- Japan

- /

- Semiconductors

- /

- TSE:6728

Is ULVAC's (TSE:6728) Updated Earnings Guidance Reshaping Its Investment Narrative?

Reviewed by Sasha Jovanovic

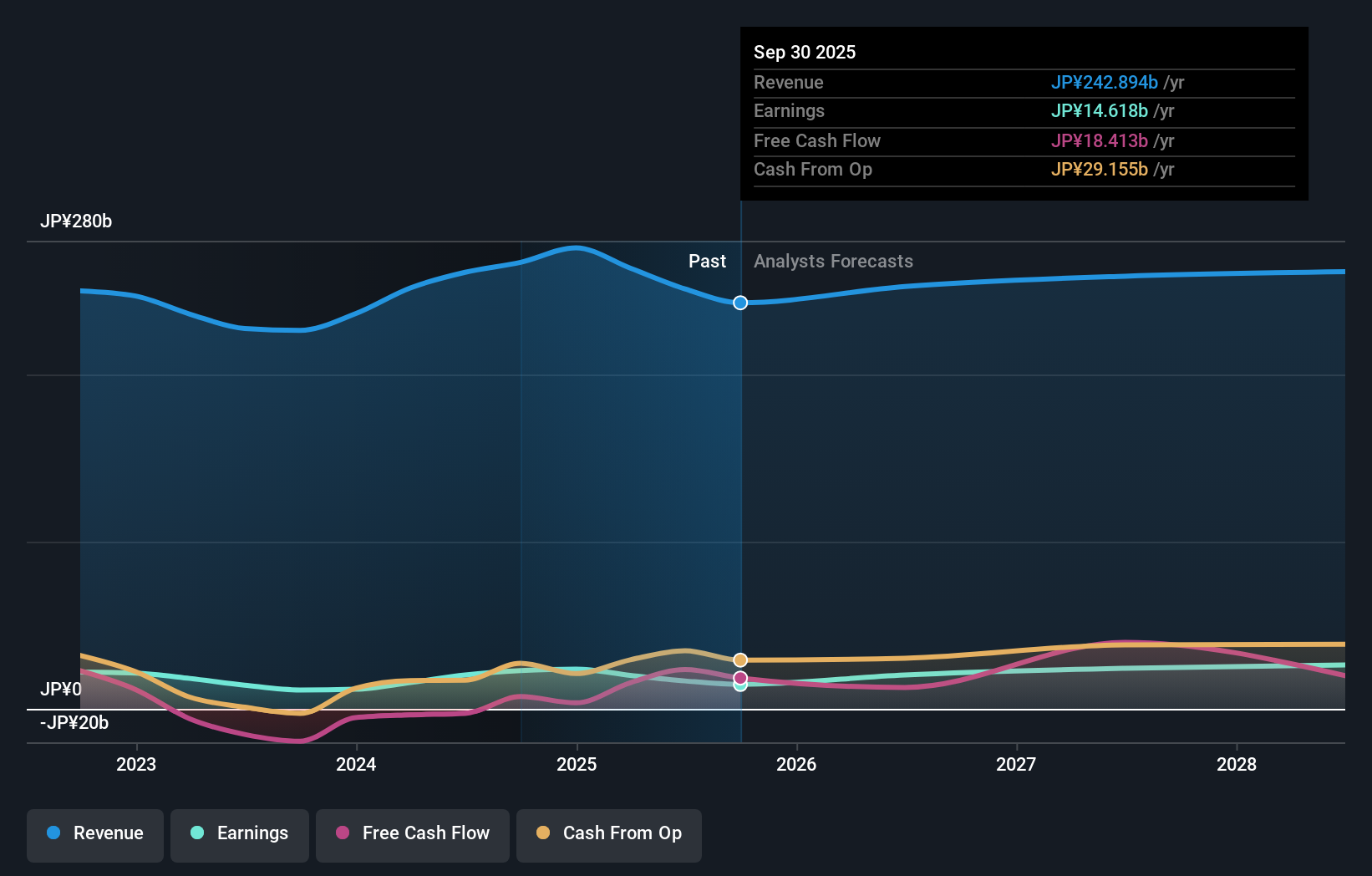

- On November 11, 2025, ULVAC, Inc. held its Q1 2026 earnings call and issued new consolidated earnings guidance, forecasting net sales of ¥115.5 billion for the half year and ¥250 billion for the full fiscal year ending June 30, 2026.

- The guidance included detailed expectations for operating profit, profit attributable to owners, and basic earnings per share, offering investors a transparent view of ULVAC's financial targets for both periods.

- We'll examine how ULVAC's updated forecasts shape its investment narrative, with particular focus on the visibility provided by its earnings and sales outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is ULVAC's Investment Narrative?

For anyone considering ULVAC, the core investment story revolves around believing in the company's ability to sustain its profit turnaround and ride structural demand in the semiconductor equipment space. The company’s just-released guidance largely reinforced earlier forecasts, signaling management’s confidence about stability after a difficult prior year. However, with the updated forecast, the risk/catalyst balance shifts: strong earnings visibility could support near-term sentiment, but the modest revenue growth outlook and history of volatile dividends keep some of the bigger questions open, especially when compared to peers. On the risk side, the stock’s valuation remains high compared to the industry, so it will be crucial to watch for any signs that expected growth does not materialize, especially as broader demand and sector cycles remain uncertain. The recent news provides some reassurance, but the main debates remain much the same.

But, dividend reliability remains a point investors should keep in mind. ULVAC's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on ULVAC - why the stock might be worth as much as 20% more than the current price!

Build Your Own ULVAC Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ULVAC research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ULVAC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ULVAC's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6728

ULVAC

Engages in the vacuum equipment and applications business in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives