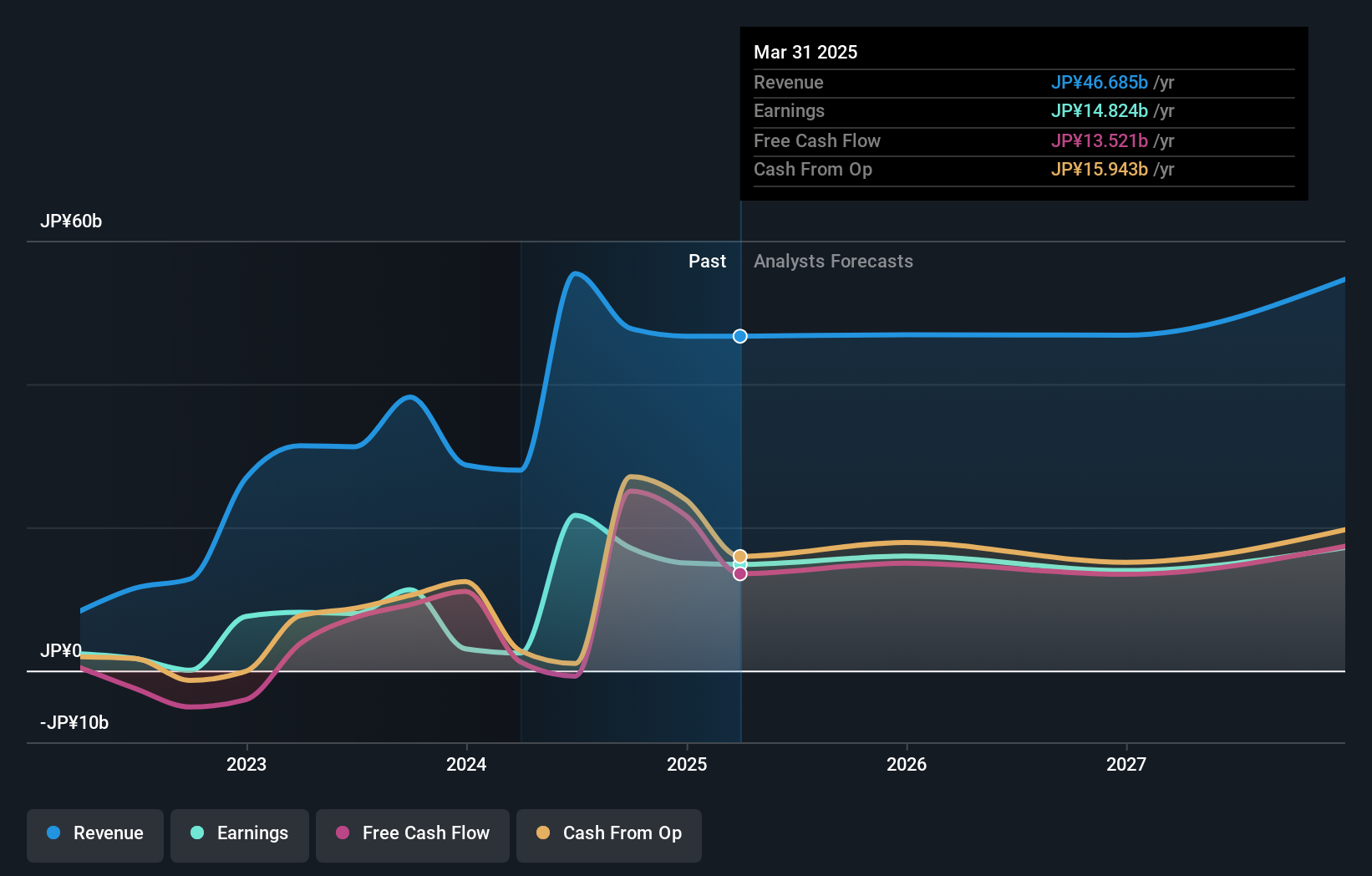

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lasertec Corporation specializes in designing, manufacturing, and selling inspection and measurement equipment both in Japan and internationally, with a market capitalization of approximately ¥3.92 trillion.

Operations: The company generates revenue through the design, production, and sale of inspection and measurement systems globally.

Insider Ownership: 12.1%

Earnings Growth Forecast: 20.7% p.a.

Lasertec, a Japanese growth company with high insider ownership, is experiencing robust earnings and revenue expansion. Earnings have surged by 105.6% over the past year and are projected to grow at 20.71% annually, outpacing the JP market average. Recent executive changes aim to bolster this trajectory, with Tetsuya Sendoda stepping in as CEO, potentially bringing fresh strategic insights to foster further growth amidst a volatile share price environment.

- Click here to discover the nuances of Lasertec with our detailed analytical future growth report.

- Our expertly prepared valuation report Lasertec implies its share price may be too high.

Key Takeaways

- Click here to access our complete index of 108 Fast Growing Japanese Companies With High Insider Ownership.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Lasertec is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Flawless balance sheet with high growth potential.