- Japan

- /

- Specialty Stores

- /

- TSE:262A

Discovering Japan's Undiscovered Gems in October 2024

Reviewed by Simply Wall St

As Japan's stock markets experience a downturn, with the Nikkei 225 Index and TOPIX Index both declining, investors are keenly observing how easing domestic inflation and export declines could influence the Bank of Japan's monetary policy decisions. Amidst these challenging conditions, identifying promising small-cap stocks requires an understanding of market resilience and potential growth opportunities that align with current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| Intelligent Wave | NA | 6.92% | 15.18% | ★★★★★★ |

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| Nippon Denko | 18.00% | 4.31% | 48.41% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Imuraya Group | 26.21% | 2.37% | 32.09% | ★★★★★☆ |

| Kappa Create | 74.42% | -0.45% | 3.62% | ★★★★★☆ |

| GakkyushaLtd | 23.64% | 5.03% | 18.56% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Intermestic (TSE:262A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Intermestic Inc. operates retail and online platforms for selling eyeglasses and sunglasses in Japan, with a market capitalization of ¥46.89 billion.

Operations: Intermestic Inc. generates revenue primarily from its Domestic Business segment, contributing ¥38.17 billion, while the Overseas Segment adds ¥2.09 billion. The company has a market capitalization of ¥46.89 billion.

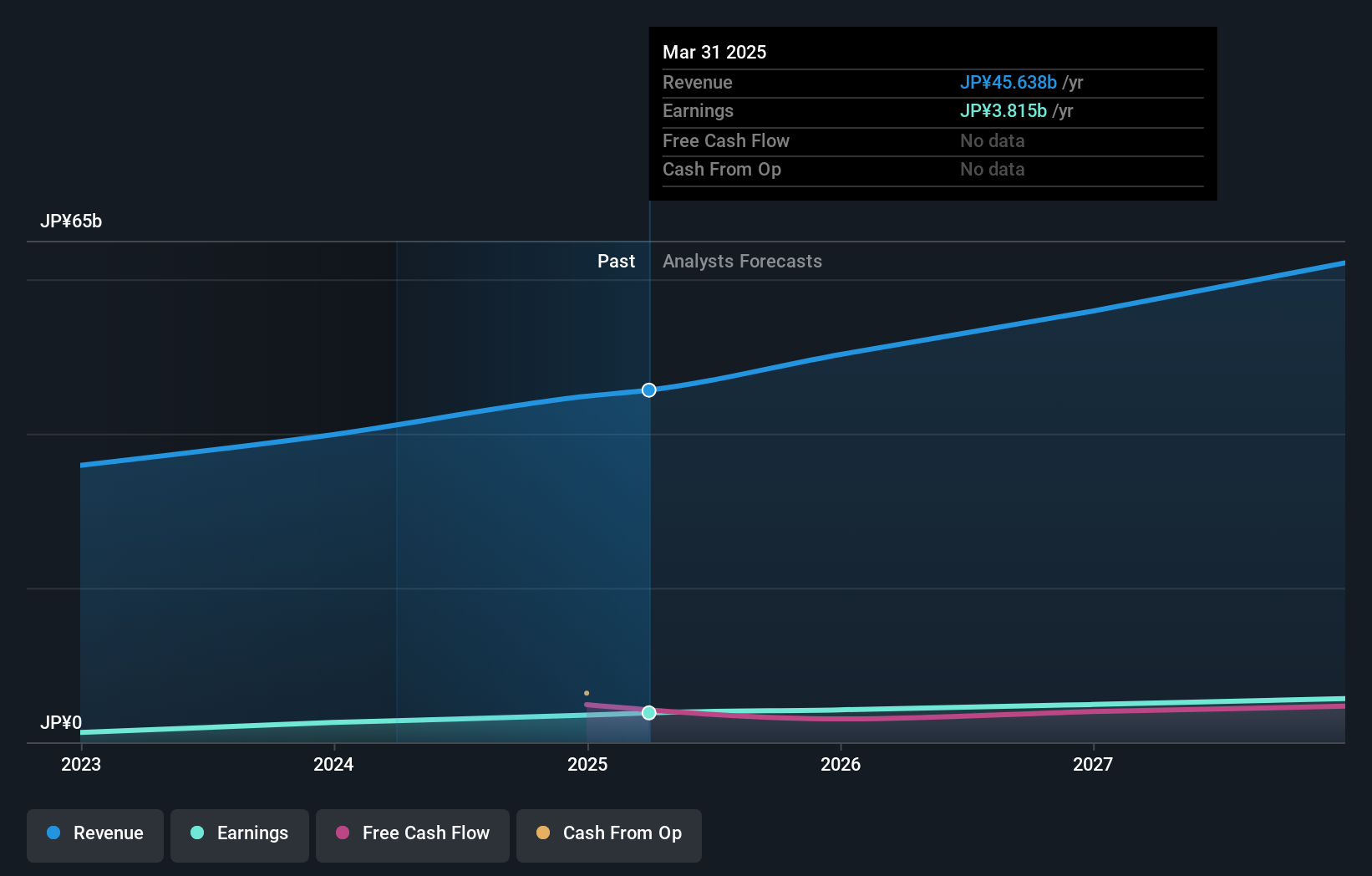

Intermestic, a relatively small player in Japan's market, recently completed an IPO raising ¥17.48 billion by offering common stock at a price of ¥1630 with a discount of ¥97.8 per security. The company has shown impressive earnings growth of 102% over the past year, outpacing the Specialty Retail industry’s 4.6% increase. With high-quality earnings and satisfactory net debt to equity ratio at 9.5%, Intermestic's financial health appears solid. Despite its shares being highly illiquid, future prospects look promising with forecasted annual earnings growth of 11%.

- Dive into the specifics of Intermestic here with our thorough health report.

Assess Intermestic's past performance with our detailed historical performance reports.

PAL GROUP Holdings (TSE:2726)

Simply Wall St Value Rating: ★★★★★★

Overview: PAL GROUP Holdings CO., LTD. operates in Japan, focusing on the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories, with a market cap of ¥279.57 billion.

Operations: The company generates revenue through the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories in Japan. It has a market capitalization of ¥279.57 billion.

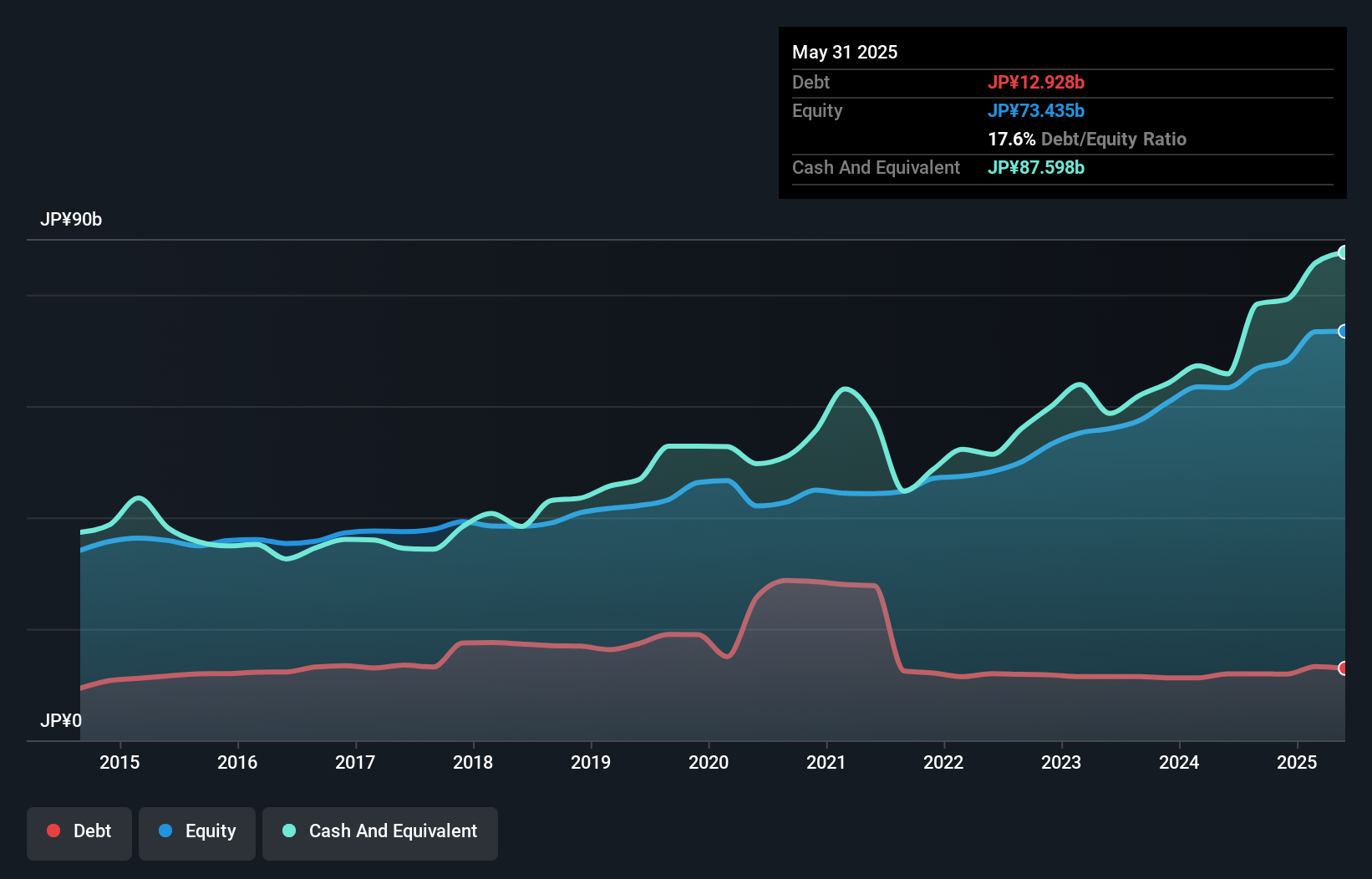

PAL GROUP Holdings, a small but promising player in the Japanese market, has been making waves with its robust financial health. The company boasts an impressive EBIT coverage of interest payments at 216 times, reflecting strong operational efficiency. Over the past year, earnings have grown by 11%, outpacing the industry average of 4.6%, suggesting effective management strategies and market positioning. Additionally, PAL's debt-to-equity ratio has improved significantly from 44% to 17.9% over five years, indicating prudent financial management. Trading at approximately 11% below estimated fair value further enhances its appeal as an investment prospect with room for growth.

- Click here and access our complete health analysis report to understand the dynamics of PAL GROUP Holdings.

Understand PAL GROUP Holdings' track record by examining our Past report.

Bic Camera (TSE:3048)

Simply Wall St Value Rating: ★★★★★★

Overview: Bic Camera Inc., along with its subsidiaries, operates in Japan focusing on the manufacture and sale of audiovisual products, with a market cap of ¥290.15 billion.

Operations: Bic Camera generates revenue primarily from the sale of audiovisual products in Japan. The company's cost structure is influenced by manufacturing and sales expenses. Notably, its net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and market conditions.

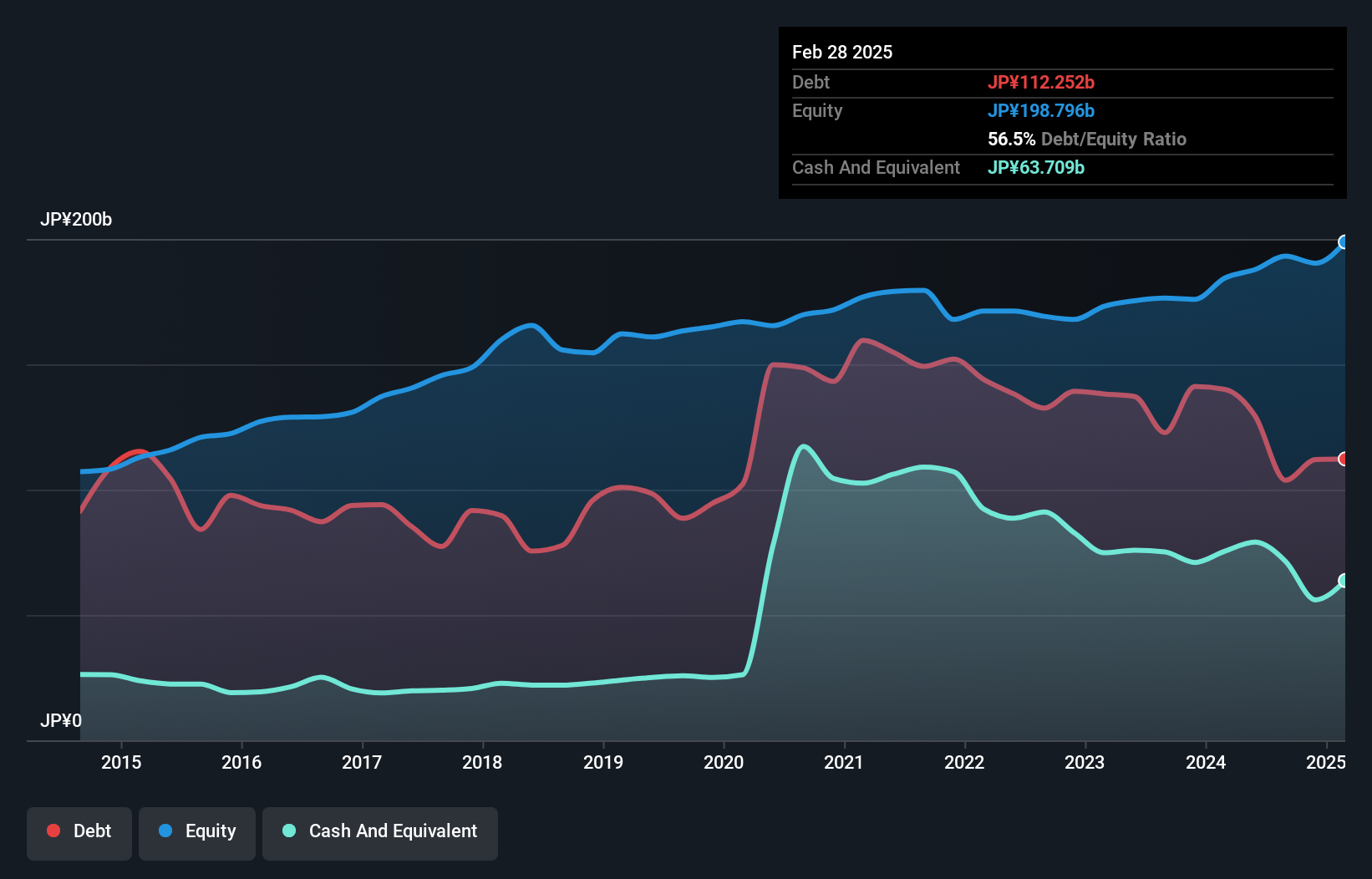

Bic Camera, a notable player in Japan's retail sector, has demonstrated impressive financial strides. Over the past year, earnings surged by 374%, outpacing the Specialty Retail industry average of 4.6%. The company's debt to equity ratio slightly improved from 54.2% to 53.7% over five years, indicating prudent financial management. With a satisfactory net debt to equity ratio of 16.7%, Bic Camera appears financially sound and capable of covering interest obligations comfortably. Trading at about 5% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities in the market.

- Delve into the full analysis health report here for a deeper understanding of Bic Camera.

Gain insights into Bic Camera's past trends and performance with our Past report.

Next Steps

- Unlock more gems! Our Japanese Undiscovered Gems With Strong Fundamentals screener has unearthed 730 more companies for you to explore.Click here to unveil our expertly curated list of 733 Japanese Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:262A

Intermestic

Sells eyeglasses and sunglasses through stores and online in Japan.

Adequate balance sheet with moderate growth potential.