- Japan

- /

- Specialty Stores

- /

- TSE:8185

Chiyoda Co., Ltd.'s (TSE:8185) 25% Price Boost Is Out Of Tune With Revenues

Chiyoda Co., Ltd. (TSE:8185) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 27% in the last year.

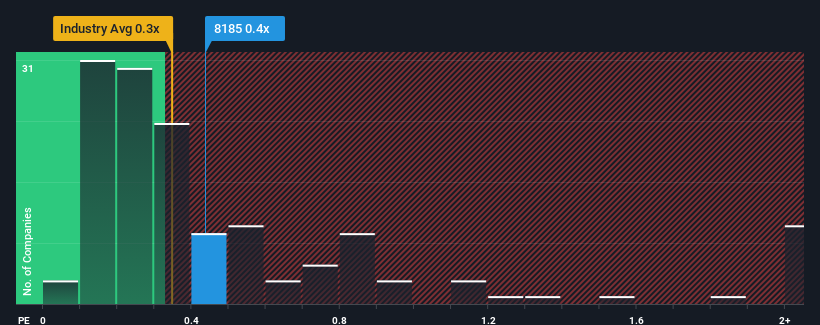

Although its price has surged higher, there still wouldn't be many who think Chiyoda's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Japan's Specialty Retail industry is similar at about 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Chiyoda

What Does Chiyoda's Recent Performance Look Like?

Chiyoda could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chiyoda.Is There Some Revenue Growth Forecasted For Chiyoda?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Chiyoda's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 3.3% drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 1.3% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 8.0%, which is noticeably more attractive.

In light of this, it's curious that Chiyoda's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Chiyoda's P/S Mean For Investors?

Its shares have lifted substantially and now Chiyoda's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given that Chiyoda's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Chiyoda that you need to be mindful of.

If you're unsure about the strength of Chiyoda's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8185

Chiyoda

Engages in the development, manufacture, and sale of shoes in Japan.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives