- Japan

- /

- Specialty Stores

- /

- TSE:3020

Applied's (TYO:3020) Earnings Are Growing But Is There More To The Story?

As a general rule, we think profitable companies are less risky than companies that lose money. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding Applied (TYO:3020).

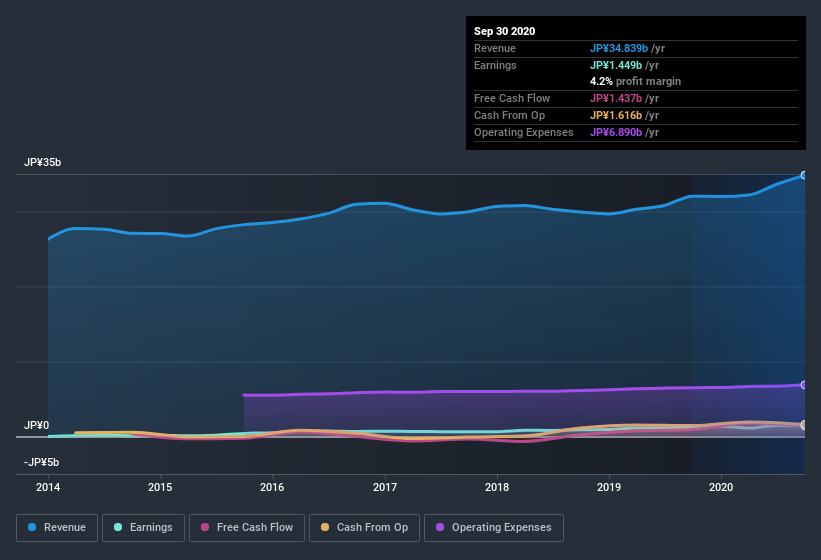

It's good to see that over the last twelve months Applied made a profit of JP¥1.45b on revenue of JP¥34.8b. One positive is that it has grown both its profit and its revenue, over the last few years.

Check out our latest analysis for Applied

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. In this article we will consider how Applied's decision to issue new shares in the company has impacted returns to shareholders. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Applied.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. Applied expanded the number of shares on issue by 6.2% over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Applied's EPS by clicking here.

A Look At The Impact Of Applied's Dilution on Its Earnings Per Share (EPS).

Applied has improved its profit over the last three years, with an annualized gain of 130% in that time. And over the last 12 months, the company grew its profit by 16%. But in comparison, EPS only increased by 15% over the same period. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, earnings per share growth should beget share price growth. So Applied shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Applied's Profit Performance

Each Applied share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Because of this, we think that it may be that Applied's statutory profits are better than its underlying earnings power. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Case in point: We've spotted 3 warning signs for Applied you should be aware of.

This note has only looked at a single factor that sheds light on the nature of Applied's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Applied, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSE:3020

AppliedLtd

Sells computers, peripherals, and digital products in Japan, Asia, and the United States.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion