Stock Analysis

- Japan

- /

- Specialty Stores

- /

- TSE:2792

Exploring Undiscovered Japanese Stocks July 2024

Reviewed by Simply Wall St

In recent trading sessions, Japan's stock markets have faced challenges, particularly in the technology sector due to heightened U.S. restrictions on semiconductor exports—a situation that has notably impacted Japanese chip manufacturers. Amidst these market dynamics and a broader economic backdrop marked by the yen's fluctuations and speculation about Bank of Japan's policy moves, investors might find potential in lesser-known Japanese stocks that could demonstrate resilience or growth independent of these larger pressures. Exploring such stocks requires a keen eye for companies that not only navigate current economic uncertainties but also capitalize on unique business models or domestic market advantages.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Uchida Yoko | 6.26% | 7.83% | 16.58% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.49% | 11.48% | ★★★★★★ |

| Kanda HoldingsLtd | 31.83% | 4.29% | 19.02% | ★★★★★★ |

| Toukei Computer | NA | 5.18% | 11.71% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.81% | 6.05% | 3.32% | ★★★★★★ |

| QuickLtd | 0.74% | 9.42% | 13.89% | ★★★★★★ |

| NPR-Riken | 13.26% | 6.00% | 32.17% | ★★★★★☆ |

| Denyo | 4.86% | 3.76% | 1.84% | ★★★★★☆ |

| Kappa Create | 73.80% | -1.08% | -8.46% | ★★★★★☆ |

| YagiLtd | 30.82% | -9.63% | -6.89% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Honeys Holdings (TSE:2792)

Simply Wall St Value Rating: ★★★★★★

Overview: Honeys Holdings Co., Ltd. is a Japanese company specializing in the design, production, and wholesale distribution of women's apparel and accessories, with a market capitalization of ¥44.03 billion.

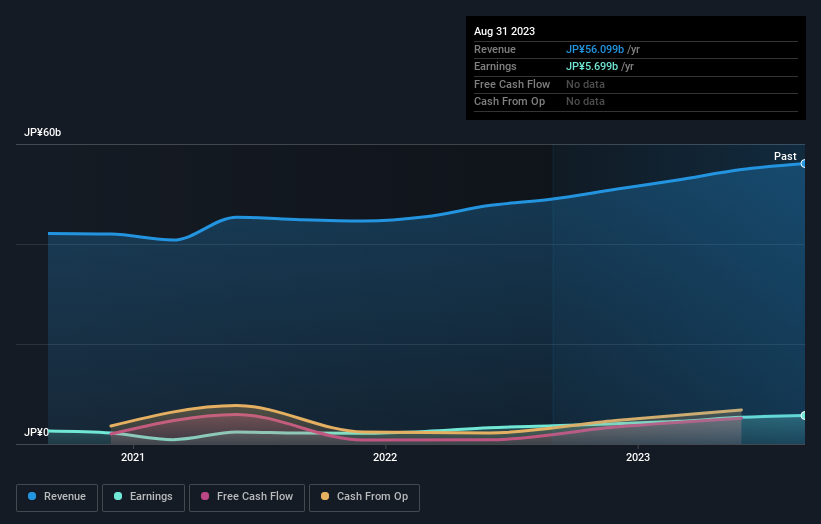

Operations: This company generates revenue primarily through the sale of goods, reflected in a consistent gross profit margin averaging around 58% over multiple periods. The cost structure is dominated by cost of goods sold (COGS) and general & administrative expenses, with COGS typically accounting for approximately half of the revenue.

Honeys Holdings, a lesser-known yet compelling player in Japan's retail sector, has demonstrated robust financial health and growth. The company is currently trading at 56.4% below its estimated fair value, signaling potential undervaluation. Over the past year, earnings surged by 56.7%, outpacing the specialty retail industry's growth of 7.4%. Notably debt-free for over five years, Honeys also maintains a strong dividend policy, with recent announcements confirming dividends of JPY 30 per share for FY2024 and projecting consistent payouts for FY2025.

- Unlock comprehensive insights into our analysis of Honeys Holdings stock in this health report.

Explore historical data to track Honeys Holdings' performance over time in our Past section.

SRS HoldingsLtd (TSE:8163)

Simply Wall St Value Rating: ★★★★★☆

Overview: SRS Holdings Co., Ltd. operates a chain of Japanese food restaurants in Japan, with a market capitalization of ¥52.68 billion.

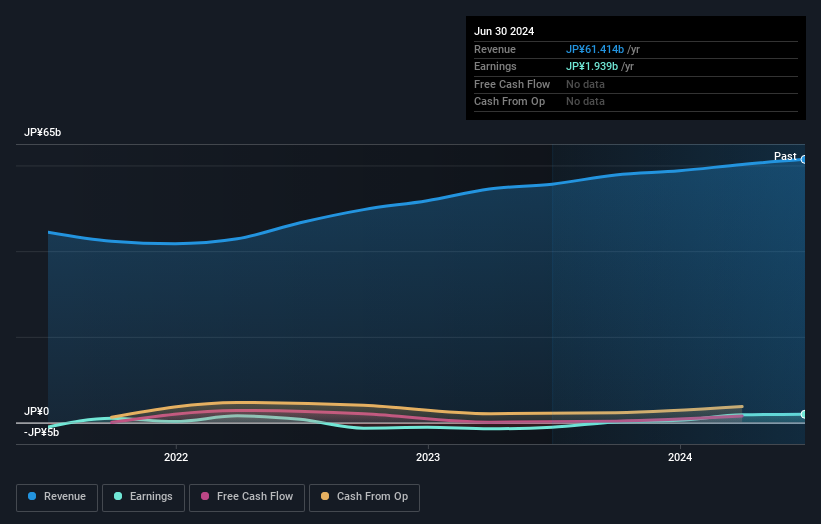

Operations: The company operates in the restaurant sector, generating a revenue of ¥60.23 billion as of the latest reporting period. It primarily earns through direct sales in its dining facilities, with a consistent gross profit margin around 65%, reflecting stable operational efficiency in cost management relative to its revenue generation.

SRS Holdings Ltd., a lesser-known yet promising entity in Japan's market, has recently announced significant financial maneuvers, including a private placement aimed at raising approximately ¥5 billion. This strategic move underscores their robust financial health, evidenced by an impressive interest coverage ratio of 28 times EBIT. The company turned profitable this year and showcases high-quality earnings with more cash on hand than total debt. These factors make SRS Holdings a compelling consideration for those looking into untapped potential within the Japanese market.

- Click to explore a detailed breakdown of our findings in SRS HoldingsLtd's health report.

Evaluate SRS HoldingsLtd's historical performance by accessing our past performance report.

ARCS (TSE:9948)

Simply Wall St Value Rating: ★★★★★☆

Overview: ARCS Company Limited is a Japanese supermarket operator with a market capitalization of approximately ¥144.51 billion.

Operations: The company generates its revenue primarily through the sale of goods, with a consistent gross profit margin averaging approximately 25% over recent years. Key expenses include cost of goods sold (COGS), which typically consumes around 75% of revenue, and operating expenses, notably general and administrative costs.

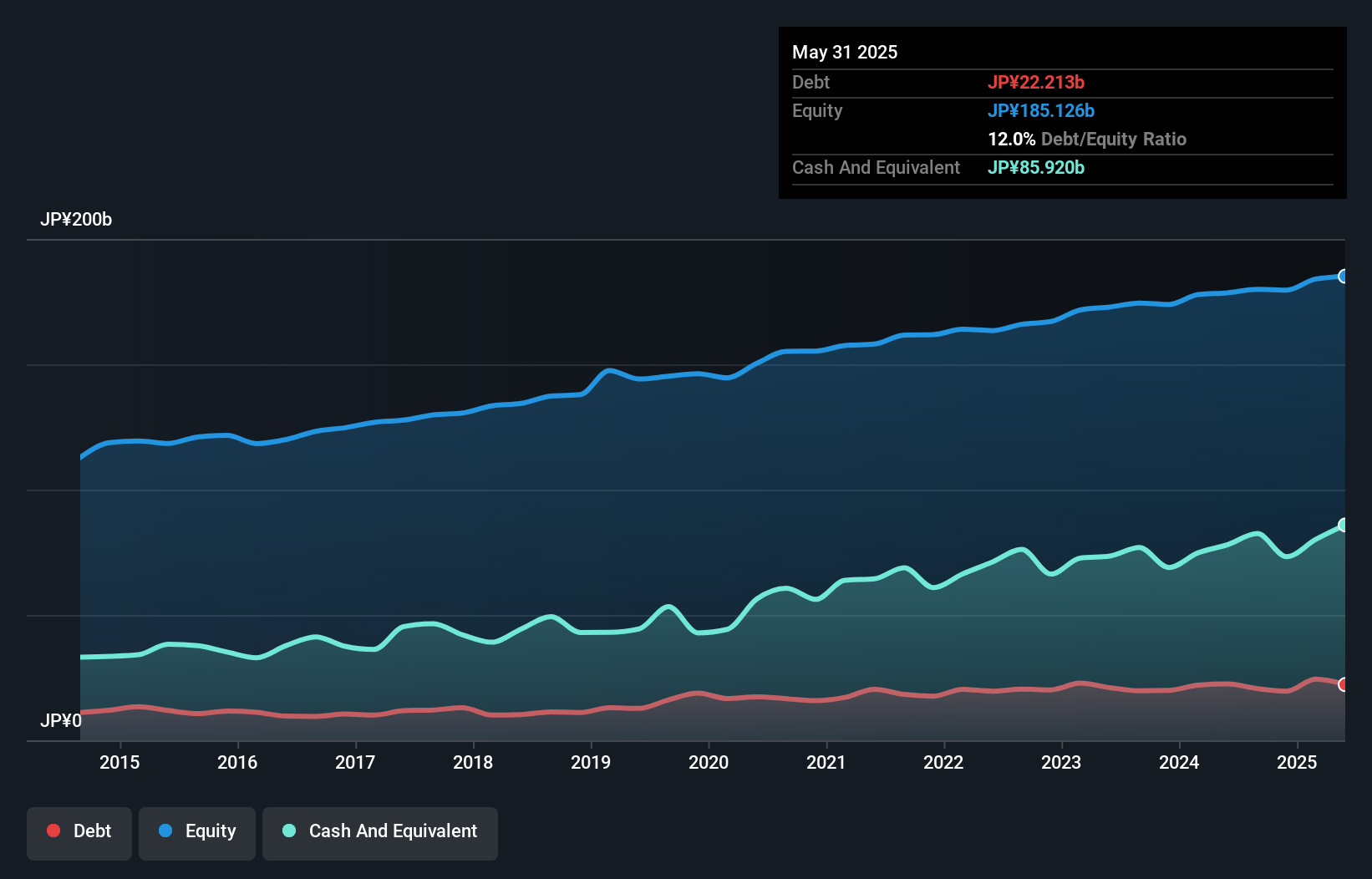

ARCS Company Limited, trading at a compelling 57.4% below estimated fair value, showcases robust financial health with more cash than debt and a debt to equity ratio that has grown modestly from 8.8% to 12.6% over five years. With earnings growth of 3% annually in the same period and a forecasted increase of 3.19% per year, ARCS stands out in the consumer retailing sector, despite lagging behind industry growth last year by 13.3%. The company's positive free cash flow and high-quality earnings underline its potential as an undiscovered gem in Japan’s market landscape.

- Get an in-depth perspective on ARCS' performance by reading our health report here.

Examine ARCS' past performance report to understand how it has performed in the past.

Taking Advantage

- Explore the 748 names from our Japanese Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honeys Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2792

Honeys Holdings

Engages in the planning, manufacture, and wholesale of women’s clothing and accessories.

Flawless balance sheet with solid track record.