- Japan

- /

- Semiconductors

- /

- TSE:6298

Y.A.C. Holdings Co., Ltd. (TSE:6298) May Have Run Too Fast Too Soon With Recent 33% Price Plummet

The Y.A.C. Holdings Co., Ltd. (TSE:6298) share price has fared very poorly over the last month, falling by a substantial 33%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

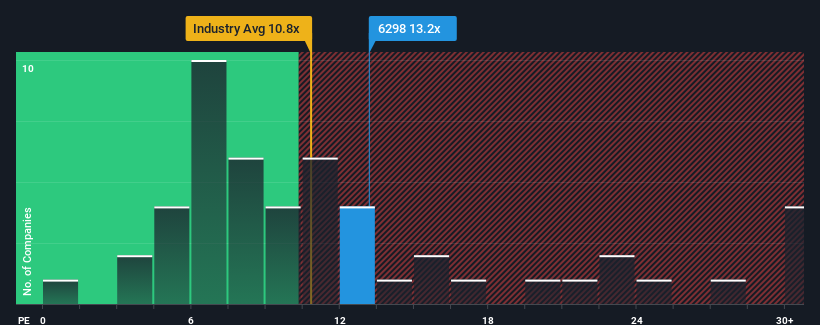

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Y.A.C. Holdings' P/E ratio of 13.2x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

As an illustration, earnings have deteriorated at Y.A.C. Holdings over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Y.A.C. Holdings

How Is Y.A.C. Holdings' Growth Trending?

In order to justify its P/E ratio, Y.A.C. Holdings would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 10% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Y.A.C. Holdings is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Y.A.C. Holdings' P/E

Following Y.A.C. Holdings' share price tumble, its P/E is now hanging on to the median market P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Y.A.C. Holdings currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Y.A.C. Holdings (of which 1 makes us a bit uncomfortable!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6298

Y.A.C. Holdings

Provides mechatronics, display, industrial machinery, and electronics related products in Japan and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives