- Japan

- /

- Semiconductors

- /

- TSE:6871

Micronics Japan (TSE:6871) Revises Down Q3 Earnings Guidance

Reviewed by Simply Wall St

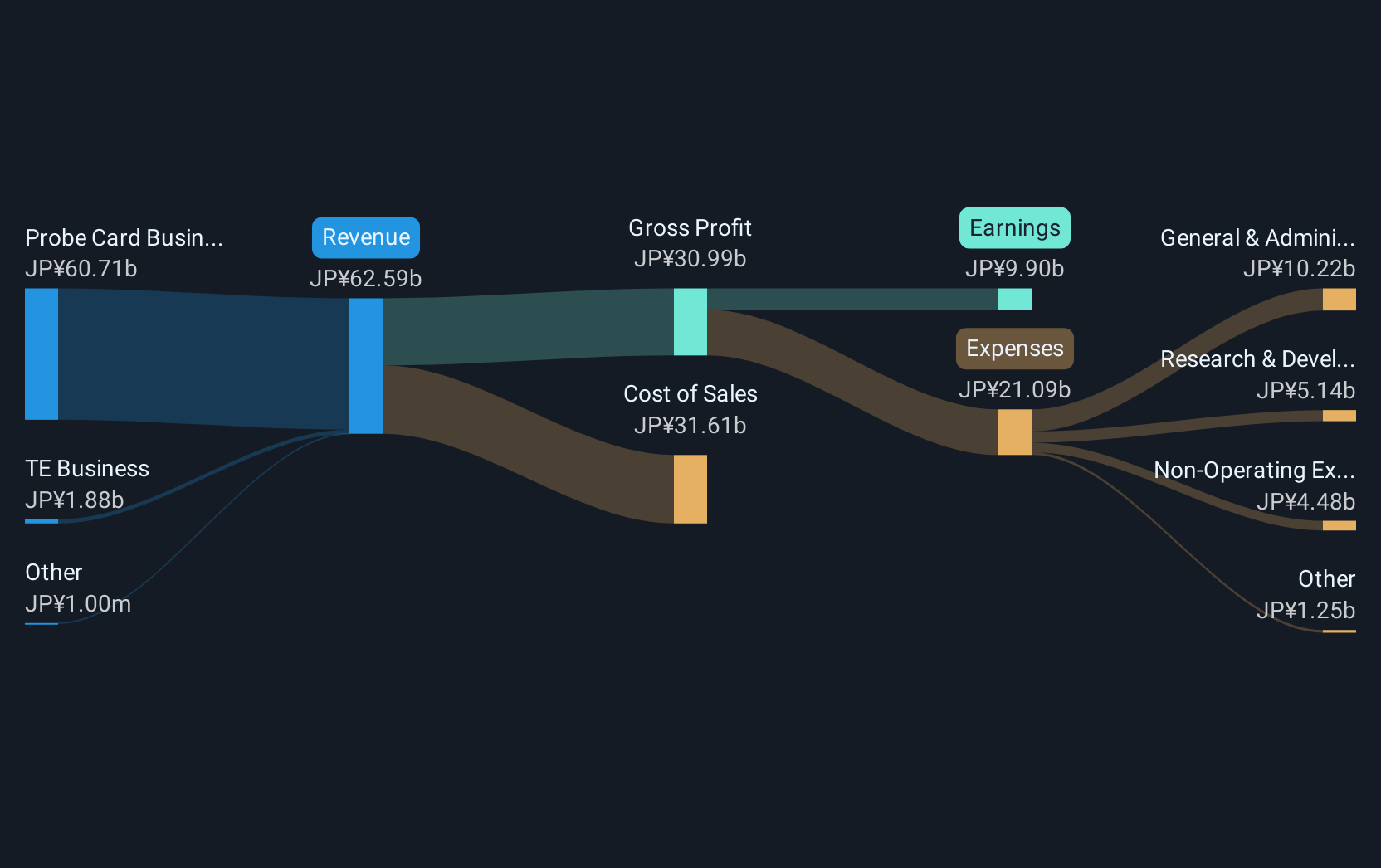

Micronics Japan (TSE:6871) recently announced an increased annual dividend and revised down its Q3 earnings guidance due to production delays. Despite these mixed events, the company's stock price rose 18% last week. This price movement aligns with the broader market trend, which saw significant gains driven by investor optimism on the macroeconomic front, including expectations for Federal Reserve rate cuts. While Micronics Japan's dividend increase would have supported investor sentiment, the revision in earnings guidance could have countered these gains, indicating that broader market optimism likely played a more substantial role in the price movement.

Over the past five years, Micronics Japan has delivered a very large total return of 421.81%, which offers significant context to its recent 18% price surge. This long-term performance positions the company favorably, particularly as it outpaced the JP market's return of 23.3% and the Semiconductor industry’s 17% return over the past year. Such metrics highlight the resilience and growth trajectory of Micronics Japan.

The company's decision to increase dividends coupled with revised earnings guidance could influence revenue and earnings forecasts. While the dividend boost could enhance shareholder sentiment, the downward revision in third-quarter earnings guidance may prompt more conservative revenue projections due to the indicated production delays. Moreover, the share price of ¥5070.00 showcases a 20.3% gap below the consensus price target of ¥6100.00, suggesting potential for future appreciation should the company's forecasts align with market expectations. Such dynamics underscore the importance of monitoring future developments in both operational performance and broader market conditions.

Jump into the full analysis health report here for a deeper understanding of Micronics Japan.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6871

Micronics Japan

Develops, manufactures, and sells body measuring equipment, semiconductor, and liquid crystal display inspection equipment worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives