- Japan

- /

- Semiconductors

- /

- TSE:6146

The Bull Case For Disco (TSE:6146) Could Change Following Updated Dividend and Earnings Guidance – Learn Why

Reviewed by Sasha Jovanovic

- On October 29, 2025, Disco Corporation approved an increased interim dividend of ¥129.00 per share, up from ¥124.00 last year, and issued new guidance projecting consolidated net sales of ¥287.1 billion and net income of ¥80.3 billion for the nine months ending December 31, 2025.

- This performance-linked dividend policy and updated earnings guidance offer investors transparency into the company's financial approach amid ongoing demand uncertainty in the semiconductor and electronic component sectors.

- With the interim dividend increase underscoring Disco's shareholder return focus, we examine how these updates influence the company's overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Disco's Investment Narrative?

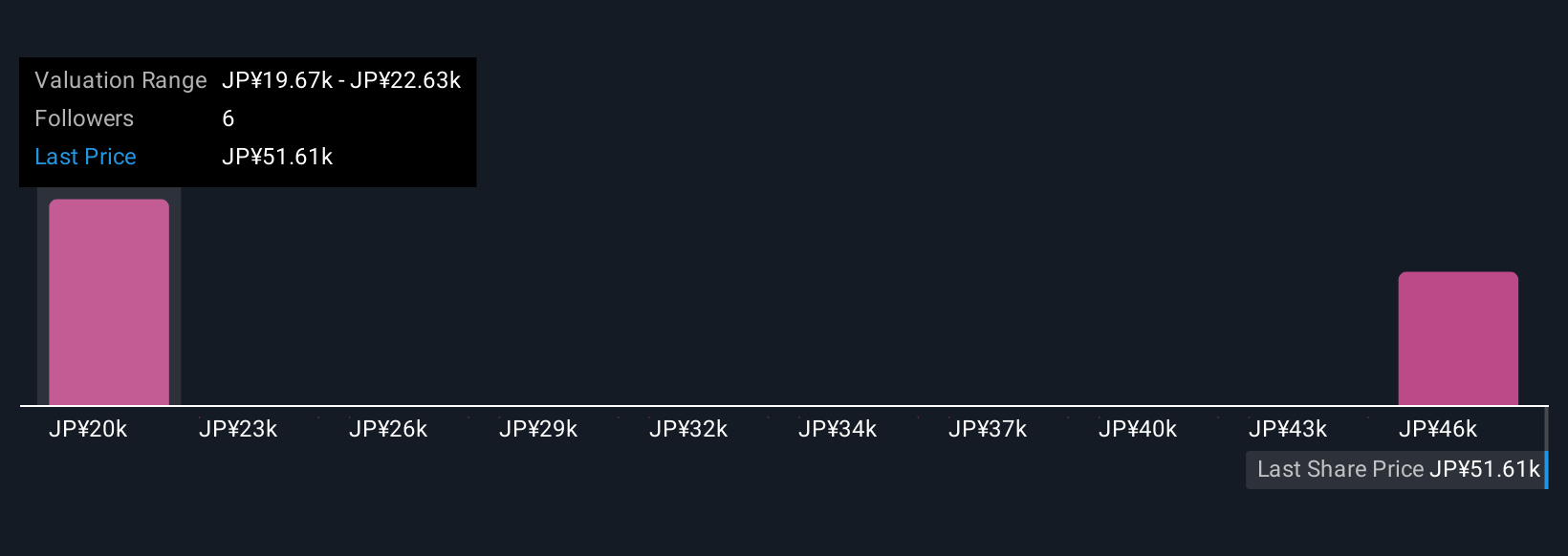

For investors considering Disco, the core narrative remains centered on its leadership in semiconductor equipment and its ability to deliver consistent profit growth against a backdrop of volatile industry demand. The most recent guidance and interim dividend bump suggest management is comfortable with near-term performance and committed to rewarding shareholders. Still, while the updated outlook and dividend policy reinforce confidence in Disco’s financial discipline, they don’t meaningfully shift the investment catalysts or ease the industry's underlying risks. The biggest short-term drivers continue to be shifts in global electronics demand and the pace of technology upgrades, while risks are tied to order cyclicality and elevated valuation levels compared to both industry averages and analyst fair value estimates. Although the October 29 news event signals sound execution, these financial updates do not eliminate the sector’s ongoing uncertainties and will likely not be a material catalyst on their own as recent price momentum already incorporates positive expectations.

Yet, the volatility in customer investment cycles remains a critical detail for anyone following the story. Disco's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Disco - why the stock might be worth less than half the current price!

Build Your Own Disco Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Disco research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Disco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Disco's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6146

Disco

Manufactures and sells precision cutting, grinding, and polishing machines in Japan and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives