- Japan

- /

- Construction

- /

- TSE:1879

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets continue to react positively to recent political developments and economic indicators, major indices like the S&P 500 have reached new highs amid optimism over potential trade deals and AI advancements. In this environment of growth, dividend stocks offer a compelling opportunity for investors seeking steady income streams alongside capital appreciation. A good dividend stock typically combines reliable yield with strong fundamentals, making it an attractive choice in today's dynamic market landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.00% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

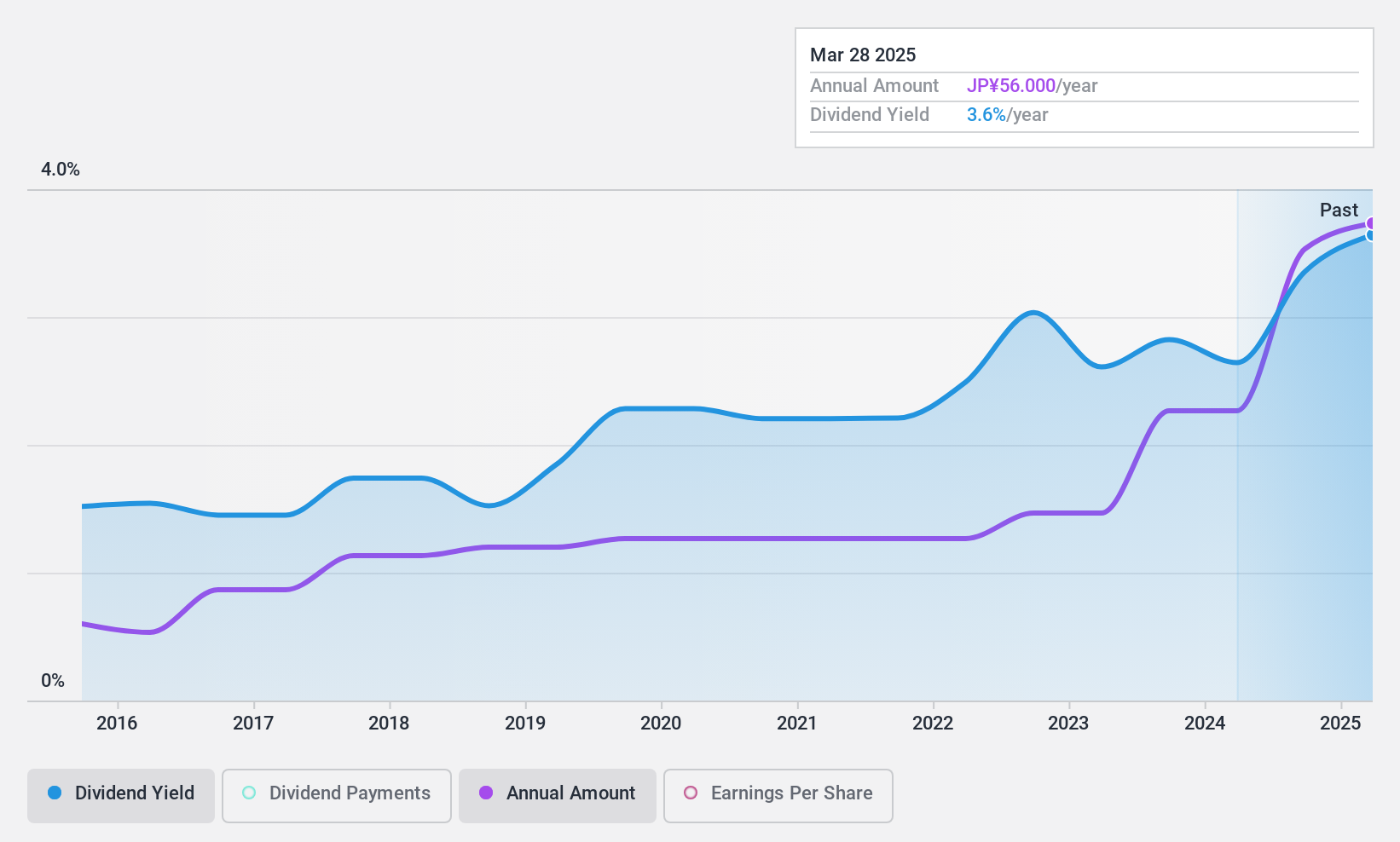

Shinnihon (TSE:1879)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shinnihon Corporation is a Japanese construction company with a market cap of ¥92.76 billion.

Operations: Shinnihon Corporation generates revenue primarily from its Development segment, which accounts for ¥69.70 billion, and its Construction Business segment, contributing ¥69.05 billion.

Dividend Yield: 4%

Shinnihon Corporation recently announced a dividend increase to JPY 26.00 per share, up from JPY 15.00 a year ago, reflecting its efforts to enhance shareholder returns. The company's dividends are well covered by earnings and cash flows with payout ratios of 31.1% and 19.4%, respectively, suggesting sustainability despite past volatility in payments. Trading significantly below estimated fair value, Shinnihon's dividend yield is among the top tier in Japan's market.

- Unlock comprehensive insights into our analysis of Shinnihon stock in this dividend report.

- Our valuation report unveils the possibility Shinnihon's shares may be trading at a discount.

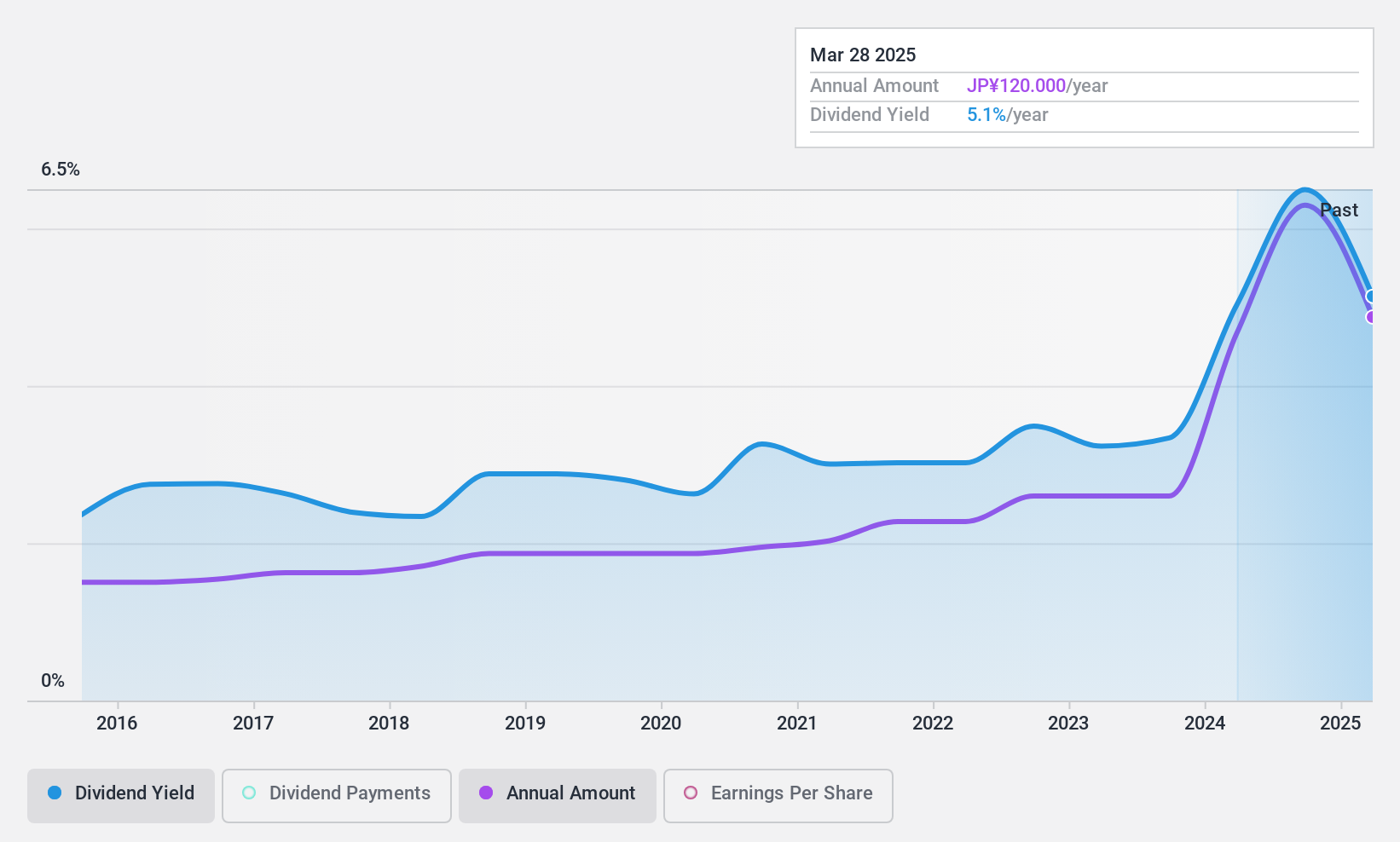

FALCO HOLDINGS (TSE:4671)

Simply Wall St Dividend Rating: ★★★★★★

Overview: FALCO HOLDINGS Co., Ltd. is a medical service company in Japan that offers clinical testing and dispensing pharmacy services to medical institutions and companies, with a market cap of ¥25.02 billion.

Operations: FALCO HOLDINGS Co., Ltd. generates revenue primarily through its Clinical Testing Business, which accounts for ¥26.07 billion, followed by the Dispensing Pharmacy Business at ¥15.82 billion, and the ICT Business contributing ¥1.16 billion.

Dividend Yield: 6.5%

FALCO HOLDINGS offers a compelling dividend profile with a yield of 6.51%, placing it in the top 25% of Japanese dividend payers. Its dividends have been stable and growing over the past decade, supported by earnings and cash flows with payout ratios of 58.6% and 68.8%, respectively, indicating sustainability. Currently trading at a significant discount to its estimated fair value, the company has also completed a share buyback to enhance capital efficiency.

- Navigate through the intricacies of FALCO HOLDINGS with our comprehensive dividend report here.

- Our expertly prepared valuation report FALCO HOLDINGS implies its share price may be lower than expected.

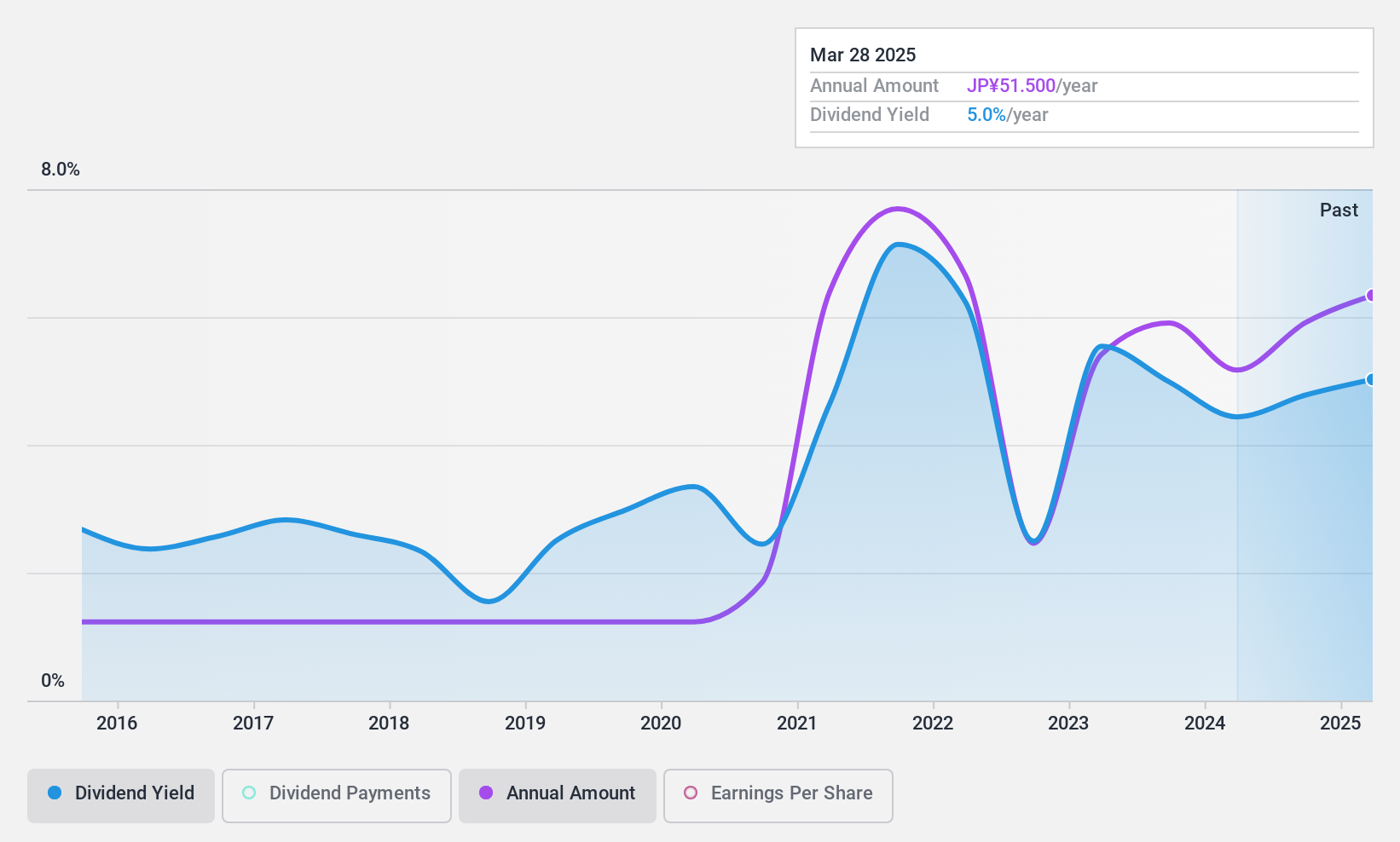

Scroll (TSE:8005)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Scroll Corporation primarily operates in the mail-order and e-commerce sectors in Japan, with a market cap of ¥37.10 billion.

Operations: Scroll Corporation's revenue is derived from its Solution Business at ¥41.60 billion, E-Commerce Business at ¥14.74 billion, Mail Order Business at ¥25.17 billion, and Group-Controlled Business at ¥3.43 billion.

Dividend Yield: 4.5%

Scroll Corporation's dividend yield of 4.45% ranks in the top 25% of Japanese dividend payers, supported by a low payout ratio of 35.6%, indicating strong coverage by earnings and cash flows. Despite a history of volatility and unreliability over the past decade, recent affirmations suggest stability with JPY 24 per share dividends matching last year's figures. The company trades significantly below estimated fair value, potentially offering value to investors seeking dividend income amidst fluctuating payouts.

- Dive into the specifics of Scroll here with our thorough dividend report.

- The analysis detailed in our Scroll valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Dive into all 1962 of the Top Dividend Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1879

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion