As Japan's stock markets experience declines, with the Nikkei 225 Index down 1.58% and the broader TOPIX Index losing 0.64%, investors are closely monitoring economic indicators such as easing domestic inflation and fluctuating exports, which may influence future monetary policy decisions by the Bank of Japan. In this context of market uncertainty, identifying high growth tech stocks that demonstrate resilience and innovation becomes crucial for investors seeking opportunities in Japan's dynamic technology sector.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 21.22% | 71.29% | ★★★★★★ |

We'll examine a selection from our screener results.

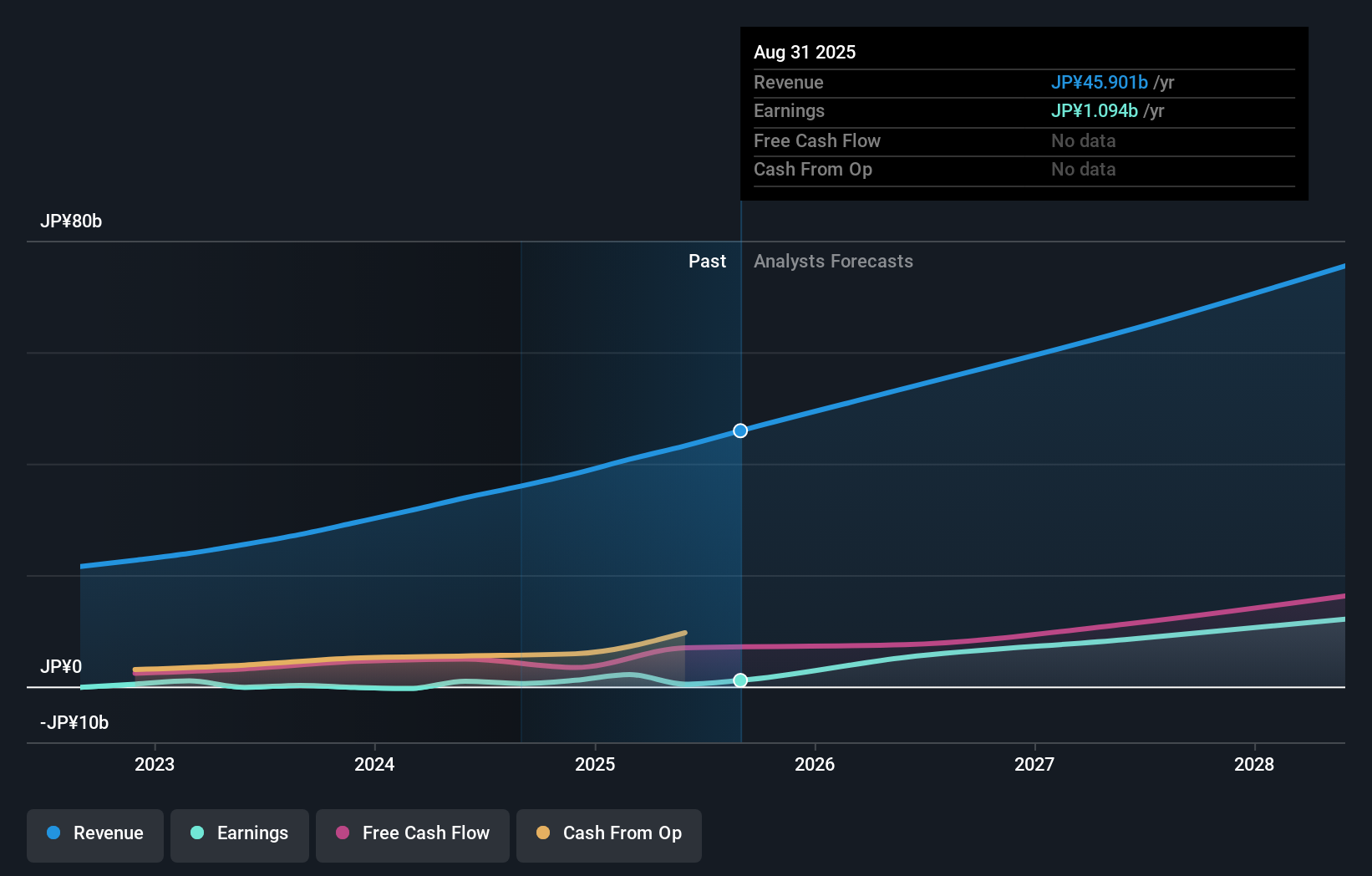

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. is a Japanese company that specializes in the planning, development, and sale of cloud-based solutions with a market capitalization of ¥291.61 billion.

Operations: Sansan, Inc. generates revenue primarily from its Sansan/Bill One Business, which accounts for ¥31.79 billion, and the Eight Business, contributing ¥3.80 billion. The company's focus on cloud-based solutions underpins its business model in Japan.

Sansan, a Japanese tech firm, is navigating an intriguing phase with its aggressive R&D spending and share repurchase activities. The company's commitment to innovation is evident from its substantial investment in research and development, which constitutes a significant portion of its revenue. Recently, Sansan reported a robust annual earnings growth of 39.3% and anticipates further acceleration with projected revenue growth at 16.3% per year, outpacing the broader Japanese market's average of 4.2%. This financial trajectory is complemented by recent strategic moves including the repurchase of 141,700 shares for ¥299.95 million, underscoring confidence in its operational direction and future prospects. Moreover, Sansan’s focus extends beyond mere financial metrics; it actively adapts to evolving market dynamics by enhancing its software solutions portfolio. The firm recently concluded a series of corporate actions aimed at optimizing its asset base and reinforcing its market position within the high-demand sectors of cloud-based services and contact management solutions. These strategic decisions are set against a backdrop of increasing reliance on digital infrastructure in Japan's tech landscape, positioning Sansan favorably among enterprises seeking comprehensive digital transformation solutions.

- Click here and access our complete health analysis report to understand the dynamics of Sansan.

Evaluate Sansan's historical performance by accessing our past performance report.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a global entertainment company involved in the planning, development, manufacturing, sale, and distribution of video games across various platforms including home consoles, online services, mobile devices, and arcade systems; it has a market capitalization of approximately ¥1.37 trillion.

Operations: Capcom generates revenue primarily from its Digital Content segment, which accounts for ¥103.38 billion, followed by Amusement Facilities at ¥20.09 billion and Amusement Equipment at ¥10.34 billion. The company is engaged in the development and distribution of video games across multiple platforms both domestically and internationally.

Capcom, a stalwart in the gaming industry, is positioning itself strategically amidst Japan's competitive tech landscape. With an R&D expenditure that notably aligns with its forward-thinking ethos—14.6% of its revenue dedicated to innovation—the company not only underscores its commitment to leading in high-demand sectors like gaming and digital content but also ensures it stays relevant in evolving market dynamics. This investment strategy is complemented by a robust forecast of earnings growth at 14.6% per year, outpacing the broader Japanese market projection of 8.7%. Additionally, Capcom's recent actions include repurchasing shares, signaling confidence in their operational trajectory and financial health. As digital entertainment continues to command a significant share of consumer spending, Capcom’s emphasis on enriching its gaming portfolio through continuous innovation positions it well for sustained growth amidst shifting industry trends.

- Navigate through the intricacies of Capcom with our comprehensive health report here.

Examine Capcom's past performance report to understand how it has performed in the past.

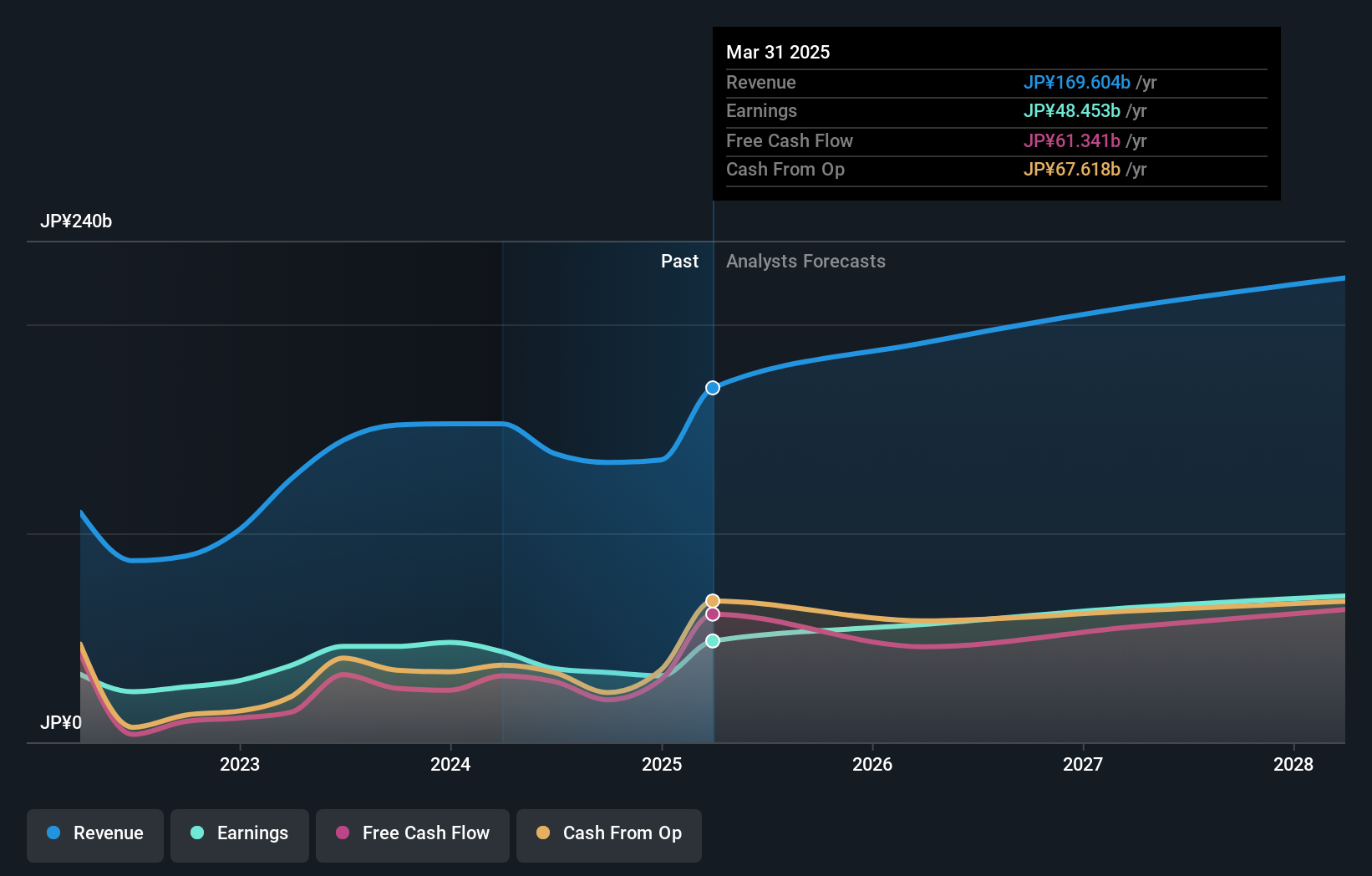

Fuji Soft (TSE:9749)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fuji Soft Incorporated is an IT company that provides a range of technology services and solutions both in Japan and internationally, with a market capitalization of ¥588.76 billion.

Operations: The company generates revenue primarily through its SI Business, which accounts for ¥290.11 billion. Additionally, it engages in the Facility Business segment contributing ¥3.42 billion to its total revenue.

Fuji Soft, amid Japan's tech evolution, is poised for significant growth with its earnings projected to surge by 21.7% annually, outstripping the broader market's 8.7%. This forecast aligns with a robust R&D commitment—21.7% of revenue funneled into innovation—underscoring its strategy to stay at the forefront of technological advancements. Recent M&A activities, including a high-profile bid from Bain Capital at ¥9,450 per share, reflect strong investor confidence and potential shifts in ownership that could further shape its strategic direction and market presence.

- Delve into the full analysis health report here for a deeper understanding of Fuji Soft.

Explore historical data to track Fuji Soft's performance over time in our Past section.

Summing It All Up

- Discover the full array of 119 Japanese High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9749

High growth potential with excellent balance sheet.