- Japan

- /

- Specialty Stores

- /

- TSE:8136

Does Sanrio Company (TSE:8136) See Dividend Changes as a Signal of Brand Strength or Strategic Caution?

Reviewed by Sasha Jovanovic

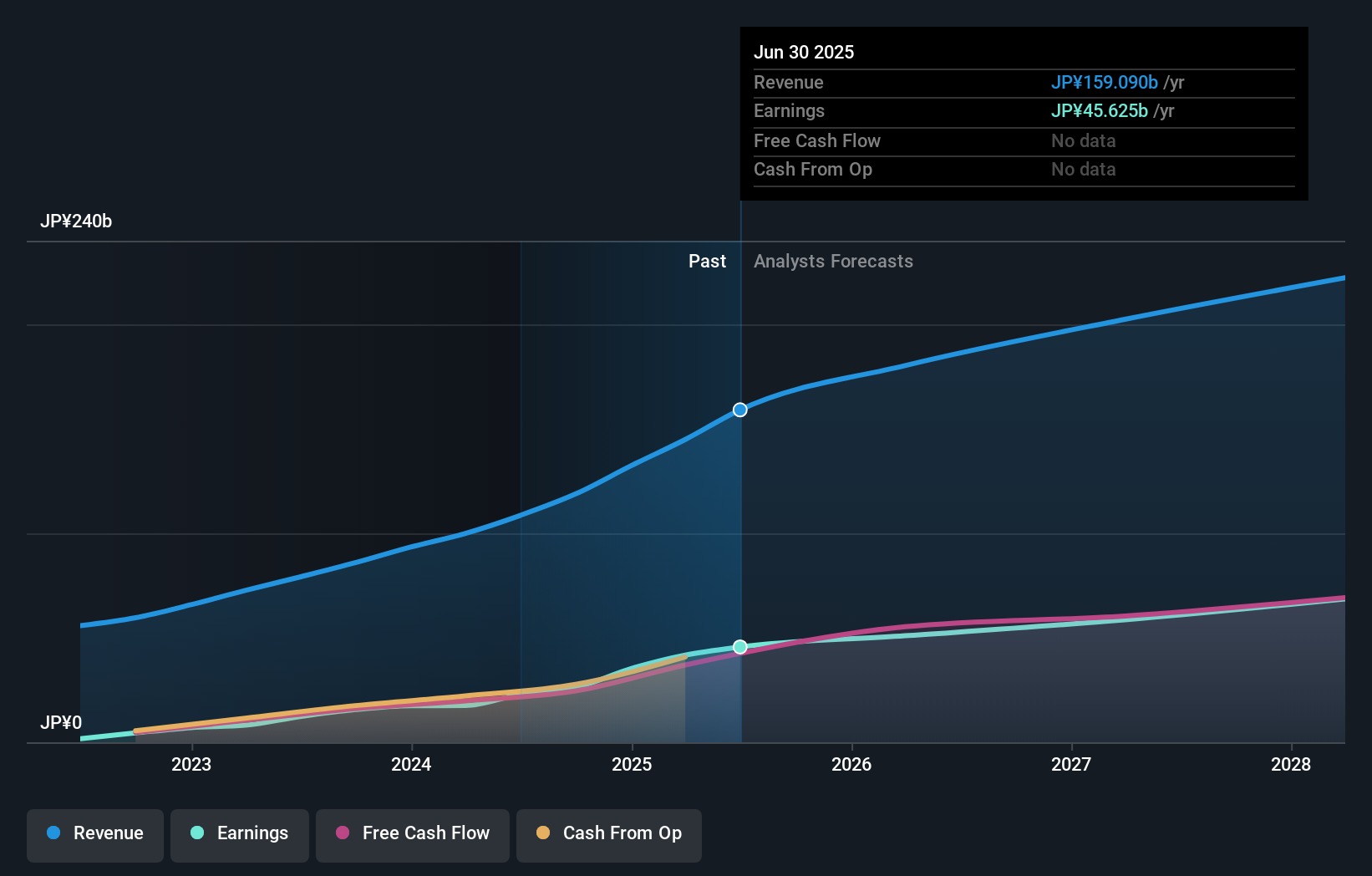

- Sanrio Company recently announced an increase in its second quarter dividend to ¥31 per share and revised its full-year earnings guidance upward for the fiscal year ending March 31, 2026, following a stronger-than-expected first half, but also indicated a slight decrease in its projected year-end dividend compared to the prior year.

- This move reflects the continued global popularity of Sanrio's character brands such as Hello Kitty, and management's confidence in ongoing robust sales despite market risks and higher spending on growth initiatives.

- We'll explore how Sanrio's international character brand appeal and upgraded earnings guidance shape its current investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Sanrio Company's Investment Narrative?

To be a Sanrio shareholder today, you need to believe in the ongoing worldwide resonance of Hello Kitty and its character portfolio, as well as management’s ability to keep evolving its global strategy. The recent surprise increase in Sanrio’s earnings guidance and higher-than-expected interim dividend provide validation that the brands remain a magnet for consumer spending even amid volatile markets. These announcements may shift short term catalysts, with renewed attention on potential upside as global demand and earnings continue to exceed forecasts. On the risk side, management clearly signals caution around higher spending, such as elevated SG&A outlays, which could press margins if growth slows or competition intensifies, and the company remains exposed to external market headwinds like tariffs. While the updated guidance appears directionally positive, it’s worth weighing whether the uplift is enough to materially move sentiment given recent share price volatility and ongoing uncertainty in discretionary spending.

But with the company highlighting tariff headwinds, there’s more to this story than just brand strength. Despite retreating, Sanrio Company's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Sanrio Company - why the stock might be worth just ¥5697!

Build Your Own Sanrio Company Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sanrio Company research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sanrio Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sanrio Company's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8136

Sanrio Company

Plans and sells social communication gifts, greeting cards, and books in Japan, Europe, North America, South America, rest of Asia, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives