- Japan

- /

- Electronic Equipment and Components

- /

- TSE:5214

3 Dividend Stocks Yielding Over 3.3% To Boost Your Portfolio

Reviewed by Simply Wall St

In the midst of global market fluctuations driven by political shifts and economic data, investors are seeking stability amidst uncertainty. With U.S. stocks experiencing a partial pullback from recent gains and interest rate expectations adjusting, dividend stocks offering yields over 3.3% present an appealing option for those looking to enhance portfolio resilience through regular income streams.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.12% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.63% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.79% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.80% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.51% | ★★★★★★ |

Click here to see the full list of 1969 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

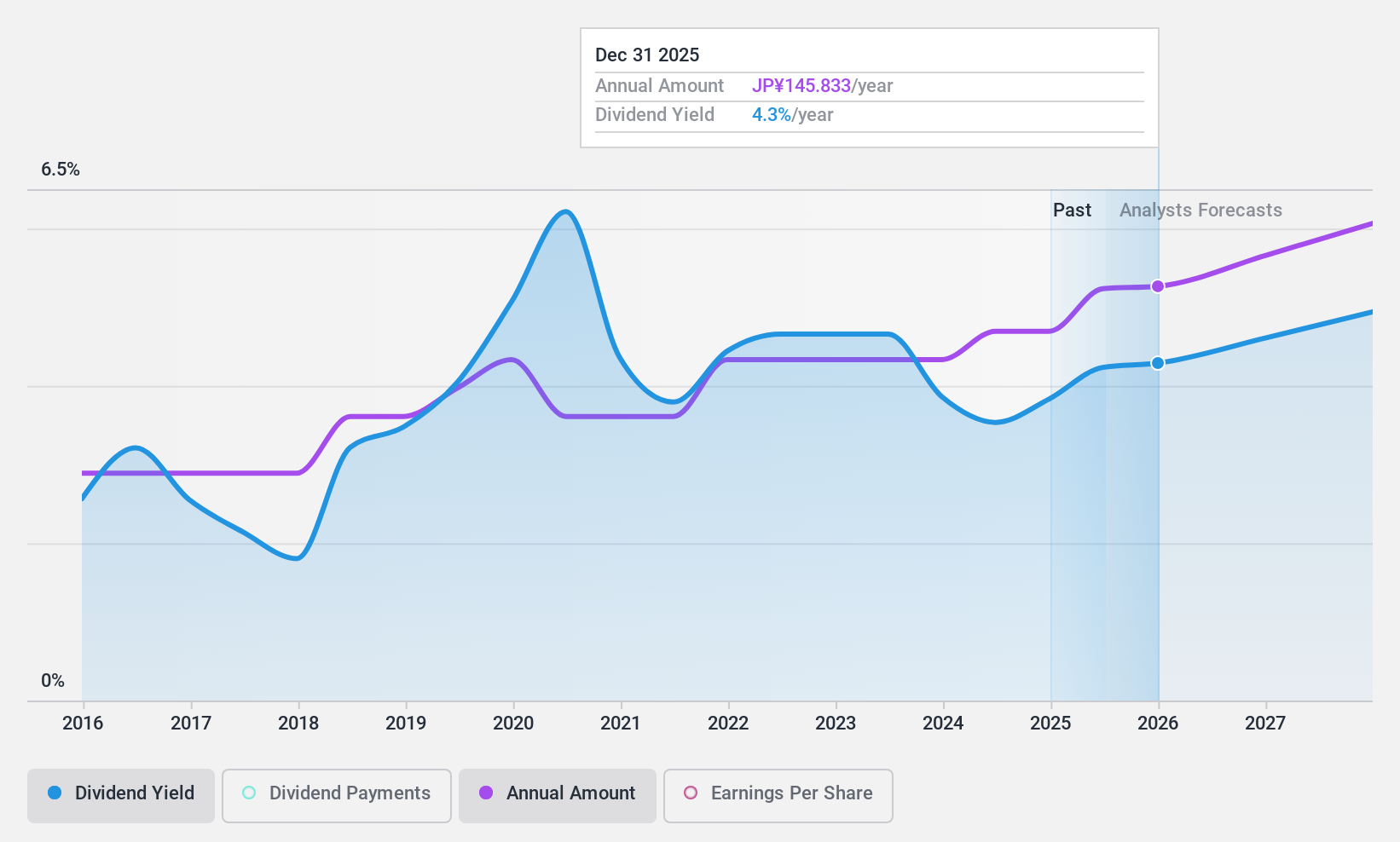

Nippon Electric Glass (TSE:5214)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Electric Glass Co., Ltd. and its subsidiaries manufacture and sell specialty glass products and glass making machinery across Japan, China, South Korea, the United States, Europe, and other international markets with a market cap of ¥287.29 billion.

Operations: Nippon Electric Glass Co., Ltd.'s revenue primarily comes from its Glass Business, which generated ¥298.14 billion.

Dividend Yield: 3.8%

Nippon Electric Glass's dividend payout is supported by earnings with a 52.5% payout ratio, but its cash flow coverage is tighter at 81.6%. While dividends have grown over the past decade, they have been unreliable and volatile. The company recently raised its earnings guidance for 2024, expecting net sales of ¥310 billion and profit of ¥30 billion. Additionally, it completed a share buyback worth approximately ¥10 billion, which may impact future dividend stability positively or negatively.

- Navigate through the intricacies of Nippon Electric Glass with our comprehensive dividend report here.

- The analysis detailed in our Nippon Electric Glass valuation report hints at an deflated share price compared to its estimated value.

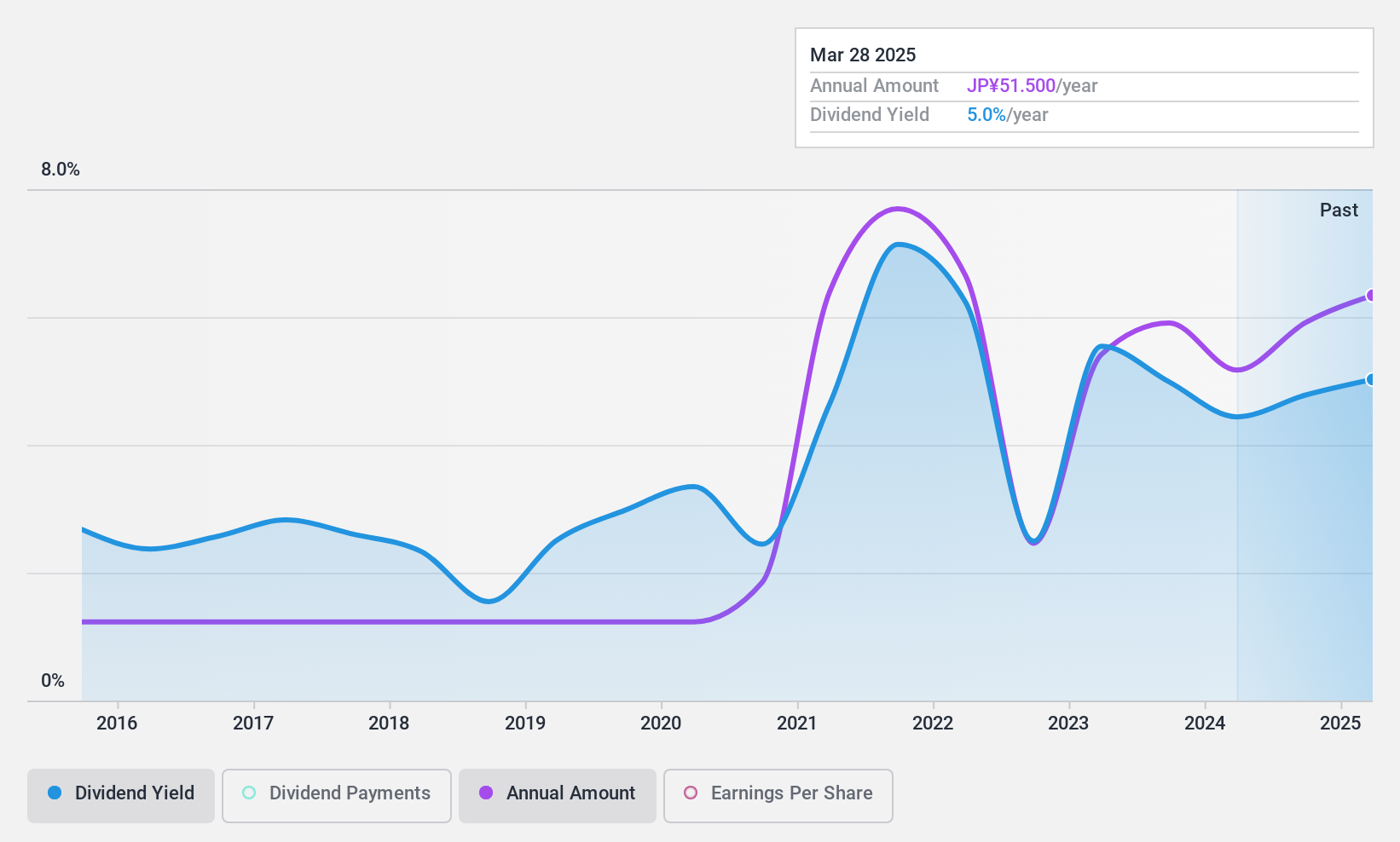

Scroll (TSE:8005)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Scroll Corporation primarily operates in the mail-order and e-commerce sectors in Japan, with a market cap of ¥36.35 billion.

Operations: Scroll Corporation's revenue is primarily derived from its mail-order and e-commerce operations in Japan.

Dividend Yield: 4%

Scroll Corporation's dividend is well-covered by earnings and cash flows, with payout ratios of 15.2% and 26.1%, respectively. Despite a stable recent announcement of JPY 24 per share, the company's dividends have been volatile over the past decade. Trading significantly below estimated fair value, Scroll's dividends are in the top tier for yield in Japan but remain unreliable due to historical fluctuations. The company projects strong financials for fiscal year-end March 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Scroll.

- The valuation report we've compiled suggests that Scroll's current price could be quite moderate.

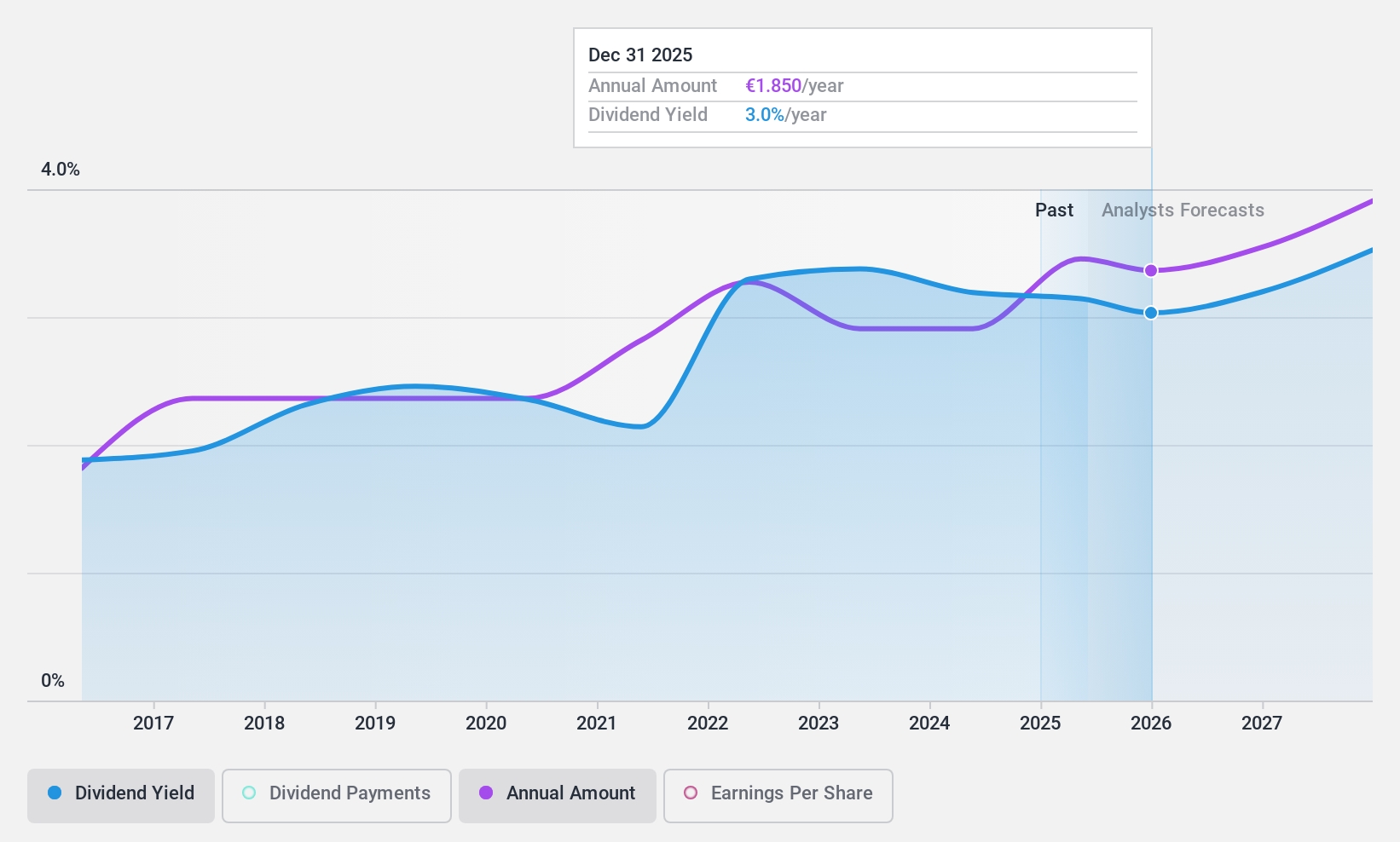

Uzin Utz (XTRA:UZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Uzin Utz SE develops, manufactures, and sells construction chemical system products in Germany, the United States, Netherlands, and internationally with a market cap of €242.13 million.

Operations: Uzin Utz SE's revenue segments include Germany - Laying Systems (€209.68 million), Western Europe (€81.64 million), Netherlands - Laying Systems (€83.59 million), USA - Laying Systems (€73.60 million), Netherlands - Wholesale (€33.66 million), Germany - Surface Care and Refinement (€34.21 million), South/Eastern Europe (€27.70 million), and Germany - Machinery and Tools (€31.94 million).

Dividend Yield: 3.3%

Uzin Utz offers a reliable dividend yield of 3.31%, supported by a low payout ratio of 33.8% and cash payout ratio of 19.9%, indicating strong coverage by earnings and cash flows. The company's dividends have been stable and growing over the past decade, although they fall short compared to the top dividend payers in Germany. With a price-to-earnings ratio of 10.2x below the market average, Uzin Utz presents good value for investors seeking consistent income streams.

- Click to explore a detailed breakdown of our findings in Uzin Utz's dividend report.

- Our valuation report here indicates Uzin Utz may be overvalued.

Taking Advantage

- Navigate through the entire inventory of 1969 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Electric Glass might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5214

Nippon Electric Glass

Manufactures and sells specialty glass products and glass manufacturing machinery in Japan and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives