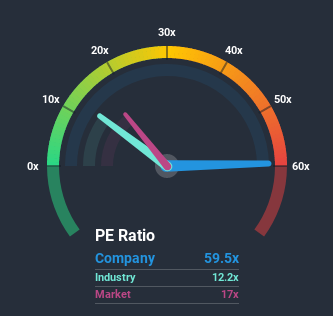

With a price-to-earnings (or "P/E") ratio of 59.5x Encho Co.,Ltd. (TYO:8208) may be sending very bearish signals at the moment, given that almost half of all companies in Japan have P/E ratios under 17x and even P/E's lower than 10x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's exceedingly strong of late, EnchoLtd has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for EnchoLtd

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, EnchoLtd would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 118% last year. The latest three year period has also seen a 21% overall rise in EPS, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 10% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's alarming that EnchoLtd's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On EnchoLtd's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of EnchoLtd revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 5 warning signs for EnchoLtd you should be aware of, and 2 of them are potentially serious.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

If you decide to trade EnchoLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EnchoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSE:8208

EnchoLtd

Operates stores in Japan. The company’s stores offer lumber, construction materials, gardening supplies, paints, glues and adhesives, power tools, carpenter's tools, metal materials for construction, interior materials, electrical equipment, lamps, automobile parts, miscellaneous goods, stationery, bicycles, and leisure goods.

Low risk and slightly overvalued.

Market Insights

Community Narratives