- Japan

- /

- Semiconductors

- /

- TSE:6832

Market Cool On AOI Electronics Co., Ltd.'s (TSE:6832) Revenues Pushing Shares 27% Lower

AOI Electronics Co., Ltd. (TSE:6832) shares have had a horrible month, losing 27% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 33%, which is great even in a bull market.

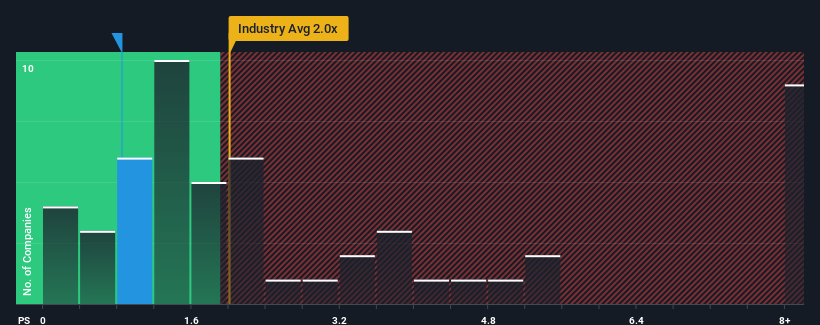

Following the heavy fall in price, AOI Electronics' price-to-sales (or "P/S") ratio of 0.8x might make it look like a buy right now compared to the Semiconductor industry in Japan, where around half of the companies have P/S ratios above 2x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for AOI Electronics

How Has AOI Electronics Performed Recently?

Recent times haven't been great for AOI Electronics as its revenue has been falling quicker than most other companies. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. You'd much rather the company improve its revenue performance if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AOI Electronics.How Is AOI Electronics' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like AOI Electronics' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 17%. As a result, revenue from three years ago have also fallen 17% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the only analyst following the company. With the industry predicted to deliver 13% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that AOI Electronics' P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From AOI Electronics' P/S?

AOI Electronics' P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of AOI Electronics' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 2 warning signs for AOI Electronics (1 is a bit unpleasant!) that you should be aware of.

If these risks are making you reconsider your opinion on AOI Electronics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6832

AOI Electronics

Produces and sells electronic parts in Japan, rest of Asia, the United States, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives