- Japan

- /

- Telecom Services and Carriers

- /

- TSE:4485

September 2024's Top Growth Companies With High Insider Ownership On Japanese Exchanges

Reviewed by Simply Wall St

In September 2024, Japan's stock markets have shown mixed performance amid expectations of further interest rate hikes by the Bank of Japan and a stronger yen. Despite this, growth companies with high insider ownership continue to attract attention for their potential resilience and alignment with shareholder interests. In the current market environment, stocks that combine robust growth prospects with significant insider ownership can offer a compelling investment case. High insider ownership often signals confidence in the company's future and aligns management's interests with those of shareholders, making these stocks particularly noteworthy in today's economic landscape.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 32.7% |

| Hottolink (TSE:3680) | 27% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 43.5% |

| Medley (TSE:4480) | 34% | 30.4% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 68.1% |

| Loadstar Capital K.K (TSE:3482) | 33.8% | 24.3% |

| AeroEdge (TSE:7409) | 10.7% | 25.3% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

Let's explore several standout options from the results in the screener.

Mercari (TSE:4385)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mercari, Inc. plans, develops, and operates Mercari marketplace applications in Japan and the United States with a market cap of ¥418.32 billion.

Operations: Mercari's revenue segments consist of ¥43.65 billion from the US and ¥138.11 billion from Japan.

Insider Ownership: 36%

Mercari, Inc. has demonstrated substantial insider ownership and is positioned for growth with revenue expected to rise between ¥200 billion and ¥210 billion for the fiscal year ending June 30, 2025. Earnings are forecasted to grow at 18.61% annually, outpacing the Japanese market average of 8.5%. Despite recent share price volatility, Mercari trades at a significant discount to its estimated fair value and boasts high-quality earnings with robust return on equity projections reaching 22.5% in three years.

- Get an in-depth perspective on Mercari's performance by reading our analyst estimates report here.

- Our valuation report here indicates Mercari may be overvalued.

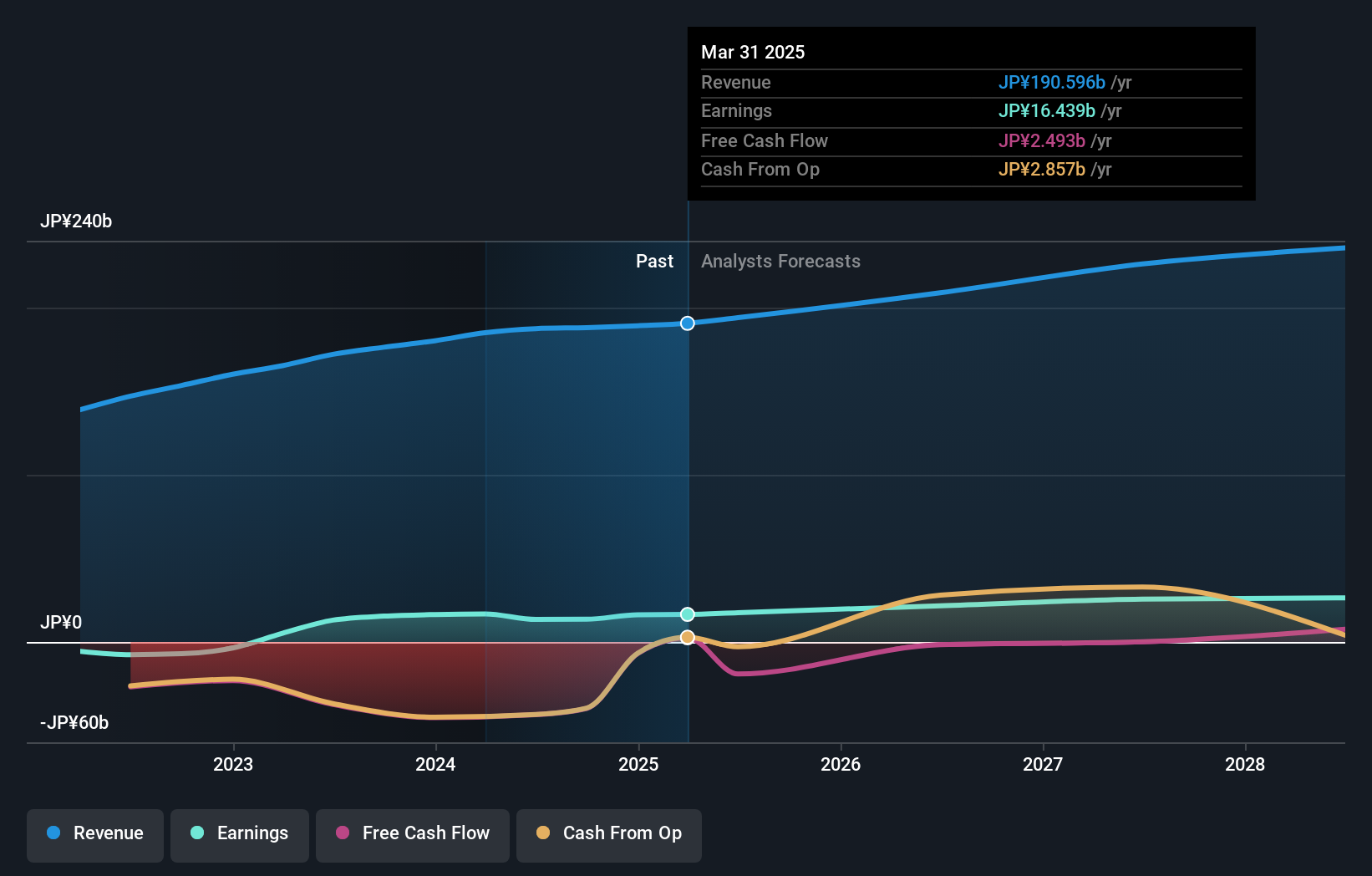

JTOWER (TSE:4485)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JTOWER Inc. offers infrastructure sharing services in Japan and has a market cap of ¥92.48 billion.

Operations: JTOWER Inc. generates revenue through its infrastructure sharing services in Japan.

Insider Ownership: 26%

JTOWER is poised for growth with revenue forecasted to increase 15.7% annually, surpassing the Japanese market average of 4.2%. Despite recent share price volatility and a low future return on equity projection of 1.1%, insider ownership remains significant. Recent events include DigitalBridge's proposal to acquire an 81.82% stake at ¥3,600 per share and a strategic alliance with KDDI Corporation aimed at developing sustainable telecommunications infrastructure amidst Japan's declining population.

- Navigate through the intricacies of JTOWER with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that JTOWER's share price might be on the expensive side.

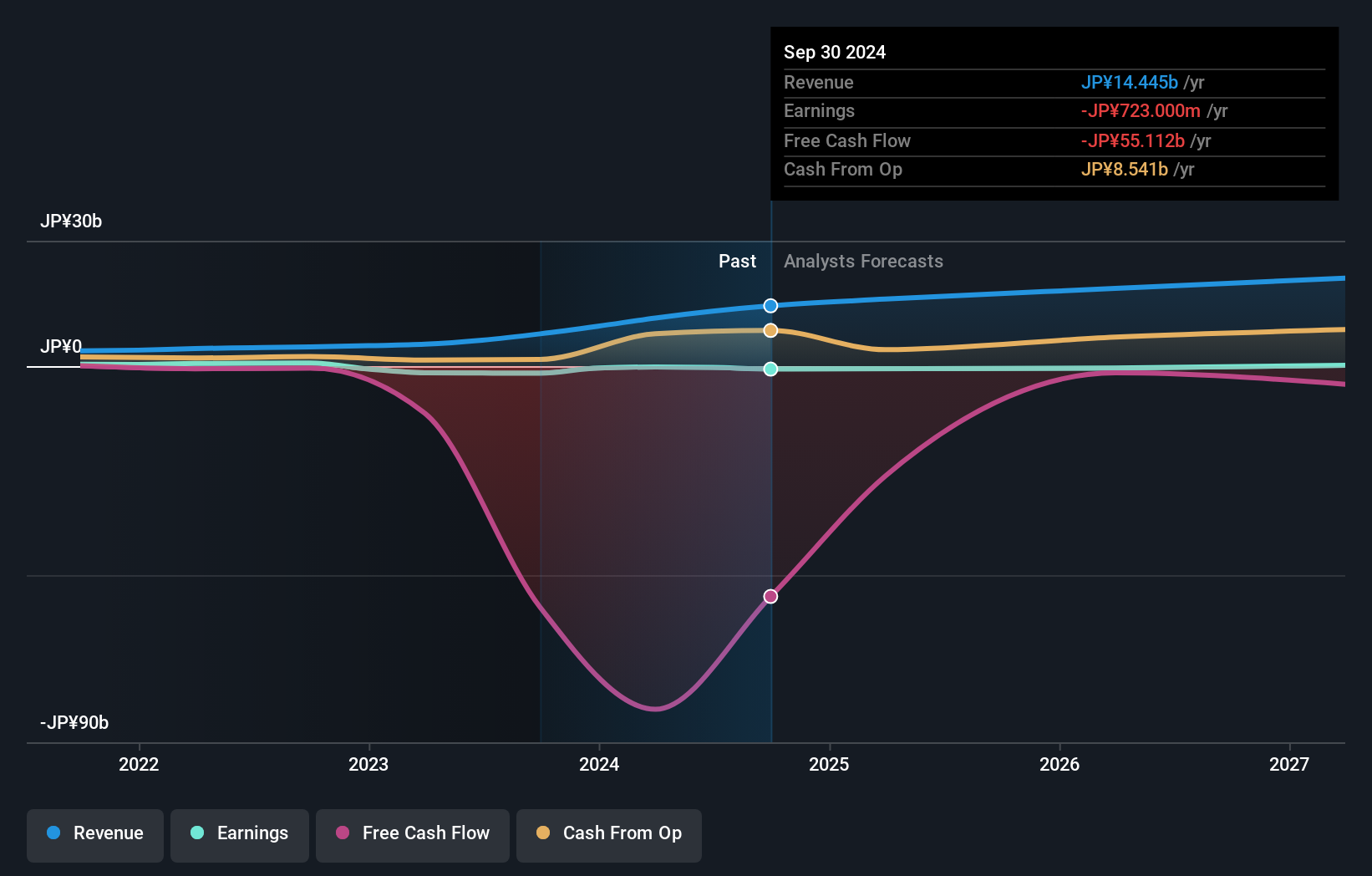

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors serving users in Japan and internationally with a market cap of ¥2.03 trillion.

Operations: The company's revenue segments include Mobile (¥382.95 million), Fin Tech (¥772.29 million), and Internet Services (¥1.24 billion).

Insider Ownership: 17.3%

Rakuten Group's revenue is forecast to grow 7.6% annually, faster than the Japanese market average of 4.2%, and earnings are expected to increase by 82.35% per year, becoming profitable within three years. However, the share price has been highly volatile recently and future return on equity is projected to be low at 9.6%. The company trades at a significant discount, with its stock valued at approximately 89.3% below estimated fair value as of Q2 2024 earnings call on Aug 09, 2024.

- Take a closer look at Rakuten Group's potential here in our earnings growth report.

- According our valuation report, there's an indication that Rakuten Group's share price might be on the cheaper side.

Next Steps

- Unlock more gems! Our Fast Growing Japanese Companies With High Insider Ownership screener has unearthed 99 more companies for you to explore.Click here to unveil our expertly curated list of 102 Fast Growing Japanese Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4485

Reasonable growth potential low.