Stock Analysis

Japanese Exchange Growth Stocks With At Least 10% Insider Ownership

Reviewed by Simply Wall St

Amid a backdrop of heightened trade tensions and technological restrictions impacting global markets, Japan's stock market has experienced notable fluctuations, particularly in the technology sector. In such an environment, growth companies with substantial insider ownership in Japan may offer unique stability and commitment to long-term value creation, aligning closely with investor interests during uncertain times.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Hottolink (TSE:3680) | 27% | 59.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 42.9% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Medley (TSE:4480) | 34% | 28.7% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| SHIFT (TSE:3697) | 35.4% | 32.8% |

| Money Forward (TSE:3994) | 21.4% | 66.9% |

| ExaWizards (TSE:4259) | 21.9% | 91.1% |

| Astroscale Holdings (TSE:186A) | 20.9% | 90% |

| freee K.K (TSE:4478) | 23.9% | 72.9% |

Underneath we present a selection of stocks filtered out by our screen.

Lifedrink Company (TSE:2585)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lifedrink Company, Inc., a beverage manufacturer and seller based in Japan, has a market capitalization of ¥90.36 billion.

Operations: The company generates its revenue through the manufacture and sale of beverages.

Insider Ownership: 14.6%

Lifedrink Company, a growth-focused entity with substantial insider ownership in Japan, shows promising financial indicators despite some challenges. The company's earnings are set to increase by 9.45% annually, outpacing the Japanese market's average. However, its revenue growth at 6.3% per year, though above the market average of 4.3%, does not reach the high-growth threshold of 20%. Additionally, while trading slightly below fair value offers potential upside, a high debt level and highly volatile share price present risks to stability.

- Get an in-depth perspective on Lifedrink Company's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Lifedrink Company's share price might be on the expensive side.

Shima Seiki Mfg.Ltd (TSE:6222)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shima Seiki Mfg., Ltd. operates globally, focusing on the development, manufacture, and sale of computerized knitting and cutting machines for fabrics, along with related design systems in sectors including apparel in Japan, Europe, the Middle East, Asia, and the Americas; it has a market capitalization of approximately ¥56.16 billion.

Operations: The company generates revenue through the sale of computerized flat and glove and sock knitting machines, automatic fabric cutting machines, and design systems across various global regions.

Insider Ownership: 10.3%

Shima Seiki Mfg., Ltd. stands out in the Japanese market with its robust forecasted earnings growth at 30.1% per year, significantly outpacing the market's average of 8.9%. Although its revenue growth is moderate at 10.5% annually, it still exceeds the broader Japanese market growth rate of 4.3%. Challenges include a low forecasted return on equity (2.9%) and large one-off items affecting earnings quality, indicating potential risks in financial stability and shareholder returns.

- Click here to discover the nuances of Shima Seiki Mfg.Ltd with our detailed analytical future growth report.

- Our valuation report here indicates Shima Seiki Mfg.Ltd may be overvalued.

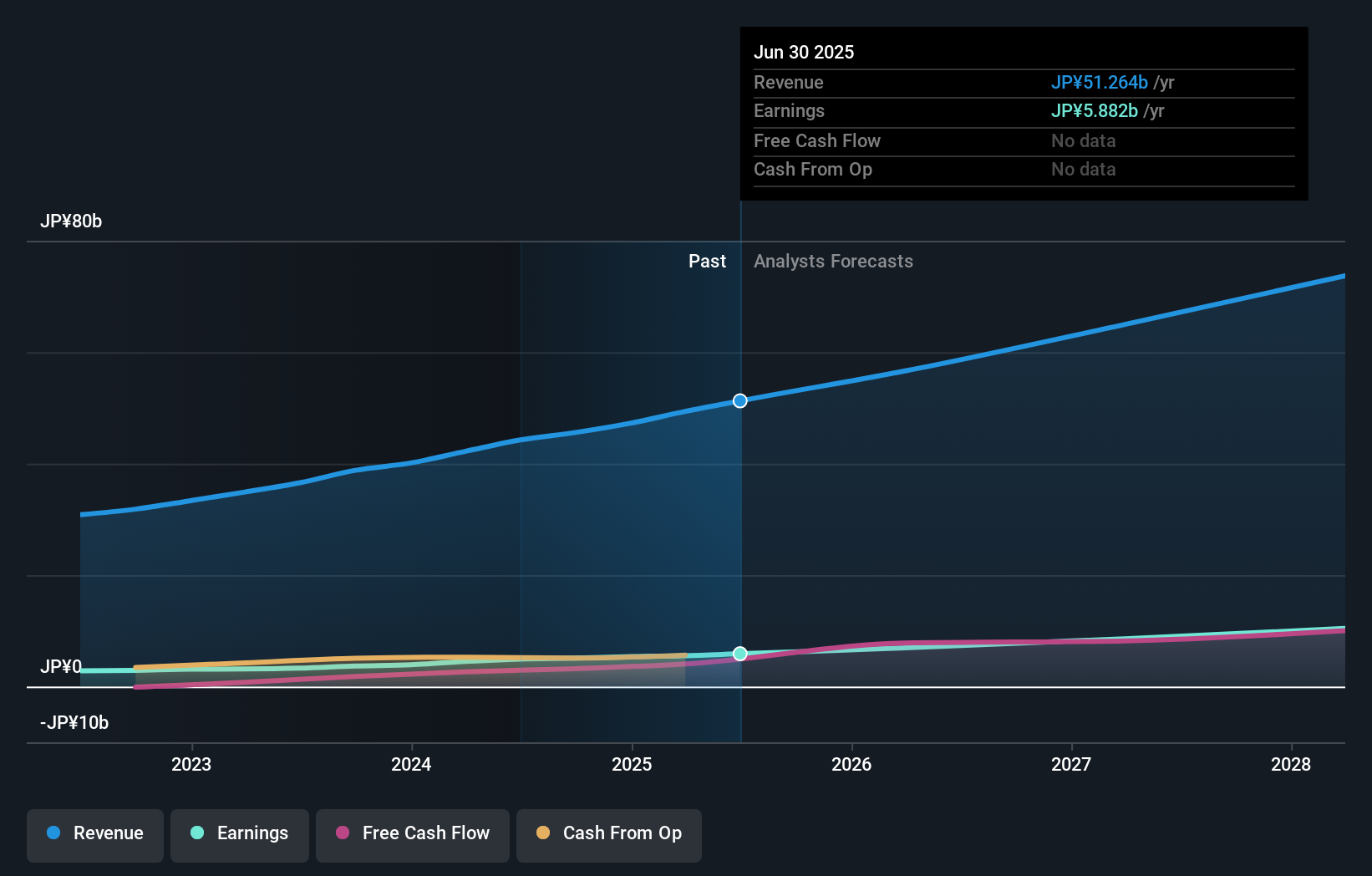

Japan Elevator Service HoldingsLtd (TSE:6544)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Japan Elevator Service Holdings Co., Ltd. specializes in the repair, maintenance, and modernization of elevators and escalators across Japan, with a market capitalization of approximately ¥245.71 billion.

Operations: The company generates revenue primarily through its maintenance services, totaling ¥42.22 billion.

Insider Ownership: 23.1%

Japan Elevator Service Holdings Co., Ltd. is positioned for substantial growth, with earnings expected to increase by 18.4% annually, outpacing the Japanese market's 8.9%. Its revenue is also set to grow at a rate of 12% per year, which is faster than the broader market's forecast of 4.3%. Despite this promising outlook, the company faces challenges with a highly volatile share price and a return on equity forecasted at a high yet not exceptional level of 31.4%. Recent expansions include new service offices aimed at enhancing customer service capabilities.

- Take a closer look at Japan Elevator Service HoldingsLtd's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Japan Elevator Service HoldingsLtd is trading beyond its estimated value.

Seize The Opportunity

- Access the full spectrum of 99 Fast Growing Japanese Companies With High Insider Ownership by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6222

Shima Seiki Mfg.Ltd

Engages in the development, manufacture, sale, marketing, and service of computerized flat knitting machines, computerized flat knitting machines, automatic fabric cutting machines, design systems, and glove and sock knitting machines in Japan, Europe, the Middle East, Asia, the Americas, and internationally.

Excellent balance sheet with reasonable growth potential.