- Japan

- /

- Retail Distributors

- /

- TSE:8283

Paltac (TSE:8283) Raises Dividend—What Does the Latest Payout Signal for Its Valuation?

Reviewed by Simply Wall St

Paltac (TSE:8283) just announced an increase to its second quarter dividend for the fiscal year ending March 2026, raising it to JPY 57 per share from JPY 50 a year earlier. This move highlights management’s confidence in the company’s ongoing financial health and stability.

See our latest analysis for Paltac.

Paltac’s recently announced dividend boost comes after a steady period for its shares, with a recent 4.3% year-to-date share price return and a 9.8% total shareholder return over the past year. Momentum appears to be building, reflecting positive market sentiment and the company’s improving fundamentals.

If you’re looking to broaden your investment radar beyond Paltac’s latest moves, now is a great time to discover fast growing stocks with high insider ownership via fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst price targets and improving financial results, investors may wonder whether Paltac is currently undervalued or if future growth is already reflected in the stock price.

Price-to-Earnings of 12.7x: Is it justified?

Paltac is currently trading at a price-to-earnings ratio of 12.7x, which stands out as a value opportunity relative to both its estimated fair P/E and some of its direct peers.

The price-to-earnings (P/E) ratio shows how much investors are paying for each yen of Paltac’s earnings. It is a key measure for evaluating the company’s valuation against its own fundamentals, the sector, and historical levels. For distributors and retailers, a reasonable P/E reflects both growth expectations and the risk appetite in the market.

At 12.7x, Paltac’s P/E ratio is below the estimated fair price-to-earnings of 15.8x and below the peer average of 13.2x. However, compared to the Japanese Retail Distributors industry average of 11.8x, Paltac does look slightly more expensive. This suggests that while the market is assigning a modest premium, it still leaves meaningful upside if the company’s earnings story continues to develop positively.

The gap between the current P/E and the fair ratio captures market scepticism but also potential for rerating. If sentiment or results improve, the share price could move up towards the fair multiple level.

Explore the SWS fair ratio for Paltac

Result: Price-to-Earnings of 12.7x (UNDERVALUED)

However, if industry demand softens or unexpected margin pressure arises, the current optimism around Paltac’s valuation and growth outlook could be quickly challenged.

Find out about the key risks to this Paltac narrative.

Another View: Discounted Cash Flow Perspective

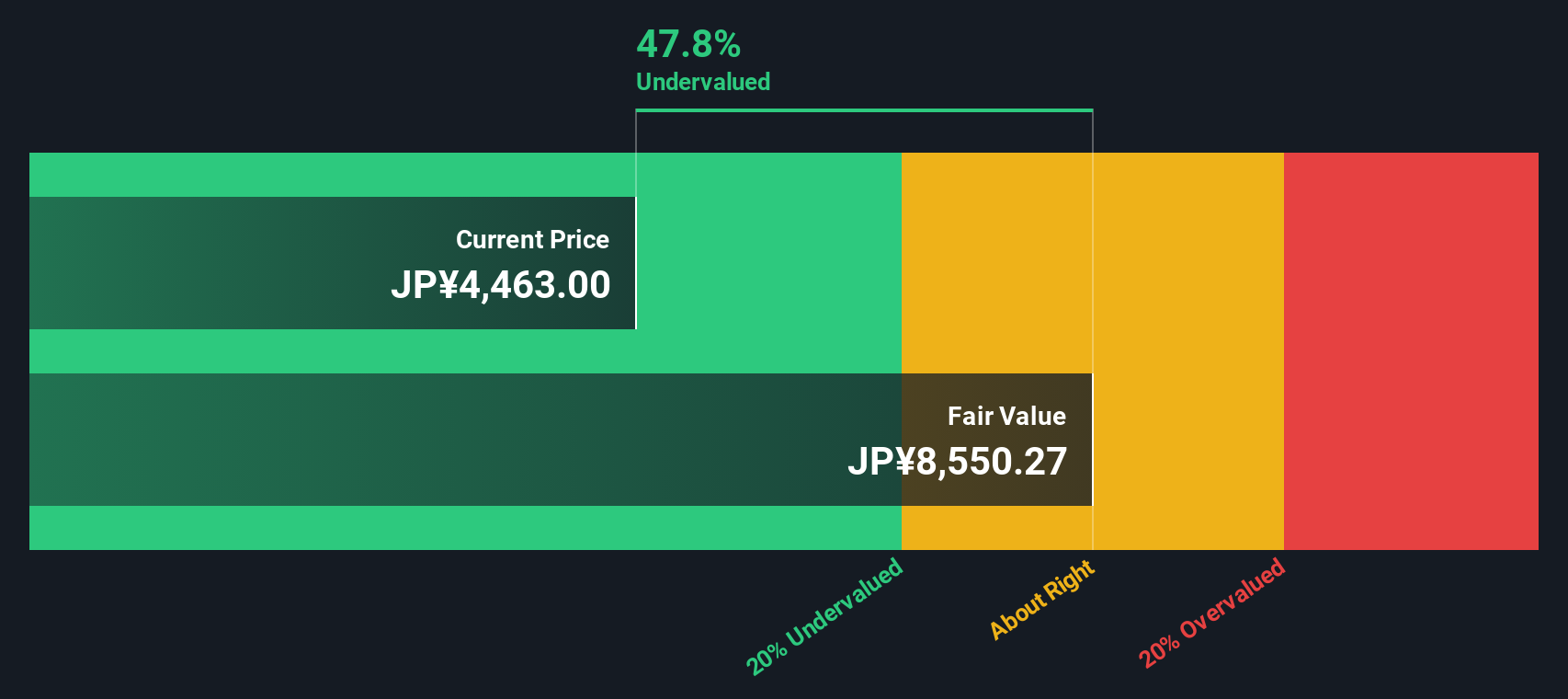

The SWS DCF model offers a very different perspective. It estimates Paltac's fair value at ¥8,626.42 compared to its current price of ¥4,551. This suggests the shares could be significantly undervalued by the market and raises the question of whether there is hidden upside, or if the DCF model is too optimistic about future cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Paltac for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Paltac Narrative

If you’d like to reach your own conclusions or believe a different story lies in the details, you can research the numbers and craft your perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Paltac.

Looking for More Smart Investment Ideas?

Why settle for one opportunity when you could spot others poised for growth? Take action now and uncover fresh investment angles that others might miss.

- Uncover high-yield opportunities and put your money to work with these 16 dividend stocks with yields > 3% offering attractive payouts above 3%.

- Capitalize on the explosive growth in artificial intelligence by reviewing these 25 AI penny stocks that are transforming multiple industries.

- Seize the chance to buy great businesses for less by finding these 879 undervalued stocks based on cash flows trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8283

Paltac

Engages in the wholesale of cosmetics, daily necessities, and over-the-counter drugs in Japan.

Flawless balance sheet and good value.

Market Insights

Community Narratives