- Japan

- /

- Retail Distributors

- /

- TSE:8283

Paltac (TSE:8283) Valuation in Focus Following New Supply Chain Joint Venture with ARATA and PLANET

Reviewed by Simply Wall St

Paltac (TSE:8283) just revealed a plan to team up with ARATA and PLANET on a new joint venture, aiming to centralize commodity information with support from the Ministry of Economy, Trade and Industry. This move is designed to streamline the entire consumer goods supply chain, from distribution to logistics.

See our latest analysis for Paltac.

Paltac’s share price has climbed 10.4% over the past 90 days, showing renewed momentum as investors digest its ambitious new joint venture with ARATA and PLANET. Looking further back, the one-year total shareholder return stands at 14.3%, marking a solid rebound after a challenging stretch for the stock.

If you’re curious about what other companies are building momentum and catching investor attention, now is a perfect time to discover fast growing stocks with high insider ownership

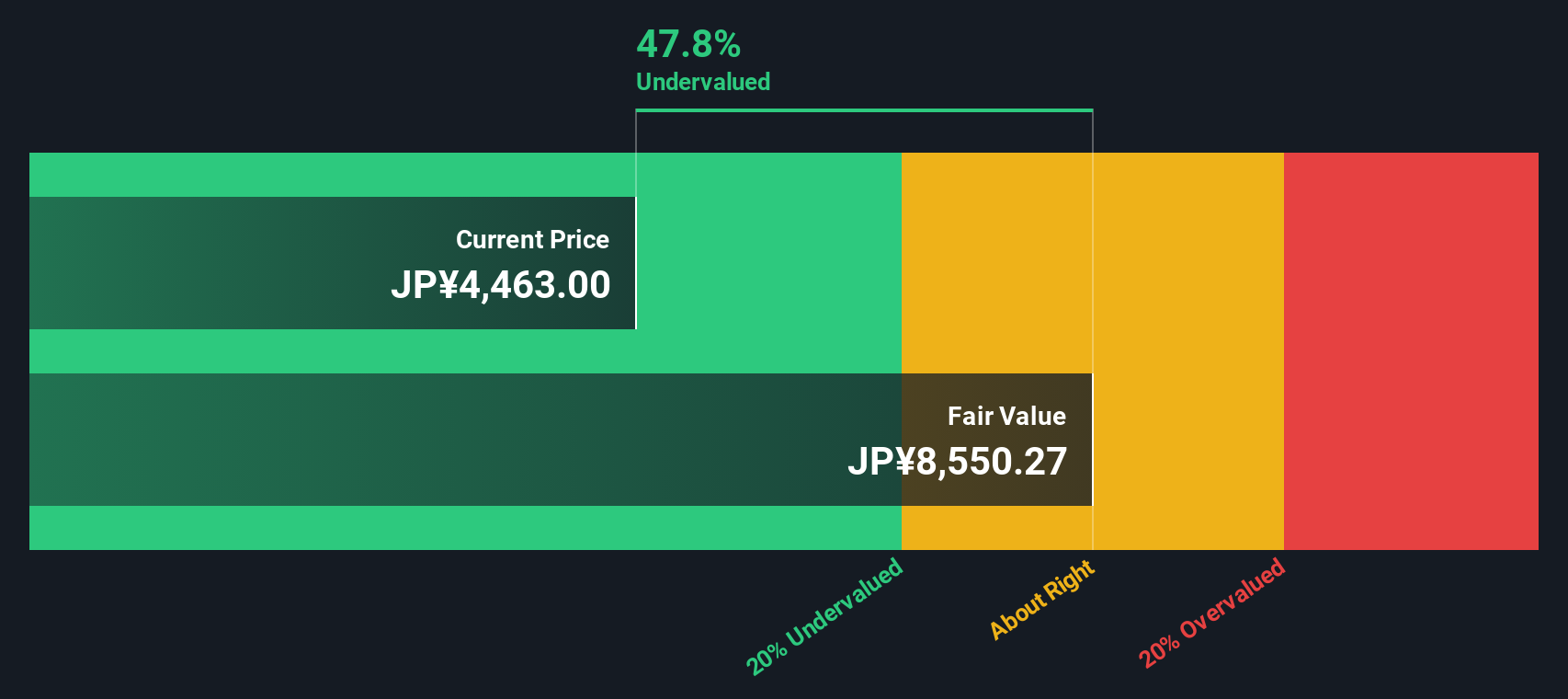

With Paltac’s recent surge and ambitious supply chain overhaul, the question now is whether the stock remains undervalued or if the recent gains suggest investors are already pricing in future growth. Is this still a buying opportunity?

Price-to-Earnings of 12.5x: Is it justified?

Paltac trades at a price-to-earnings ratio of 12.5x, placing it well below the fair price-to-earnings estimate of 14.9x. This suggests undervaluation relative to its earnings.

The price-to-earnings (P/E) ratio measures how much investors are currently willing to pay for each yen the company earns. It is a core gauge for valuing retailers like Paltac, where steady profits and margins play a vital role. A lower-than-expected P/E can indicate that the market is overlooking earnings potential or that expectations remain subdued despite recent performance shifts.

Compared to the broader peer group and the Retail Distributors industry average P/E of 12x, Paltac's 12.5x is only modestly higher. However, it remains comfortably below both its peer average of 13.8x and the calculated fair value multiple of 14.9x. This provides strong evidence that the current share price may not fully reflect the company's earnings power and potential for further expansion if its supply chain and growth initiatives succeed.

Explore the SWS fair ratio for Paltac

Result: Price-to-Earnings of 12.5x (UNDERVALUED)

However, slower revenue and net income growth, or failure to deliver on supply chain initiatives, could temper investor optimism and impact future returns.

Find out about the key risks to this Paltac narrative.

Another View: DCF Points to Even Deeper Value

While the price-to-earnings ratio hints at Paltac being undervalued, our SWS DCF model suggests an even bigger gap. According to this approach, Paltac trades 45% below its fair value. This implies the market may be underestimating future cash flows and growth.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Paltac for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Paltac Narrative

Keep in mind, if you see things differently or want to form your own perspective, it only takes a few minutes to analyze the data and shape your own view, all at your pace. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Paltac.

Looking for more investment ideas?

Make your next move count and uncover companies set for growth, innovation, or income using these unique screens on Simply Wall Street. Opportunity does not wait for hesitation.

- Capitalize on potential breakthroughs by checking out these 27 AI penny stocks built on cutting-edge artificial intelligence trends and enterprise adoption stories.

- Target smart income streams with these 17 dividend stocks with yields > 3% that consistently deliver yields above 3 percent and help support your financial goals.

- Jump on untapped value by spotting these 877 undervalued stocks based on cash flows where the market may have missed compelling cash flow stories and future upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8283

Paltac

Engages in the wholesale of cosmetics, daily necessities, and over-the-counter drugs in Japan.

Flawless balance sheet and good value.

Market Insights

Community Narratives