- Japan

- /

- Specialty Stores

- /

- TSE:9831

How Yamada Holdings' New Employee Share Plan Could Influence TSE:9831’s Investment Appeal

Reviewed by Sasha Jovanovic

- Yamada Holdings recently held a Board Meeting on November 17, 2025 to discuss the disposal of its own shares as part of an employee shareholding association restricted share incentive plan.

- This move highlights the company's focus on aligning employee interests with long-term corporate performance by expanding equity-based compensation initiatives.

- We'll explore how the decision to allocate shares for employee incentives may shape Yamada Holdings' overall investment narrative moving forward.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Yamada Holdings' Investment Narrative?

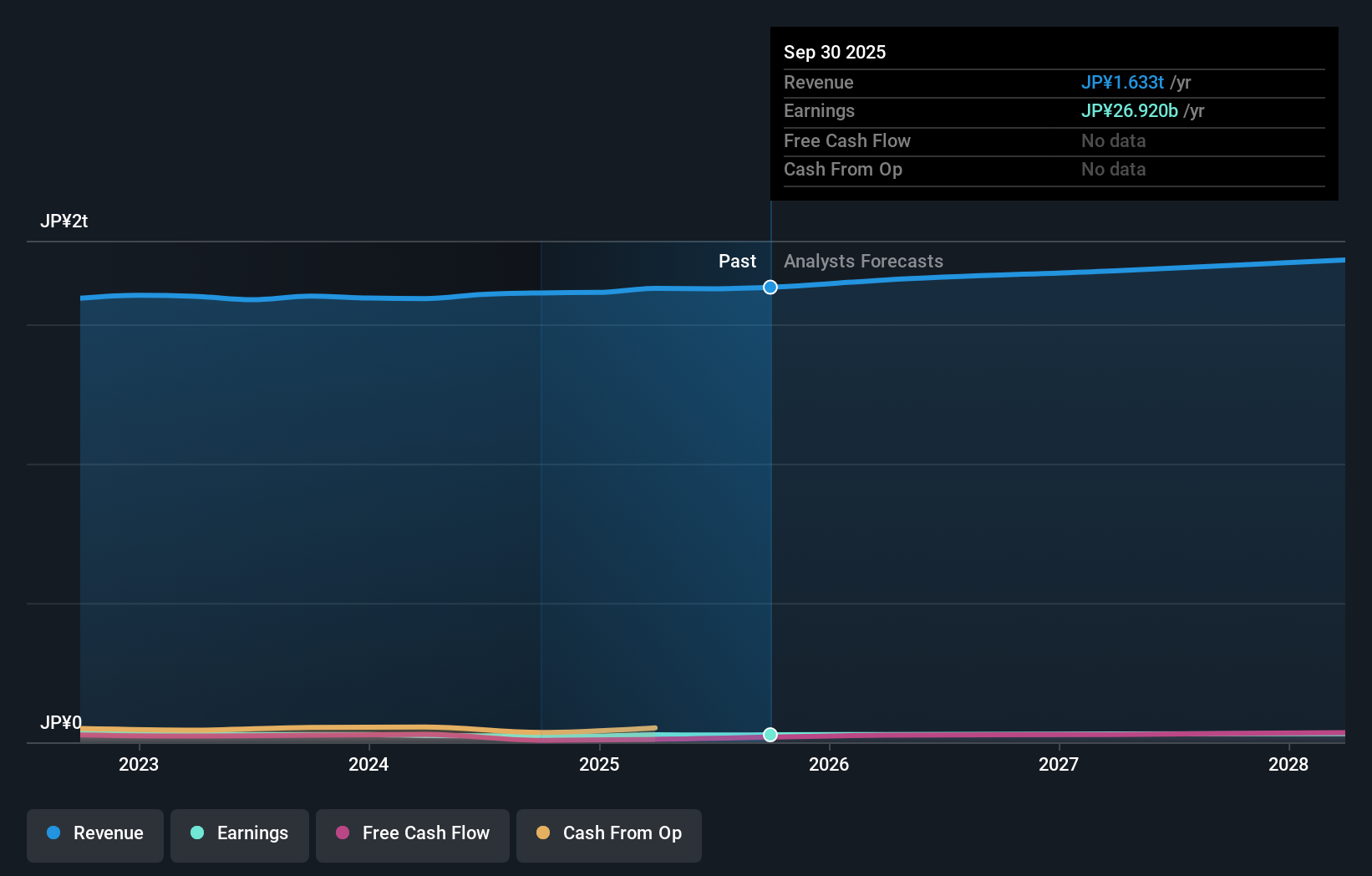

For investors considering Yamada Holdings, the long-term story often centers on its ability to enhance profitability in a low-growth retail environment while maintaining shareholder returns. The recent board decision to allocate shares to an employee incentive plan is a noteworthy step, but the immediate impact on short term catalysts and headline risks appears limited. While equity-based incentive plans can strengthen employee alignment and foster improved results over time, investors are still likely to focus on slower revenue growth forecasts and the company’s relatively low historical return on equity. Previously cited risks, like ongoing board turnover and debt coverage concerns, remain in play and may now draw greater attention as Yamada shifts capital structure to support internal incentives. For now, the primary levers for the stock, sustainable profit growth and value relative to peers, look unchanged after the recent news.

But with so many new directors, governance remains a topic investors should keep an eye on. Yamada Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Yamada Holdings - why the stock might be worth as much as ¥489!

Build Your Own Yamada Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yamada Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Yamada Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yamada Holdings' overall financial health at a glance.

No Opportunity In Yamada Holdings?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9831

Yamada Holdings

Operates in the consumer electronics retailing activities in Japan and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success