- Japan

- /

- Semiconductors

- /

- TSE:6723

October 2025's Global Stock Selections Estimating Value Below Market Norms

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and steady inflation rates, investors are reassessing their strategies amid fluctuating indices and evolving economic indicators. In such an environment, identifying stocks that may be undervalued can present opportunities for those looking to capitalize on discrepancies between market prices and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ülker Bisküvi Sanayi (IBSE:ULKER) | TRY107.20 | TRY213.40 | 49.8% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.57 | CN¥76.89 | 49.8% |

| Samyang Foods (KOSE:A003230) | ₩1509000.00 | ₩3006664.22 | 49.8% |

| Millenium Hospitality Real Estate SOCIMI (BME:YMHRE) | €2.04 | €4.05 | 49.7% |

| Kolmar Korea (KOSE:A161890) | ₩77300.00 | ₩154237.33 | 49.9% |

| freee K.K (TSE:4478) | ¥3265.00 | ¥6464.40 | 49.5% |

| Dynavox Group (OM:DYVOX) | SEK107.20 | SEK212.68 | 49.6% |

| Devsisters (KOSDAQ:A194480) | ₩48200.00 | ₩95425.56 | 49.5% |

| Circle (BIT:CIRC) | €8.20 | €16.32 | 49.8% |

| Atea (OB:ATEA) | NOK142.20 | NOK280.79 | 49.4% |

We're going to check out a few of the best picks from our screener tool.

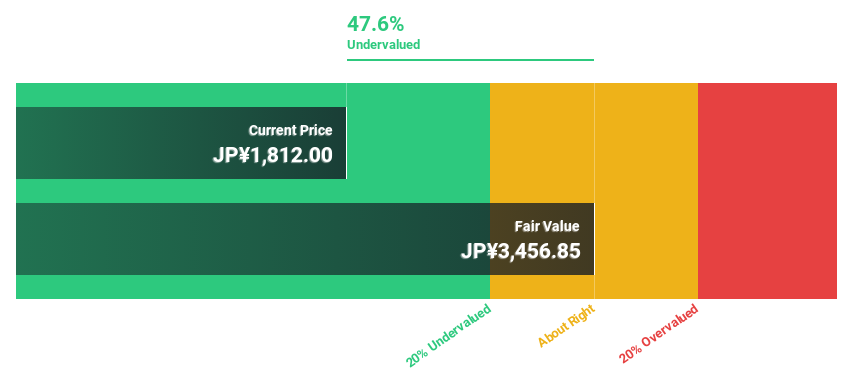

Renesas Electronics (TSE:6723)

Overview: Renesas Electronics Corporation is involved in the research, development, design, manufacturing, sales, and servicing of semiconductors across Japan, China, other parts of Asia, Europe, North America and globally with a market cap of ¥3.06 trillion.

Operations: The company's revenue is primarily generated from its Automotive segment, which accounts for ¥651.39 billion, and its Industrial/Infrastructure/IoT segment, contributing ¥611.09 billion.

Estimated Discount To Fair Value: 37.5%

Renesas Electronics is trading significantly below its estimated fair value, suggesting it may be undervalued based on cash flows. Despite recent financial challenges, including a reported net loss and declining sales, the company is expected to grow earnings substantially by 56.33% annually over the next three years. Recent product innovations in microcontrollers and AI-enabled solutions enhance its portfolio, potentially supporting future revenue growth above the Japanese market average of 4.4% per year.

- The analysis detailed in our Renesas Electronics growth report hints at robust future financial performance.

- Dive into the specifics of Renesas Electronics here with our thorough financial health report.

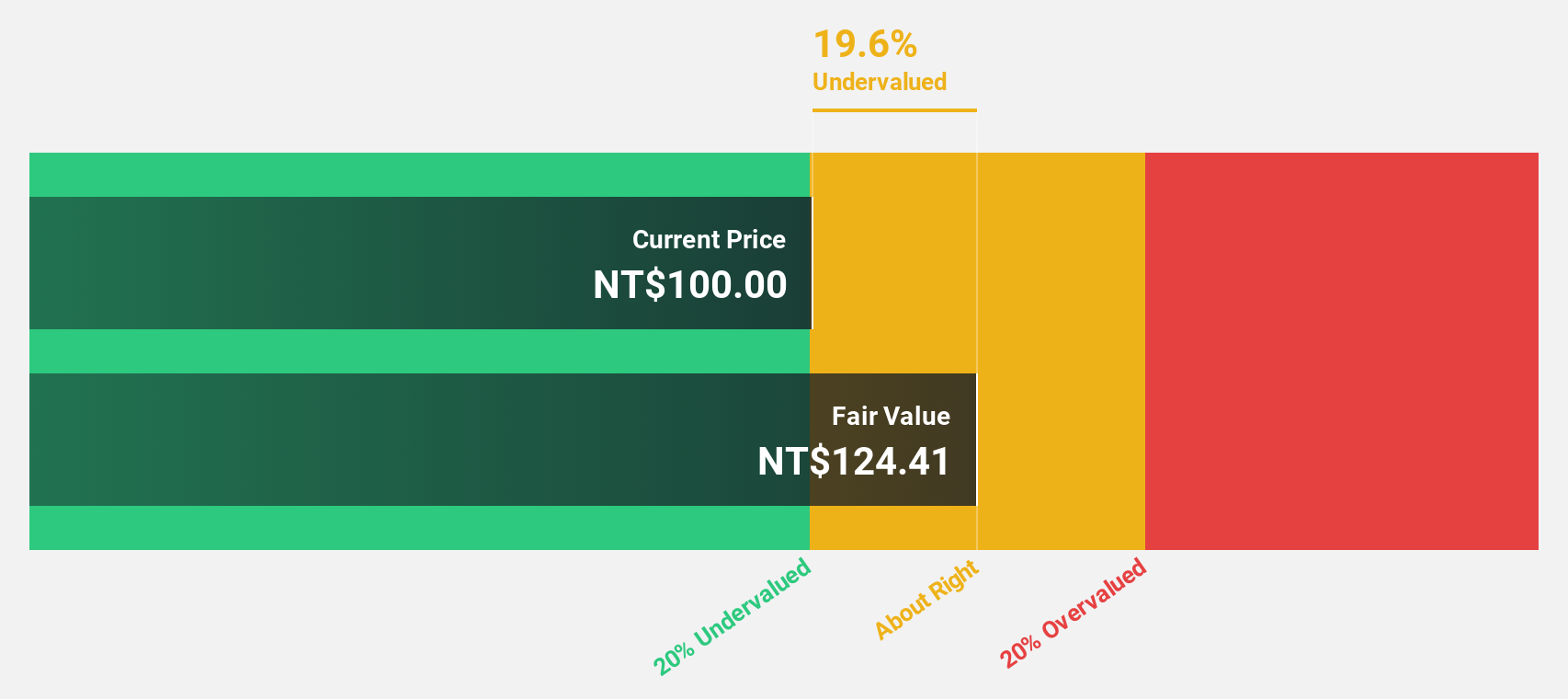

King Yuan Electronics (TWSE:2449)

Overview: King Yuan Electronics Co., Ltd. specializes in the design, manufacturing, selling, testing, and assembly of integrated circuits with a market cap of NT$204.81 billion.

Operations: King Yuan Electronics generates revenue primarily from its Contract Electronics Manufacturing Services segment, amounting to NT$30.01 billion.

Estimated Discount To Fair Value: 44.3%

King Yuan Electronics is trading well below its estimated fair value, reflecting potential undervaluation based on cash flows. The company reported strong earnings growth, with second-quarter net income rising to NT$2.18 billion from NT$1.90 billion a year ago, and sales increasing significantly. Despite high share price volatility and low forecasted return on equity, expected annual earnings growth of 22.62% surpasses the Taiwan market average, highlighting robust revenue prospects driven by significant profit expansion forecasts over the next three years.

- Upon reviewing our latest growth report, King Yuan Electronics' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of King Yuan Electronics.

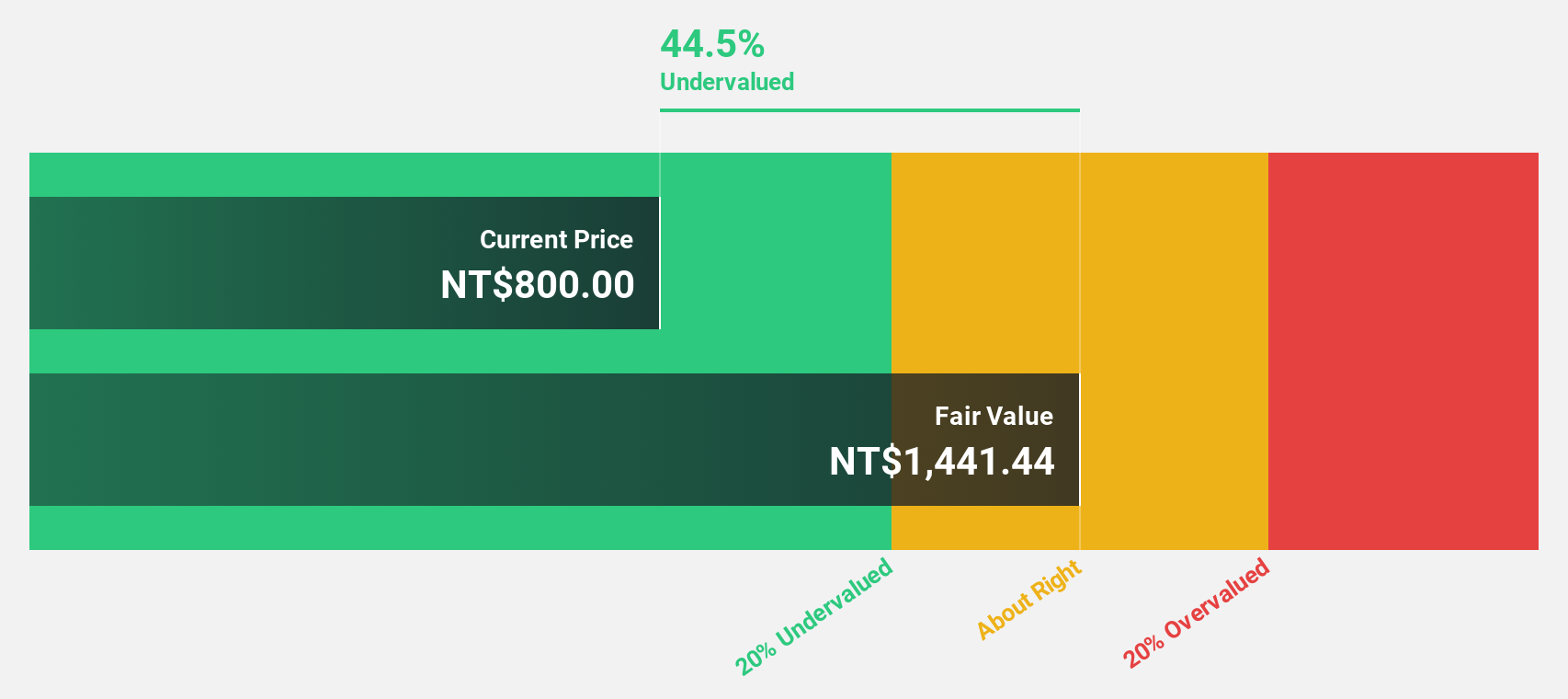

Fositek (TWSE:6805)

Overview: Fositek Corp. designs and manufactures metal stamping products across Asia, the United States, and Europe with a market cap of NT$68.90 billion.

Operations: The company's revenue is primarily derived from its Electronic Components & Parts segment, totaling NT$9.63 billion.

Estimated Discount To Fair Value: 39.9%

Fositek appears significantly undervalued based on cash flow analysis, trading at 39.9% below its estimated fair value of NT$1,837.69. Recent earnings reports show robust growth, with second-quarter net income rising to TWD 330.34 million from TWD 256.32 million a year ago and sales increasing notably. Forecasts suggest earnings and revenue will grow substantially faster than the Taiwan market average, despite recent share price volatility, underscoring strong future financial prospects.

- Our expertly prepared growth report on Fositek implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Fositek stock in this financial health report.

Seize The Opportunity

- Dive into all 532 of the Undervalued Global Stocks Based On Cash Flows we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6723

Renesas Electronics

Researches, develops, designs, manufactures, sells, and services semiconductors in Japan, China, rest of Asia, Europe, North America, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives