- Japan

- /

- Semiconductors

- /

- TSE:6227

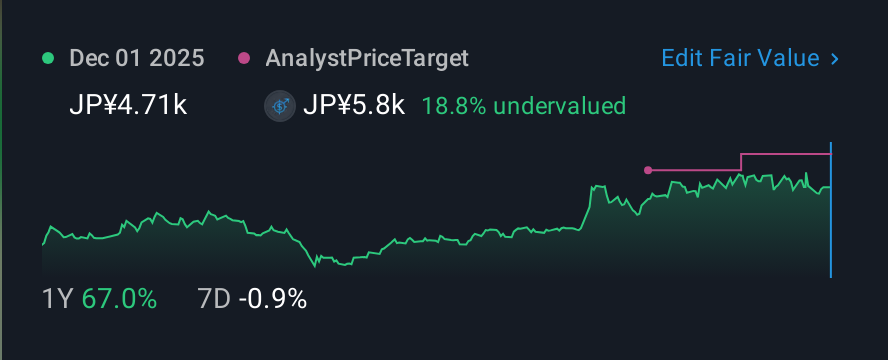

A Piece Of The Puzzle Missing From AIMECHATEC, Ltd.'s (TSE:6227) 38% Share Price Climb

Despite an already strong run, AIMECHATEC, Ltd. (TSE:6227) shares have been powering on, with a gain of 38% in the last thirty days. The last month tops off a massive increase of 156% in the last year.

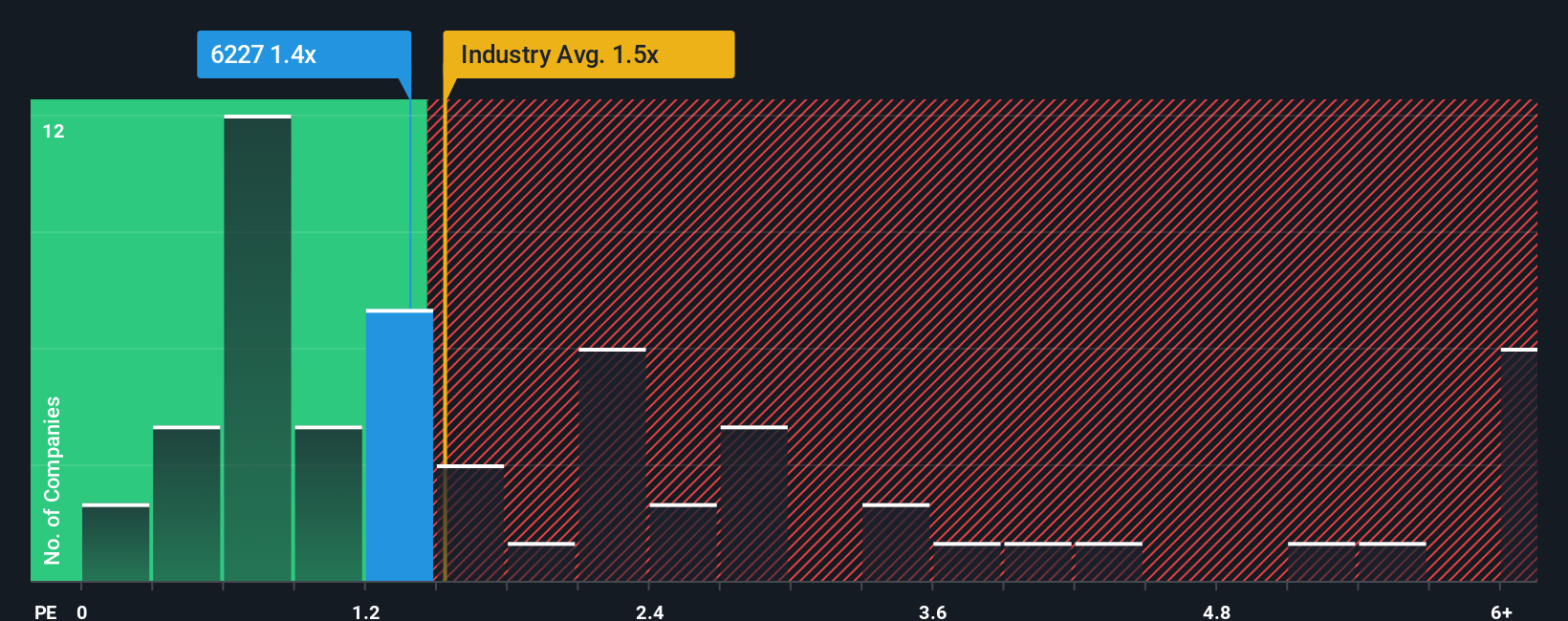

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about AIMECHATEC's P/S ratio of 1.4x, since the median price-to-sales (or "P/S") ratio for the Semiconductor industry in Japan is also close to 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for AIMECHATEC

What Does AIMECHATEC's Recent Performance Look Like?

Recent times have been advantageous for AIMECHATEC as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on AIMECHATEC will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For AIMECHATEC?

In order to justify its P/S ratio, AIMECHATEC would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 36%. Pleasingly, revenue has also lifted 43% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 18% per annum during the coming three years according to the dual analysts following the company. That's shaping up to be materially higher than the 6.6% each year growth forecast for the broader industry.

In light of this, it's curious that AIMECHATEC's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From AIMECHATEC's P/S?

Its shares have lifted substantially and now AIMECHATEC's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that AIMECHATEC currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 3 warning signs we've spotted with AIMECHATEC (including 1 which is a bit unpleasant).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6227

AIMECHATEC

Develops, manufactures, and sells for flat panel display equipment in Japan.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026