- Japan

- /

- Semiconductors

- /

- TSE:6323

Three Japanese Stocks Estimated To Be Undervalued On The Tokyo Exchange In June 2024

Reviewed by Simply Wall St

As of June 2024, Japan's stock markets exhibit a mixed performance, with the Nikkei 225 slightly up and the broader TOPIX Index experiencing a minor decline. This divergence underscores an environment where selective investment opportunities, such as potentially undervalued stocks, could be particularly compelling for discerning investors looking to capitalize on specific market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Link and Motivation (TSE:2170) | ¥465.00 | ¥894.96 | 48% |

| Hodogaya Chemical (TSE:4112) | ¥5790.00 | ¥11493.62 | 49.6% |

| OSAKA Titanium technologiesLtd (TSE:5726) | ¥2786.00 | ¥5541.16 | 49.7% |

| Cyber Security Cloud (TSE:4493) | ¥2144.00 | ¥4101.04 | 47.7% |

| Gift Holdings (TSE:9279) | ¥2768.00 | ¥5439.94 | 49.1% |

| NIHON CHOUZAILtd (TSE:3341) | ¥1438.00 | ¥2781.85 | 48.3% |

| Macromill (TSE:3978) | ¥890.00 | ¥1691.18 | 47.4% |

| Osaka Soda (TSE:4046) | ¥11170.00 | ¥21932.20 | 49.1% |

| freee K.K (TSE:4478) | ¥2336.00 | ¥4456.31 | 47.6% |

| LibertaLtd (TSE:4935) | ¥1005.00 | ¥1948.14 | 48.4% |

Let's explore several standout options from the results in the screener

Osaka Soda (TSE:4046)

Overview: Osaka Soda Co., Ltd. is a global manufacturer and seller of chemical products, operating in Japan, Asia, Europe, North America, and beyond, with a market capitalization of approximately ¥283.42 billion.

Operations: The company's revenue is generated from four primary segments: Healthcare (¥11.87 billion), Basic Chemical (¥36.27 billion), Trading and Others (¥20.24 billion), and Functional Chemical (¥30.22 billion).

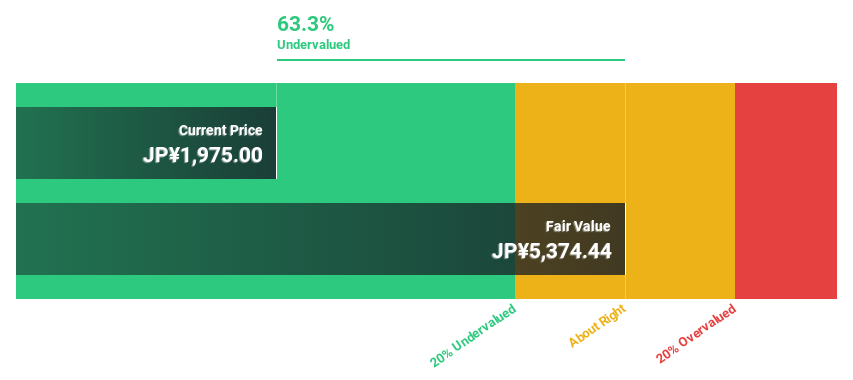

Estimated Discount To Fair Value: 49.1%

Osaka Soda, currently priced at ¥11170, shows a substantial undervaluation in the market, trading 49.1% below its estimated fair value of ¥21932.2. Despite a highly volatile share price recently, the company's financial outlook appears robust with earnings expected to increase by 25.7% annually over the next three years—significantly outpacing the average Japanese market growth rate of 8.9%. Additionally, revenue is projected to grow at 9.3% per year, again exceeding the national market forecast of 4.1%. However, its forecasted return on equity in three years is relatively low at 13.4%, which may concern some investors about long-term profitability and capital efficiency.

- Upon reviewing our latest growth report, Osaka Soda's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Osaka Soda.

Rorze (TSE:6323)

Overview: Rorze Corporation specializes in creating automation systems for semiconductor and flat panel display manufacturers globally, with a market capitalization of approximately ¥559.85 billion.

Operations: The company generates revenue primarily through its Semiconductor / FPD Related Equipment Business, which brought in ¥92.04 billion, and its Life Science Business, contributing ¥1.22 billion.

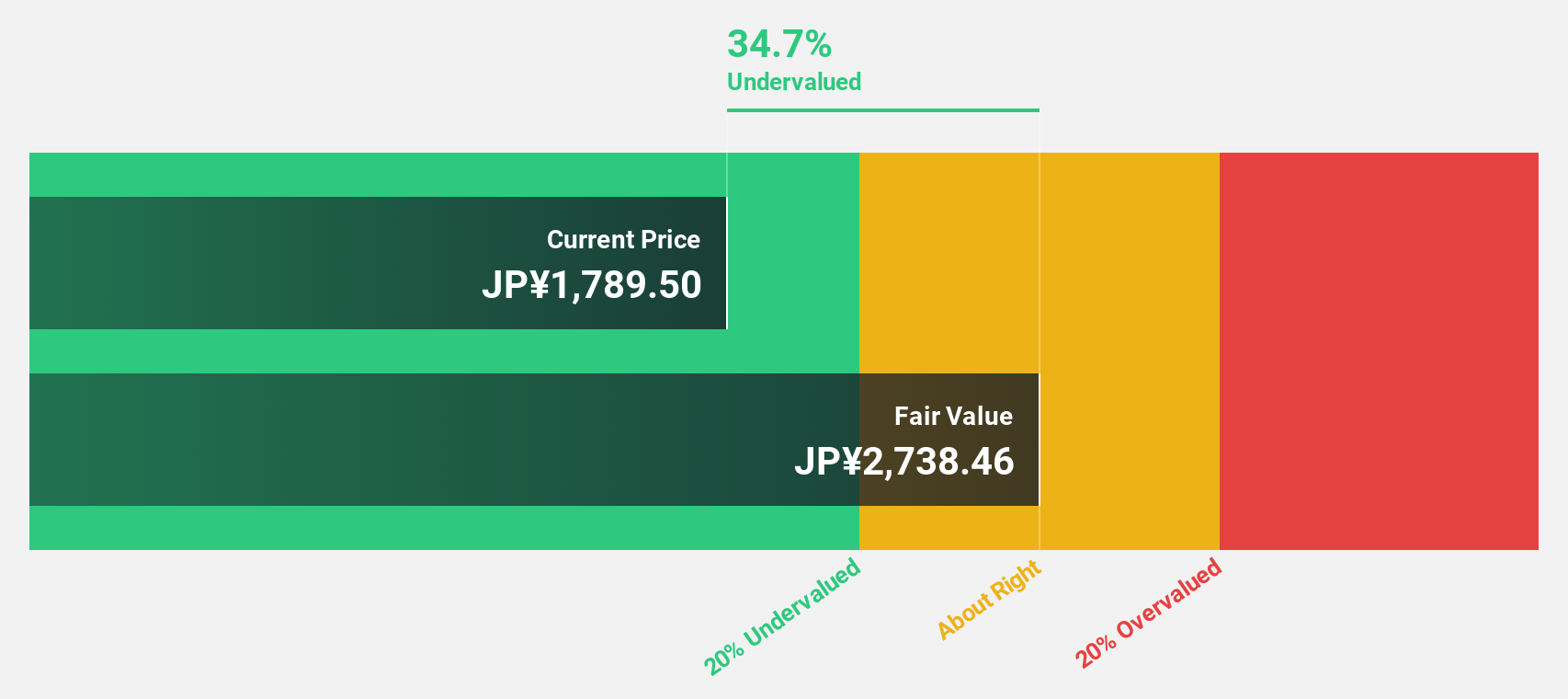

Estimated Discount To Fair Value: 33.8%

Rorze is trading at ¥31800, significantly below the calculated fair value of ¥48062.2, indicating a potential undervaluation based on cash flows. Despite its share price volatility over the past three months, Rorze's financial outlook is promising with earnings and revenue growth forecasts outpacing the Japanese market averages at 13.9% annually. Recent strategic moves include a share buyback program and positive earnings guidance for upcoming fiscal periods, underscoring management's confidence in sustained profitability and shareholder value enhancement.

- Our earnings growth report unveils the potential for significant increases in Rorze's future results.

- Navigate through the intricacies of Rorze with our comprehensive financial health report here.

Micronics Japan (TSE:6871)

Overview: Micronics Japan Co., Ltd. specializes in developing, manufacturing, and selling testing and measurement equipment for semiconductors and LCD systems globally, with a market capitalization of approximately ¥250.77 billion.

Operations: The company generates revenue primarily through the development, manufacture, and sale of semiconductor and LCD testing equipment.

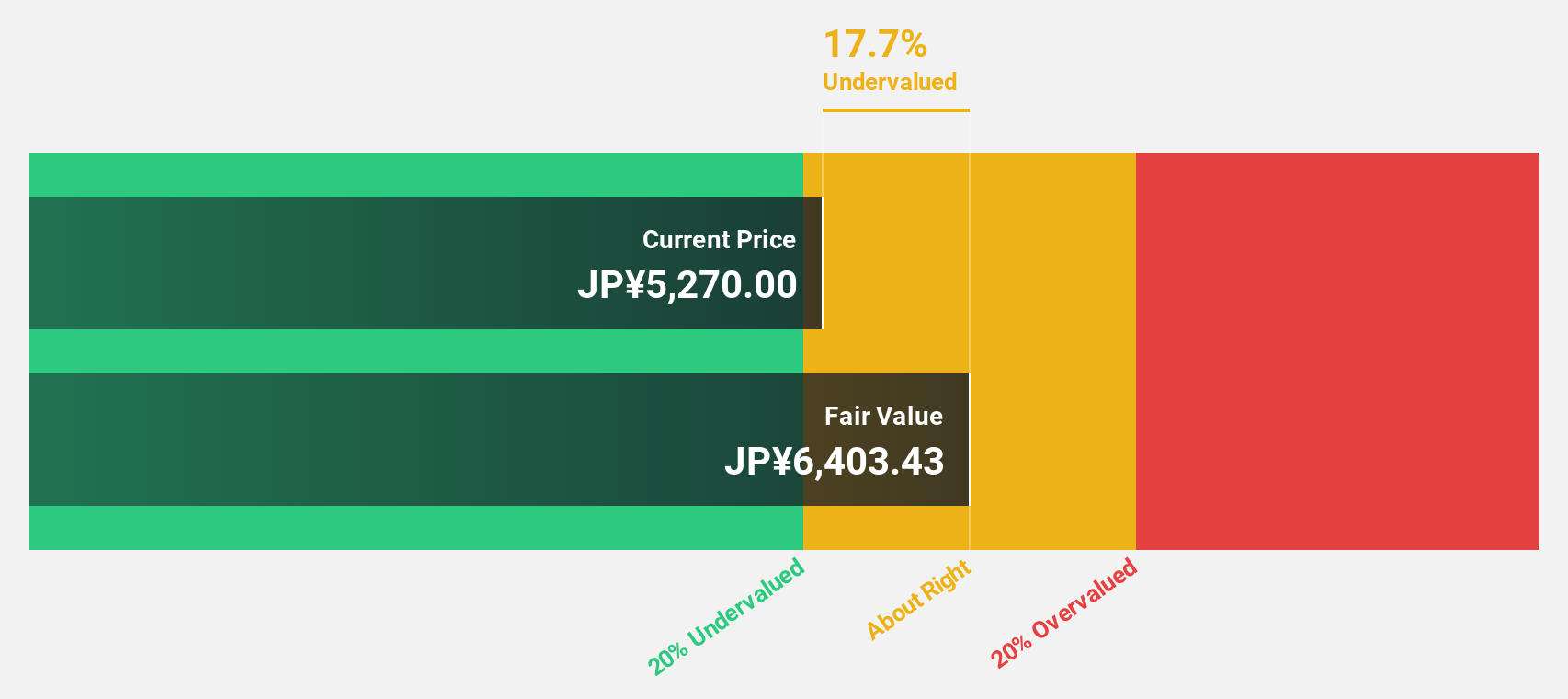

Estimated Discount To Fair Value: 37.4%

Micronics Japan, priced at ¥6500, appears undervalued compared to our fair value estimate of ¥10390.96, suggesting a potential investment opportunity based on cash flows. Despite a decline in profit margins from 16.7% to 10.6%, the company's earnings are expected to surge by 39.8% annually, outperforming the Japanese market forecast of 8.9%. Additionally, its revenue growth is projected at an impressive rate of 23.2% per year, significantly higher than the market average of 4.1%. However, investors should be cautious of its highly volatile share price in recent months.

- The analysis detailed in our Micronics Japan growth report hints at robust future financial performance.

- Take a closer look at Micronics Japan's balance sheet health here in our report.

Turning Ideas Into Actions

- Click here to access our complete index of 101 Undervalued Japanese Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6323

Rorze

Engages in the design, development, manufacture, and sale of automation systems for the semiconductor and flat panel display production worldwide.

Flawless balance sheet with solid track record.