- Japan

- /

- Semiconductors

- /

- TSE:6526

How Socionext's Launch of "Flexlets" Chiplets (TSE:6526) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- On October 28, 2025, Socionext Inc. introduced "Flexlets," a configurable platform of chiplets aimed at advancing heterogeneous integration by enabling clients to tailor semiconductor designs at the RTL level and broaden interoperability with industry standards.

- This novel approach to chiplet customization addresses key industry bottlenecks in scaling, flexibility, and advanced packaging, highlighting Socionext's engineering capabilities and support for multi-vendor ecosystems.

- We'll examine how Socionext's RTL-level chiplet customization could influence its investment narrative amid evolving demands for modular semiconductor design.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

What Is Socionext's Investment Narrative?

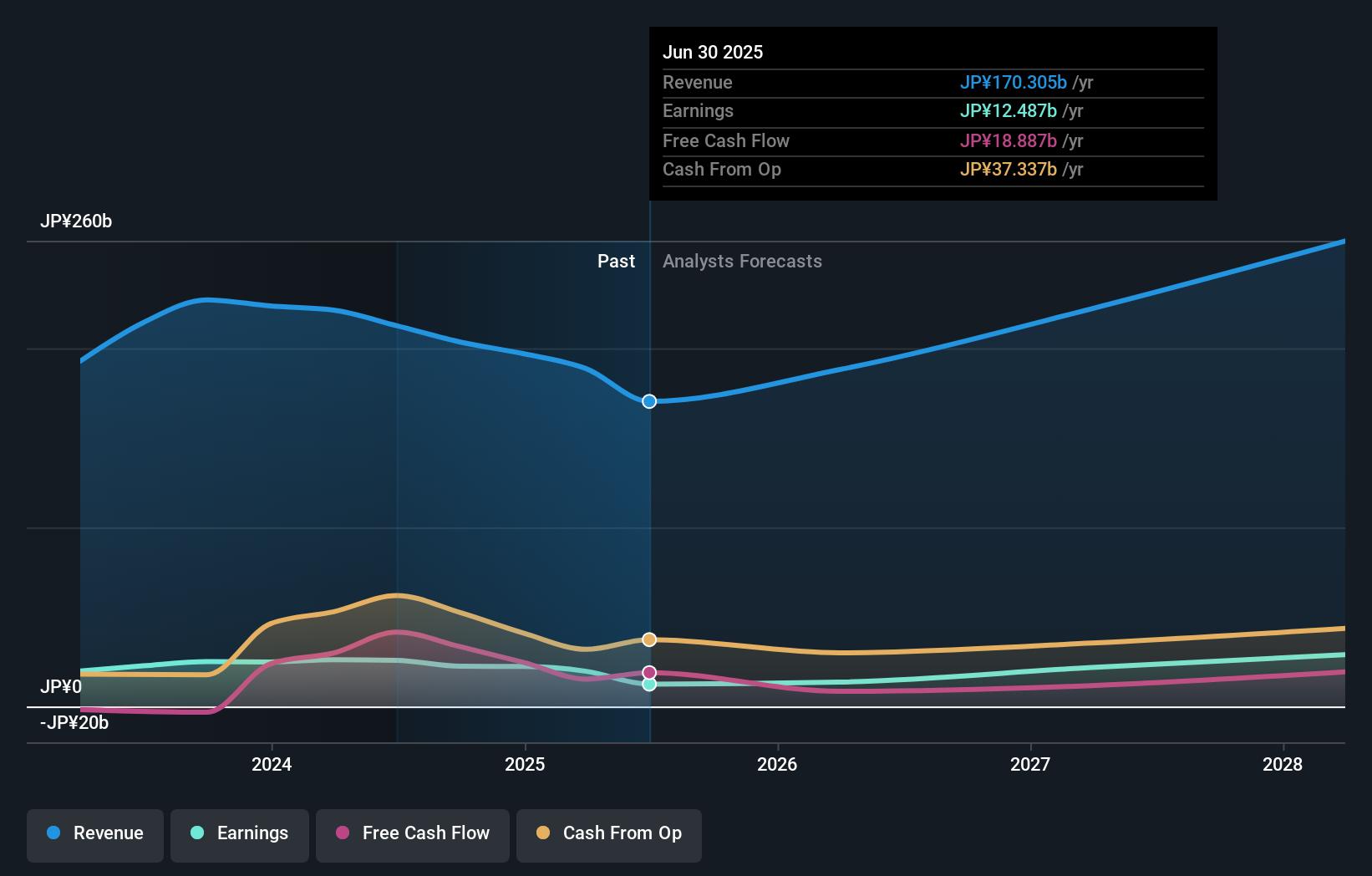

For anyone considering Socionext right now, the big picture comes down to belief in the company’s ability to stay at the cutting edge of semiconductor innovation, especially as chiplet-based design takes center stage across AI, HPC, and automotive markets. The introduction of Flexlets represents a significant technical leap, directly addressing demand for customizable, interoperable chip solutions in a field defined by rapid, modular innovation. This fresh product launch could become a new growth catalyst, potentially shifting the focus from past profit margin compression and high price-to-earnings multiples to a narrative of engineering relevance and new revenue streams. But short-term risks remain: volatility, management inexperience, and ongoing industry price pressures haven’t disappeared. Flexlets demonstrates Socionext’s ambition, but the material impact hinges on customer adoption and market share in a competitive, fast-evolving space. Investors will be weighing whether recent news can tip the scales.

But, despite all this promise, Socionext’s volatile share price is something investors should keep in mind.

Exploring Other Perspectives

Explore another fair value estimate on Socionext - why the stock might be worth as much as ¥3030!

Build Your Own Socionext Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Socionext research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Socionext research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Socionext's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6526

Socionext

Designs, develops, manufactures, and sells system-on-chip (SoC), and solutions/services centering on SoC worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives