- Japan

- /

- Semiconductors

- /

- TSE:6723

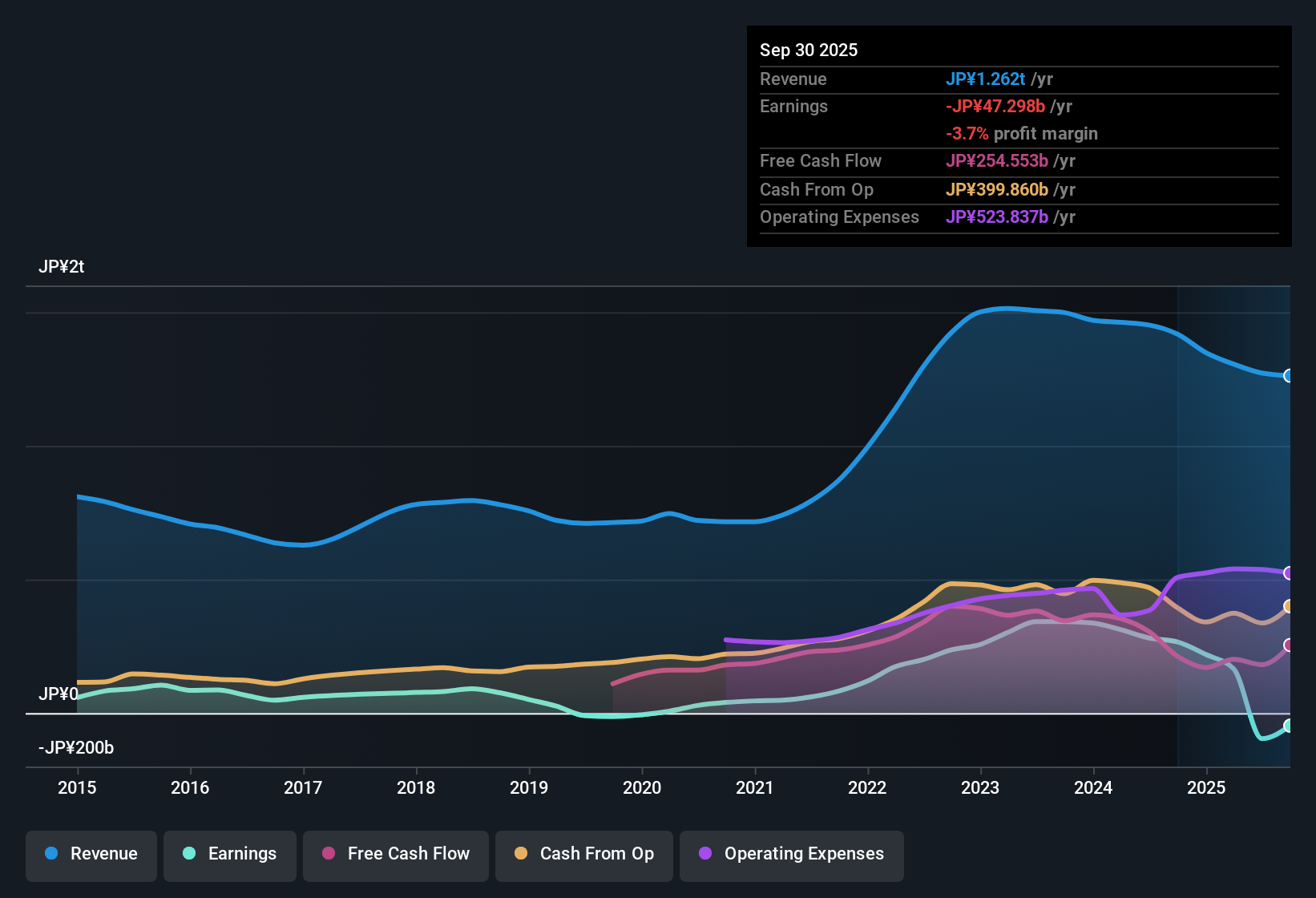

Renesas (TSE:6723): Unprofitability Persists, but Loss Reduction and Strong Growth Forecasts Challenge Bearish Narratives

Reviewed by Simply Wall St

Renesas Electronics (TSE:6723) is forecast to grow its revenue at 8.2% per year, outpacing the broader Japanese market's 4.5% annual growth expectation. Although the company remains unprofitable, it has reduced losses by 16.6% per year over the past five years and is projected to reach profitability within three years. Earnings are expected to grow at 29.17% per year. For investors, the encouraging pace of loss reduction and the current share price of ¥1,908, which sits below some fair value estimates of ¥2,667.88, present a cautiously optimistic outlook, even as concerns about financial stability and share price volatility persist.

See our full analysis for Renesas Electronics.Next, we will see how these numbers compare to the prevailing market narratives and whether the earnings release supports or challenges the consensus views.

See what the community is saying about Renesas Electronics

Margins Set to Rebound

- Analysts expect profit margins to rise sharply from -7.5% today to 16.8% within three years, boosting the company's potential for sustained profitability.

- According to the analysts' consensus view, investments in advanced automotive products and supply chain optimization are forecast to strengthen Renesas' earnings resilience and expand margins.

- Cost reduction initiatives and higher-value microcontrollers are cited as key drivers for margin growth.

- Consensus notes that improved product mix and factory optimization efforts are positioned to counteract margin erosion and support medium-term operating profit recovery.

DCF Fair Value Gap Remains Wide

- Renesas’ current share price of ¥1,908 stands 28.4% below the DCF fair value of ¥2,667.88, which implies room for a potential rerating if growth forecasts are realized.

- Analysts' consensus view highlights that while the stock trades below both fair value and the price target, competing risk factors like financial instability and price volatility leave debate unsettled.

- The analyst target price of ¥2,417.14 is 26.7% ahead of the current market price, but actual market confidence may depend on visible improvements in margin and revenue assumptions.

- Consensus cautions that achieving a PE ratio of 22.7x on future earnings is ambitious, considering the current sector average of 14.9x.

Growth Hinges on Automotive and IIoT Adoption

- Management and consensus expect automotive segment growth to be fueled by adoption of the new 28-nm MCU platform beyond China, with industrial IoT and data center demand set to bolster revenues over the next two to three years.

- Analysts' consensus view positions global expansion of connected devices and higher-value R&D investments as crucial to sustaining future growth, yet highlights sensitivity to swings in industrial demand.

- Ongoing trade risks, slow ramp-up outside Japan and China, and mixed demand recovery create earnings pressure and inventory buildup risk.

- The consensus narrative underscores the tension between strong underlying adoption trends and the enduring risks from high R&D cost intensity and regulatory headwinds, particularly in automotive and IIoT markets.

Want to see the full analyst breakdown and how Renesas' margin rebound and fair value gap play into broader industry trends? Check out the consensus narrative for more context. 📊 Read the full Renesas Electronics Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Renesas Electronics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the results? Share your view and shape your own narrative in just a few minutes. Do it your way

A great starting point for your Renesas Electronics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite projected earnings growth, Renesas faces persistent financial stability concerns, high R&D spending, and exposure to share price volatility. These factors cloud its outlook.

Worried about these risks? You can target healthier companies with robust finances and lower volatility by starting your search with solid balance sheet and fundamentals stocks screener (1986 results) now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6723

Renesas Electronics

Researches, develops, designs, manufactures, sells, and services semiconductors in Japan, China, rest of Asia, Europe, North America, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives