- Taiwan

- /

- Medical Equipment

- /

- TPEX:1565

Discovering St.Shine OpticalLtd And 2 Other Undiscovered Gems with Robust Foundations

Reviewed by Simply Wall St

In a week marked by market volatility, with U.S. stocks giving back some of their recent gains and global economic indicators presenting a mixed picture, investors are increasingly seeking stability in smaller companies with robust fundamentals. As the S&P MidCap 400 and Russell 2000 indices reflect shifts in sentiment, identifying stocks like St.Shine Optical Ltd that are grounded on solid business models and growth potential can offer promising opportunities amidst the current economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Primadaya Plastisindo | 12.52% | 18.29% | 26.12% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Tethys Petroleum | NA | 29.98% | 44.48% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

St.Shine OpticalLtd (TPEX:1565)

Simply Wall St Value Rating: ★★★★★★

Overview: St.Shine Optical Co., Ltd. and its subsidiaries are involved in the manufacturing, selling, and trading of contact lenses, optical lenses, and related products across Asia, Europe, America, and Taiwan with a market cap of approximately NT$11.85 billion.

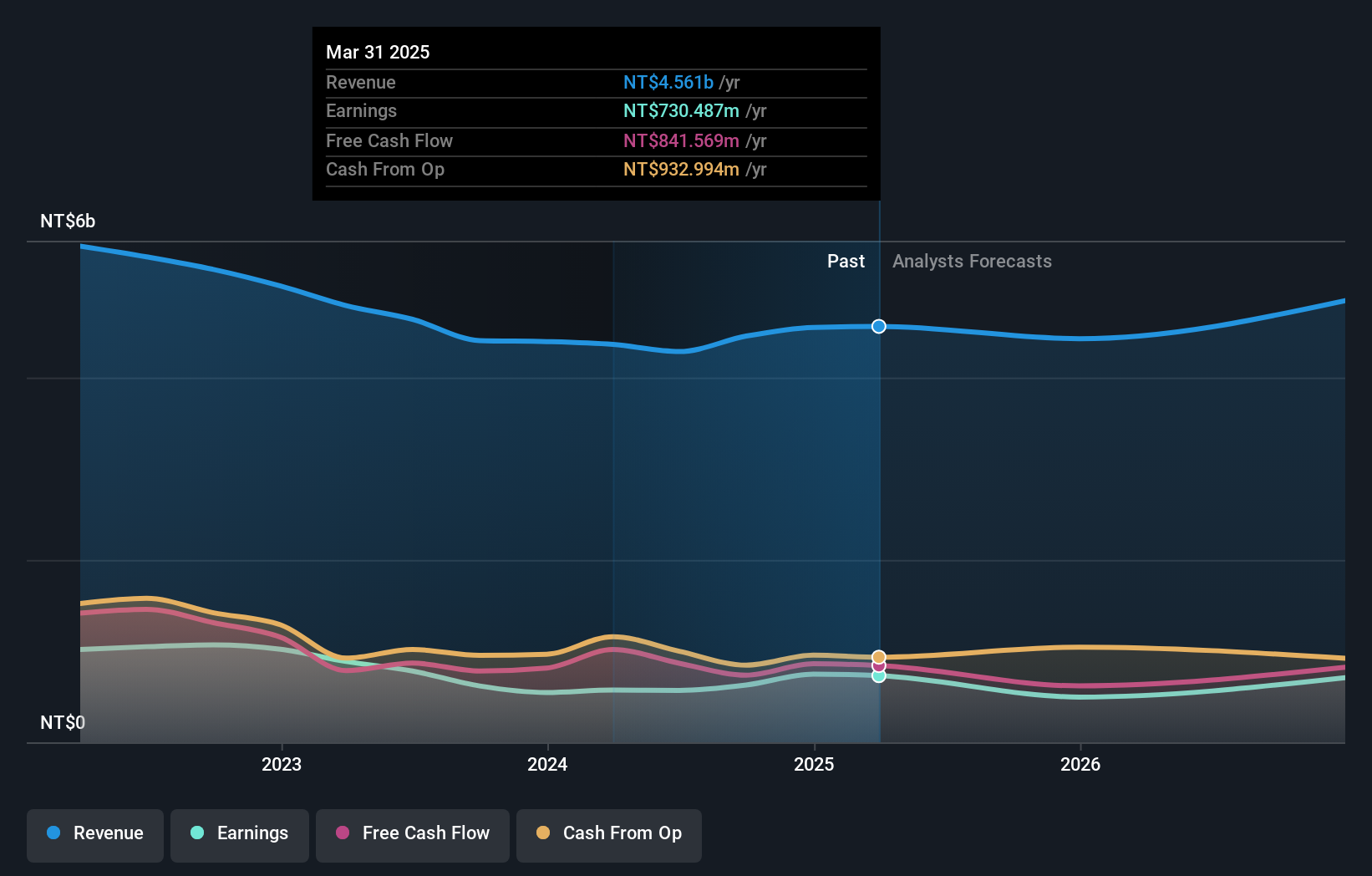

Operations: St.Shine Optical derives its revenue primarily from the sale of contact lenses and optical lenses across multiple regions, including Asia, Europe, America, and Taiwan. The company's net profit margin has shown notable variations over recent periods.

St. Shine Optical, a nimble player in the optical sector, reported robust earnings for Q3 2024 with sales reaching TWD 1.22 billion from TWD 1.05 billion last year and net income climbing to TWD 196 million from TWD 138 million. The company has high-quality earnings and trades at a significant discount of over half its estimated fair value, suggesting potential undervaluation. Its debt-to-equity ratio improved drastically over five years from 22.7% to just 5.3%, indicating prudent financial management and reduced leverage risk while maintaining more cash than total debt, which enhances financial stability and growth prospects.

- Get an in-depth perspective on St.Shine OpticalLtd's performance by reading our health report here.

Assess St.Shine OpticalLtd's past performance with our detailed historical performance reports.

Geo Holdings (TSE:2681)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Geo Holdings Corporation operates in the amusement industry in Japan and has a market capitalization of approximately ¥58.77 billion.

Operations: Geo Holdings generates revenue primarily from its retail services, amounting to ¥417.81 billion.

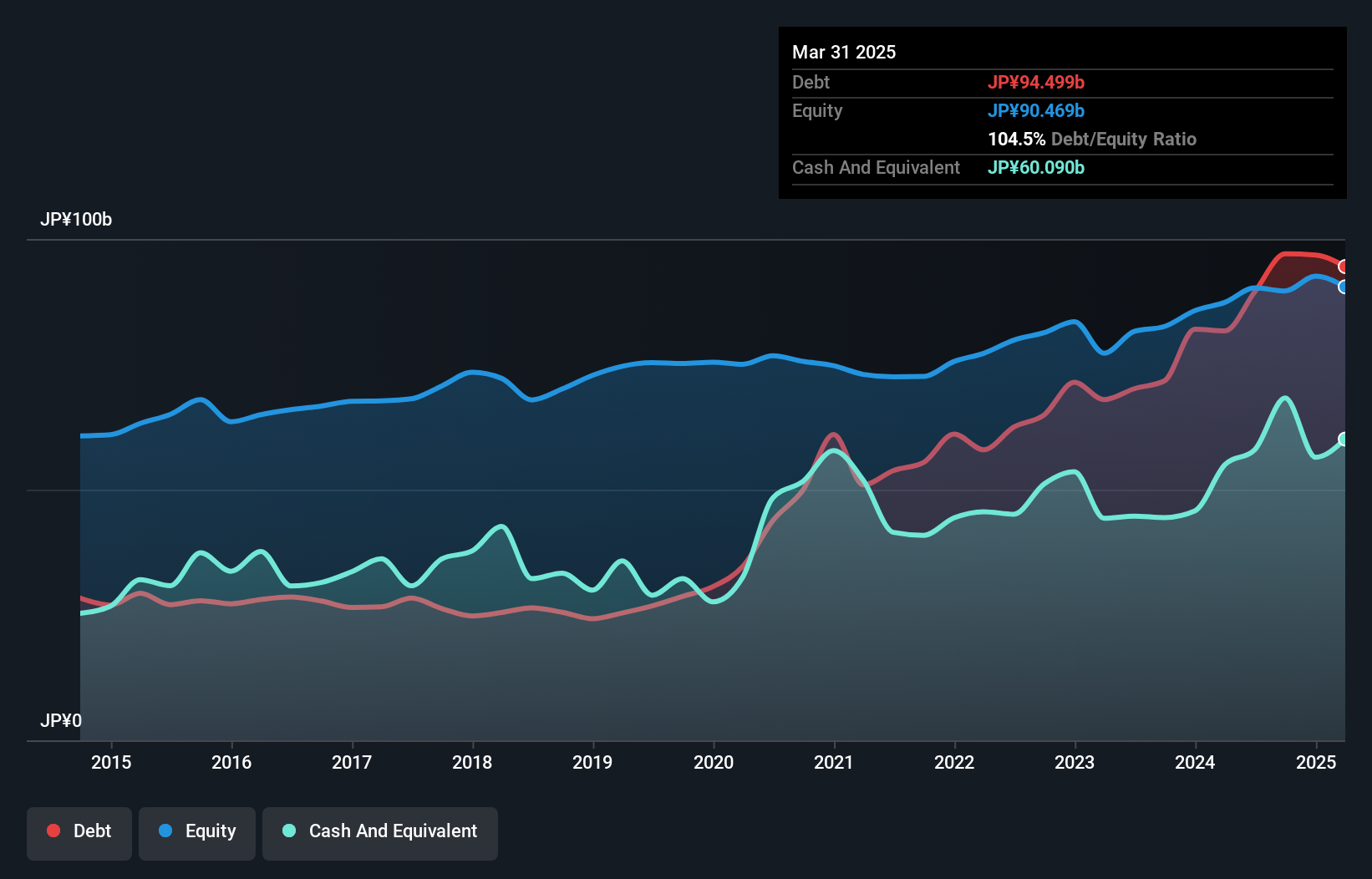

Geo Holdings, a nimble player in the market, has seen its earnings grow by 16.5% over the past year, outpacing the Specialty Retail industry’s modest 3.6%. Currently trading at 29.5% below its estimated fair value, it presents a compelling opportunity for investors seeking undervalued assets. The company maintains high-quality earnings and is forecasted to continue this trajectory with an anticipated growth rate of 20.6% annually. Despite an increase in debt to equity ratio from 38.2% to 108.2% over five years, interest payments are comfortably covered by EBIT at an impressive multiple of 481x.

- Unlock comprehensive insights into our analysis of Geo Holdings stock in this health report.

Evaluate Geo Holdings' historical performance by accessing our past performance report.

CTCI (TWSE:9933)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CTCI Corporation is involved in the design, surveying, construction, and inspection of engineering and construction plants, machinery and equipment, as well as environmental protection projects across Taiwan, the United States, and internationally with a market cap of NT$34.32 billion.

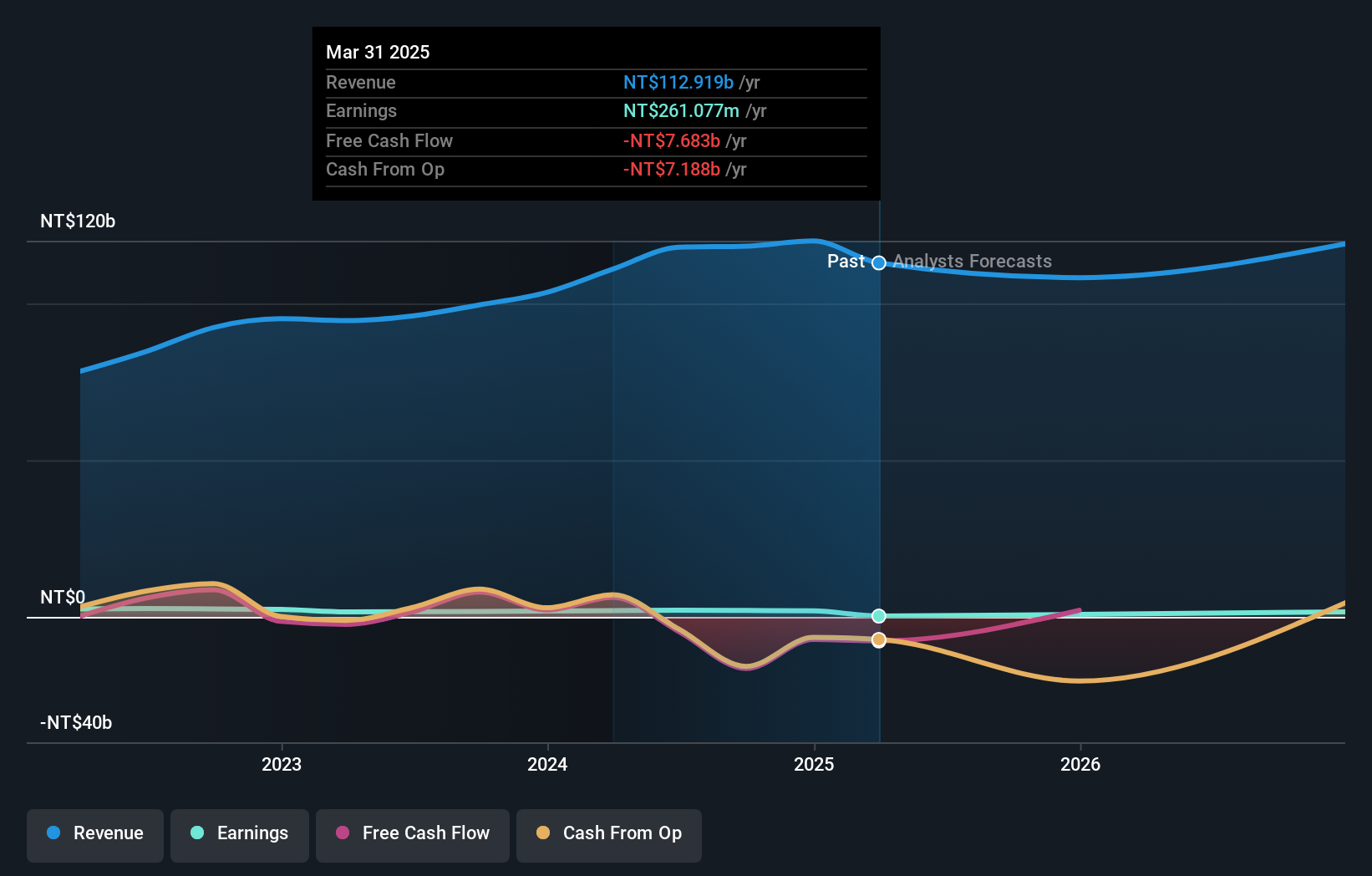

Operations: CTCI's primary revenue stream is from its Construction Engineering Department, generating NT$119.09 billion, followed by Environmental Resources Service with NT$8.65 billion. The company also earns from General Sales and Other Operating Departments, contributing NT$880.36 million and NT$490.55 million respectively. Income from Internal Divisions shows a negative value of -NT$10.81 billion, impacting overall financials significantly.

CTCI's recent performance showcases a mixed financial landscape. Over the past year, earnings grew by 17%, surpassing the construction industry's growth of 7%. The company's net debt to equity ratio stands at a satisfactory 10.7%, reflecting sound financial management despite an increase from 89% to 167% over five years. However, free cash flow remains negative, indicating challenges in liquidity management. Recent quarterly results revealed sales of TWD 28.32 billion and net income of TWD 379 million, with basic EPS dropping from TWD 0.56 to TWD 0.47 compared to last year, suggesting pressure on profitability amidst rising revenues.

- Navigate through the intricacies of CTCI with our comprehensive health report here.

Examine CTCI's past performance report to understand how it has performed in the past.

Next Steps

- Delve into our full catalog of 4644 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:1565

St.Shine OpticalLtd

Manufactures, sells, and trades contact lenses, optical lenses, and related products in Asia, Europe, America, and Taiwan.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives