- Japan

- /

- Specialty Stores

- /

- TSE:4732

USS (TSE:4732): Assessing Valuation After Upgraded Earnings Guidance and Higher Dividend Policy

Reviewed by Simply Wall St

USS (TSE:4732) just updated its earnings and dividend guidance for the next fiscal year, revealing a brighter profit outlook for investors. The company also boosted both interim and year-end dividends, and outlined a more generous payout policy.

See our latest analysis for USS.

USS has quietly built strong momentum, with a 25.18% share price gain so far this year and a 25.94% total shareholder return over twelve months. This suggests that the market is taking note of its improved earnings outlook and more rewarding dividend policy. Longer-term holders have also been rewarded, with total shareholder returns of 64.6% over three years and 77.2% over five years as the company continues to deliver steady growth.

If USS’s shareholder-focused moves have you rethinking your watchlist, now could be the right time to broaden your search and discover fast growing stocks with high insider ownership

With such a robust set of upgrades and a steady record of returns, the debate now turns to valuation. This leaves investors to wonder whether USS offers genuine upside from here, or if the market is already factoring in all the good news.

Price-to-Earnings of 20.1x: Is it justified?

USS currently trades at a price-to-earnings (P/E) ratio of 20.1x, noticeably higher than both its industry peers and the broader market. At the last close of ¥1,715, the company sits at a premium compared to typical sector valuations.

The P/E ratio reflects how much investors are willing to pay today for a yen of future earnings. It is a common tool to assess whether a stock is affordably priced. For specialty retail, this multiple captures the market's expectations about future profitability and earnings growth.

Despite strong recent profit growth, USS’s P/E of 20.1x is well above the Japanese specialty retail industry average of 13.6x and the peer average of 14.5x. The market appears to be assigning a higher value to USS’s business, possibly for its consistency, dividend reliability, and steady management. However, this is also higher than the estimated fair P/E of 16.7x. This suggests USS stock may be stretched on this basis and could revert toward that level if future results disappoint.

Explore the SWS fair ratio for USS

Result: Price-to-Earnings of 20.1x (OVERVALUED)

However, subdued revenue and profit growth, along with a premium valuation, still pose risks that could challenge the optimistic market narrative.

Find out about the key risks to this USS narrative.

Another View: Discounted Cash Flow Check

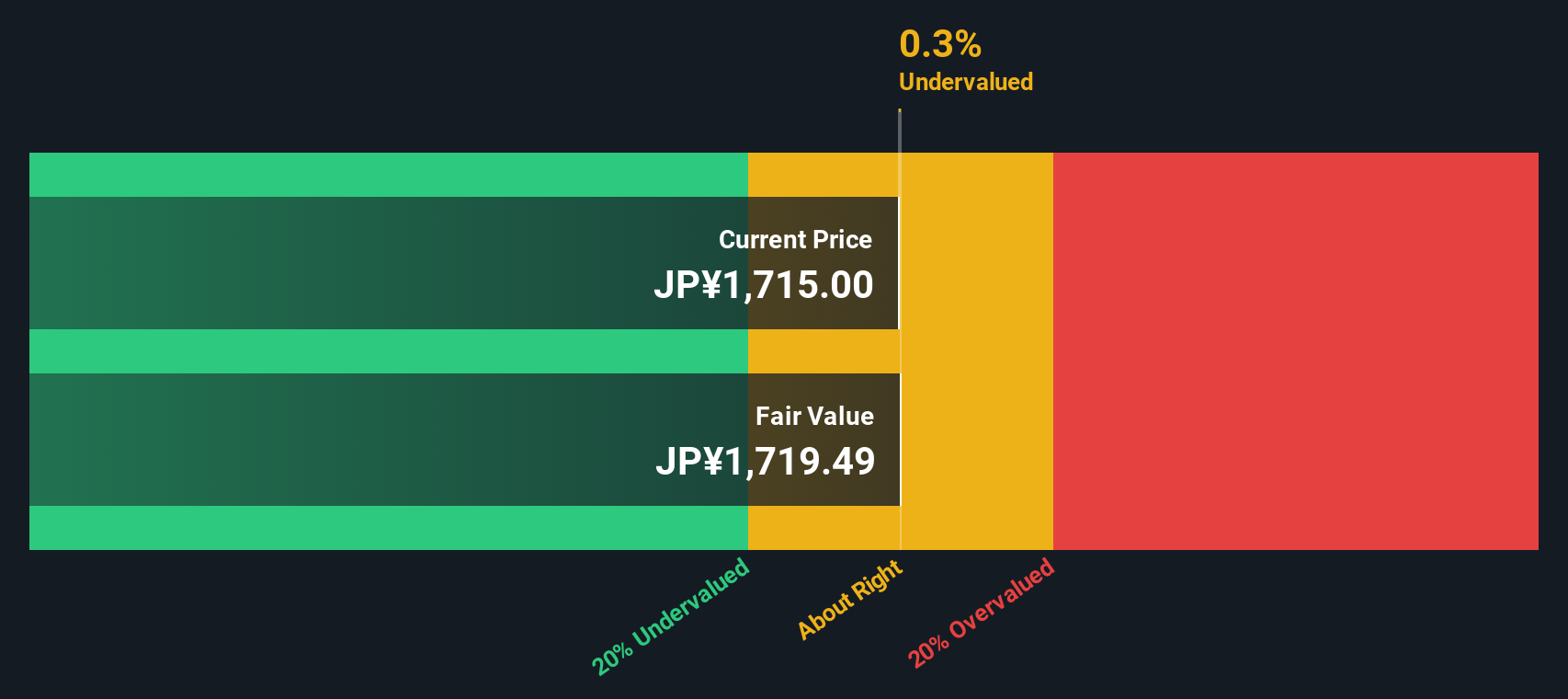

While USS looks expensive on the P/E ratio, our DCF model offers a more balanced perspective. Shares are trading just 0.3% below their fair value estimate by this method, suggesting the current price may actually be about right. Does this mean the market is fully pricing in USS's prospects, or are expectations running too high?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out USS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own USS Narrative

If you see the story differently or prefer running your own numbers, you can easily put together your own perspective on USS in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding USS.

Looking for more investment ideas?

Momentum like USS’s does not last forever. Consider taking prompt action and seek your next great opportunity among other companies with promising long-term potential.

- Accelerate your growth potential by tapping into these 25 AI penny stocks, which are reshaping industries with advancements in artificial intelligence and automation.

- Maximize your income strategy by locking in higher yields using these 17 dividend stocks with yields > 3%, designed for consistent returns and financial stability.

- Capture game-changing trends in emerging technology by selecting these 26 quantum computing stocks, companies pioneering breakthroughs in cutting-edge computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4732

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives