- Japan

- /

- Semiconductors

- /

- TSE:6315

Some Confidence Is Lacking In TOWA Corporation (TSE:6315) As Shares Slide 27%

Unfortunately for some shareholders, the TOWA Corporation (TSE:6315) share price has dived 27% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 59% loss during that time.

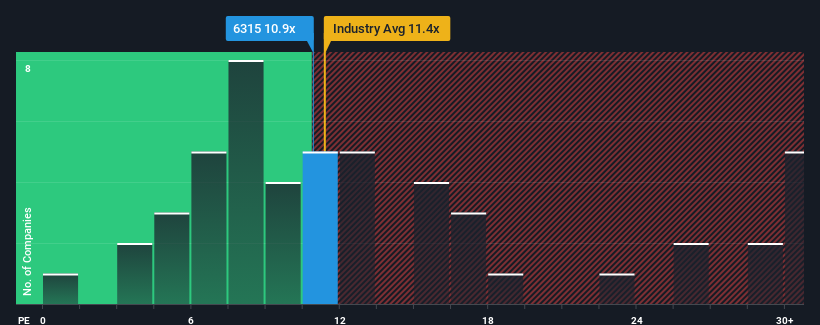

Although its price has dipped substantially, it's still not a stretch to say that TOWA's price-to-earnings (or "P/E") ratio of 10.9x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

TOWA certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for TOWA

How Is TOWA's Growth Trending?

The only time you'd be comfortable seeing a P/E like TOWA's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 76% gain to the company's bottom line. The latest three year period has also seen a 13% overall rise in EPS, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 12% during the coming year according to the six analysts following the company. That's not great when the rest of the market is expected to grow by 9.5%.

In light of this, it's somewhat alarming that TOWA's P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

What We Can Learn From TOWA's P/E?

With its share price falling into a hole, the P/E for TOWA looks quite average now. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that TOWA currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware TOWA is showing 1 warning sign in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if TOWA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6315

TOWA

Engages in the design, development, manufacture, and sale of semiconductor manufacturing equipment and high-precision molds in Japan and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives