- Japan

- /

- Semiconductors

- /

- TSE:6857

Advantest (TSE:6857) Valuation Check After New AI & HPC Die-Level Testing Collaboration With Tokyo Seimitsu

Reviewed by Simply Wall St

Advantest (TSE:6857) just put a fresh spotlight on its stock with a new collaboration with Tokyo Seimitsu, targeting die level testing for demanding AI and high performance computing devices.

See our latest analysis for Advantest.

That new AI and HPC collaboration lands after a string of product launches and capital moves, and the market seems to like the direction. The 90 day share price return of 27.8 percent and the 5 year total shareholder return of 993.5 percent suggest momentum is still firmly on Advantest's side.

If this kind of AI driven demand story has your attention, it could be a good moment to explore other high growth tech names through high growth tech and AI stocks.

But with the share price now hovering almost exactly in line with analyst targets and years of explosive gains behind it, investors have to ask whether Advantest still offers upside or if the AI test boom is already priced in.

Most Popular Narrative: 0.1% Undervalued

With Advantest last closing at approximately ¥19,195 against a narrative fair value of about ¥19,218, the story leans on sustained growth and rich multiples.

The analysts have a consensus price target of ¥11467.368 for Advantest based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥16000.0, and the most bearish reporting a price target of just ¥6000.0.

Want to see what justifies paying a premium multiple on only moderate growth? The narrative leans on powerful margin assumptions and concentrated earnings bets. Curious how that math still delivers a near perfect match to today’s price?

Result: Fair Value of ¥19,218.42 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, record margins built on one-off tailwinds and an aggressive capacity build out could quickly backfire if AI test demand normalizes or slips.

Find out about the key risks to this Advantest narrative.

Another Angle on Valuation

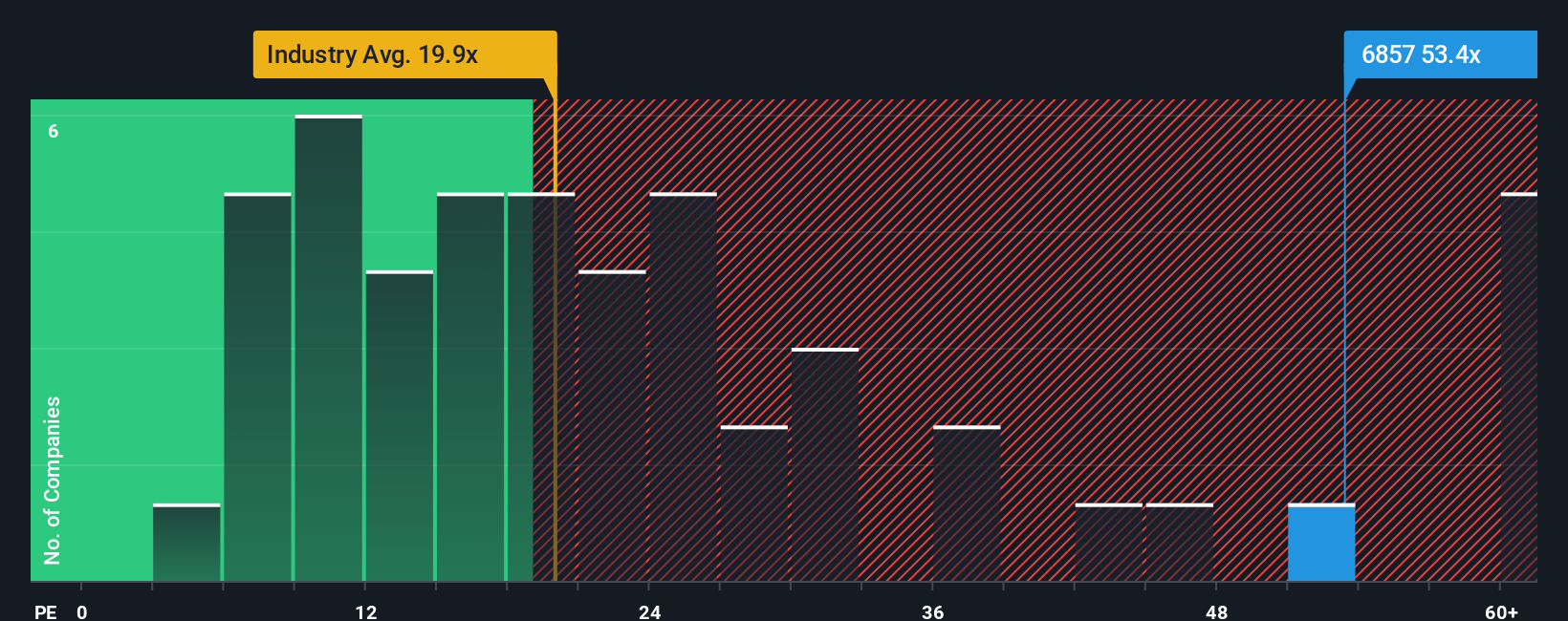

While the narrative fair value pegs Advantest almost exactly at today’s price, a simple earnings multiple tells a sharper story. The shares trade on about 53 times earnings versus a fair ratio near 37 times and a Japanese semiconductor average below 20 times, so any stumble in AI demand could hit this premium hard.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Advantest Narrative

If you want to challenge this view or dig into the numbers yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your Advantest research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, put Advantest in context by scanning focused stock shortlists that surface fresh opportunities, hidden risks and potential outperformers in seconds.

- Capture potential mispricings by targeting companies trading below their cash flow potential through these 914 undervalued stocks based on cash flows.

- Explore the structural trends in automation and smart systems by reviewing companies among these 24 AI penny stocks.

- Assess income potential and stability by filtering for companies with reliable payouts using these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6857

Advantest

Manufactures and sells semiconductors, component test systems, and mechatronics-related products in Japan, rest of Asia, the Americas, and Europe.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion