- Japan

- /

- Semiconductors

- /

- TSE:285A

There's No Escaping Kioxia Holdings Corporation's (TSE:285A) Muted Revenues

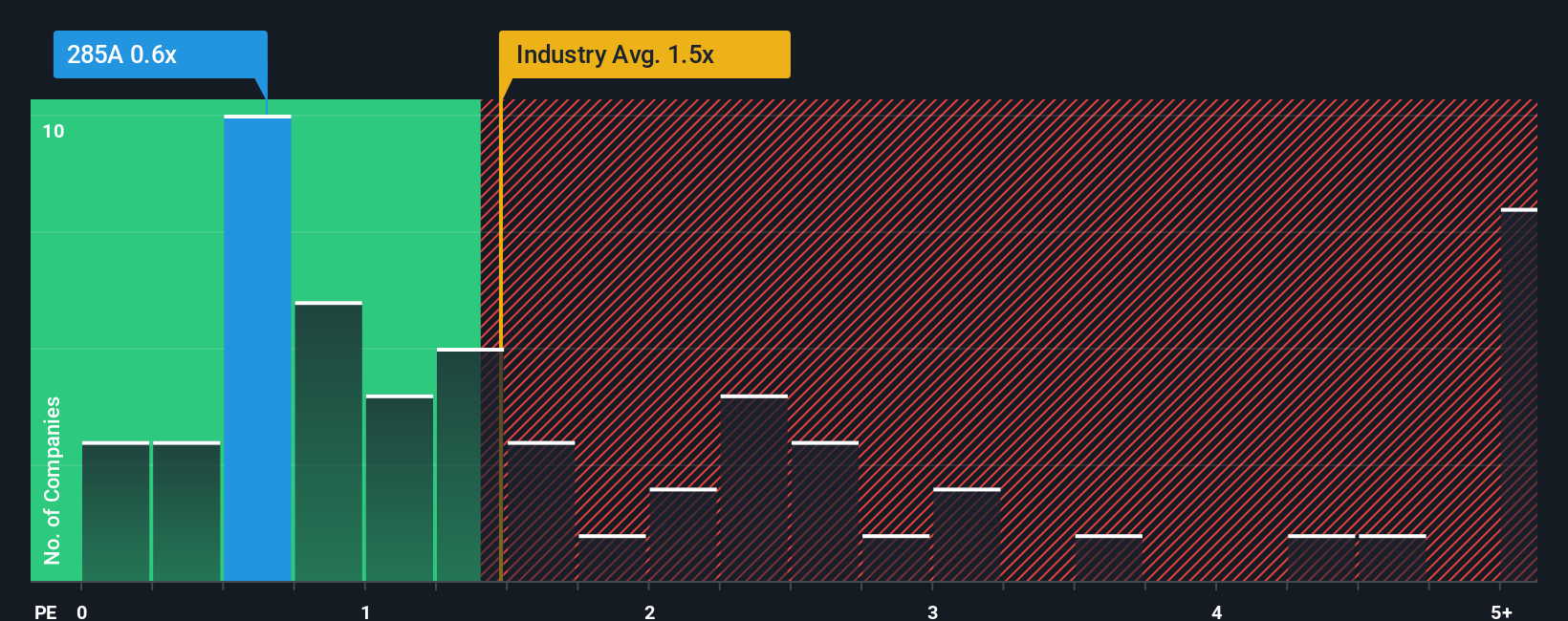

Kioxia Holdings Corporation's (TSE:285A) price-to-sales (or "P/S") ratio of 0.6x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Semiconductor industry in Japan have P/S ratios greater than 1.5x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Kioxia Holdings

How Kioxia Holdings Has Been Performing

With revenue growth that's superior to most other companies of late, Kioxia Holdings has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Kioxia Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Kioxia Holdings' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 59% gain to the company's top line. The latest three year period has also seen a 12% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue growth is heading into negative territory, declining 0.7% each year over the next three years. Meanwhile, the broader industry is forecast to expand by 7.2% per year, which paints a poor picture.

With this in consideration, we find it intriguing that Kioxia Holdings' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Kioxia Holdings' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Kioxia Holdings' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Kioxia Holdings' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Kioxia Holdings (2 are concerning!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kioxia Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:285A

Kioxia Holdings

Engages in the development, production and sale of flash memory and solid state drives (SSDs) in Japan and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success