- Japan

- /

- Specialty Stores

- /

- TSE:8218

Komeri (TSE:8218) Valuation Debate Grows as Forecasted Growth Trails Japanese Market

Reviewed by Simply Wall St

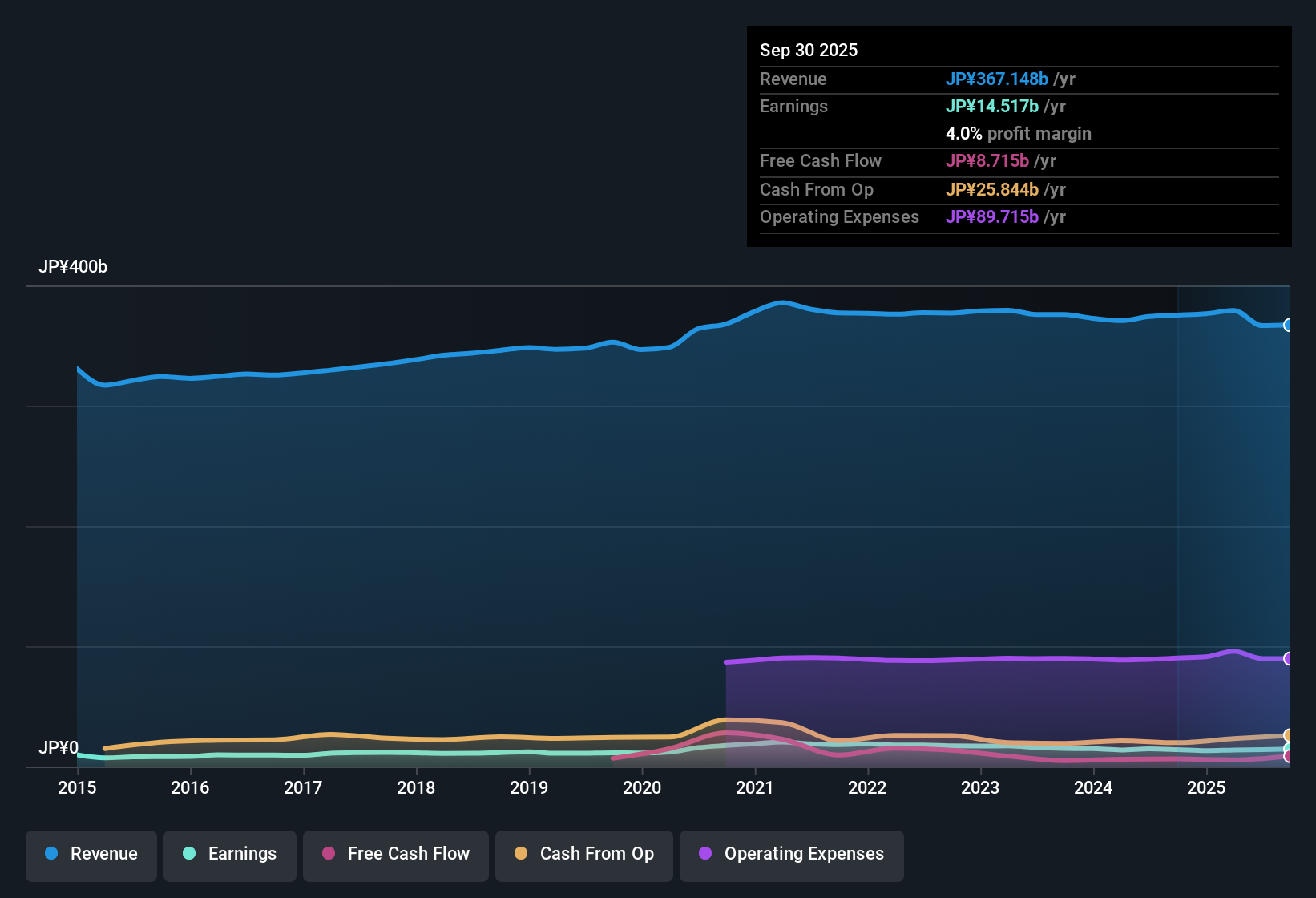

Komeri Ltd (TSE:8218) is forecasting revenue growth of 2.4% per year and EPS growth of 4.6% per year, both lagging behind the broader Japanese market’s expected rates of 4.5% and 7.9%, respectively. The company’s net profit margin has edged down to 3.8% from last year’s 3.9%, and over the past five years, earnings have declined at an annual rate of 8.2%, with negative earnings growth most recently reported. Investors are weighing the company’s good relative value, highlighted by its Price-to-Earnings ratio of 10.8x against peers and the broader industry, against continued revenue and profit underperformance.

See our full analysis for KomeriLtd.Next up, we will see how these headline numbers stack up against the narratives shaping investor sentiment. Sometimes those stories line up, but sometimes they get put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Stability Despite Industry Pressures

- Net profit margin held at 3.8%, only slightly below last year’s 3.9%. This demonstrates resilience as the broader specialty retail sector faces ongoing cost headwinds.

- Investor commentary highlights Komeri’s reliable operations and steady cash flows even as industry competition intensifies.

- The steady margin performance positions Komeri as a lower-risk, defensive choice. This is especially valued when sector peers have reported steeper margin compression amid inflation.

- While margin stability is seen as a strength, the modest 0.1 percentage point decline indicates that securing future profitability will depend on ongoing operational improvements, not just defensive positioning.

DCF Discount Signals Underlying Value Debate

- Shares trade at ¥3,200, a 59% premium to the DCF fair value estimate of ¥2,007.03. The company’s P/E of 10.8x is attractively below peers and industry averages.

- Prevailing analysis points out that while Komeri looks undervalued on earnings compared to competitors, the significant DCF premium raises debate over whether the share price already reflects all its defensive advantages.

- This valuation tension spotlights Komeri’s appeal as a “good value” pick for relative P/E shoppers, but leaves room for debate on whether the broader market is overlooking risks tied to lagging growth rates and past earnings declines.

- Investors weighing value versus growth must reconcile the company’s below-peer P/E and defensive cash generation with the gap to intrinsic value implied by discounted cash flows.

Five-Year Earnings Slide Raises Bar for Improvement

- Earnings have declined by an annual rate of 8.2% over the last five years, and the latest period also saw negative growth. This extends a multi-year pattern of underperformance compared to market averages.

- Despite commendable cost management, broader market observers caution that continued declines amplify the importance of management executing on digital upgrades and margin stabilization.

- Some see Komeri’s steady dividend and focus on operational improvements as important, but argue that these have yet to reverse the entrenched earnings downtrend that positions the company as a “reliable but slow” performer compared to more dynamic peers.

- With revenue and earnings growth forecasts still trailing the Japanese market, calls for bold execution are growing louder among investors who want evidence that management can deliver a meaningful turnaround.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on KomeriLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Komeri’s earnings have consistently declined over five years, and growth forecasts remain well below the market. This raises concerns for long-term investors.

If you want companies showing steadier results, use our stable growth stocks screener (2124 results) to uncover businesses delivering reliable revenue and earnings through market ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KomeriLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8218

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives