A Fresh Look at MORI TRUST REIT (TSE:8961) Valuation Following Latest Earnings Decline and Stable Payouts

Reviewed by Simply Wall St

MORI TRUST REIT (TSE:8961) just released its earnings for the fiscal period ended August 31, 2025, showing both operating revenues and net income slipping from the previous period. Even so, the REIT stuck to a full payout to investors, maintaining its 100% distribution ratio.

See our latest analysis for MORI TRUST REIT.

Following the latest earnings update, which signaled slight drops in both operating revenues and net income, MORI TRUST REIT’s momentum has actually strengthened. The share price climbed 4.8% over the past month and boasts a 26.4% year-to-date return. Interestingly, when you take distributions into account, the total shareholder return over the past year stands at a robust 36.7%, reflecting resilient investor confidence despite softer fundamentals.

If you’re curious about where else investors are spotting opportunity, now’s the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

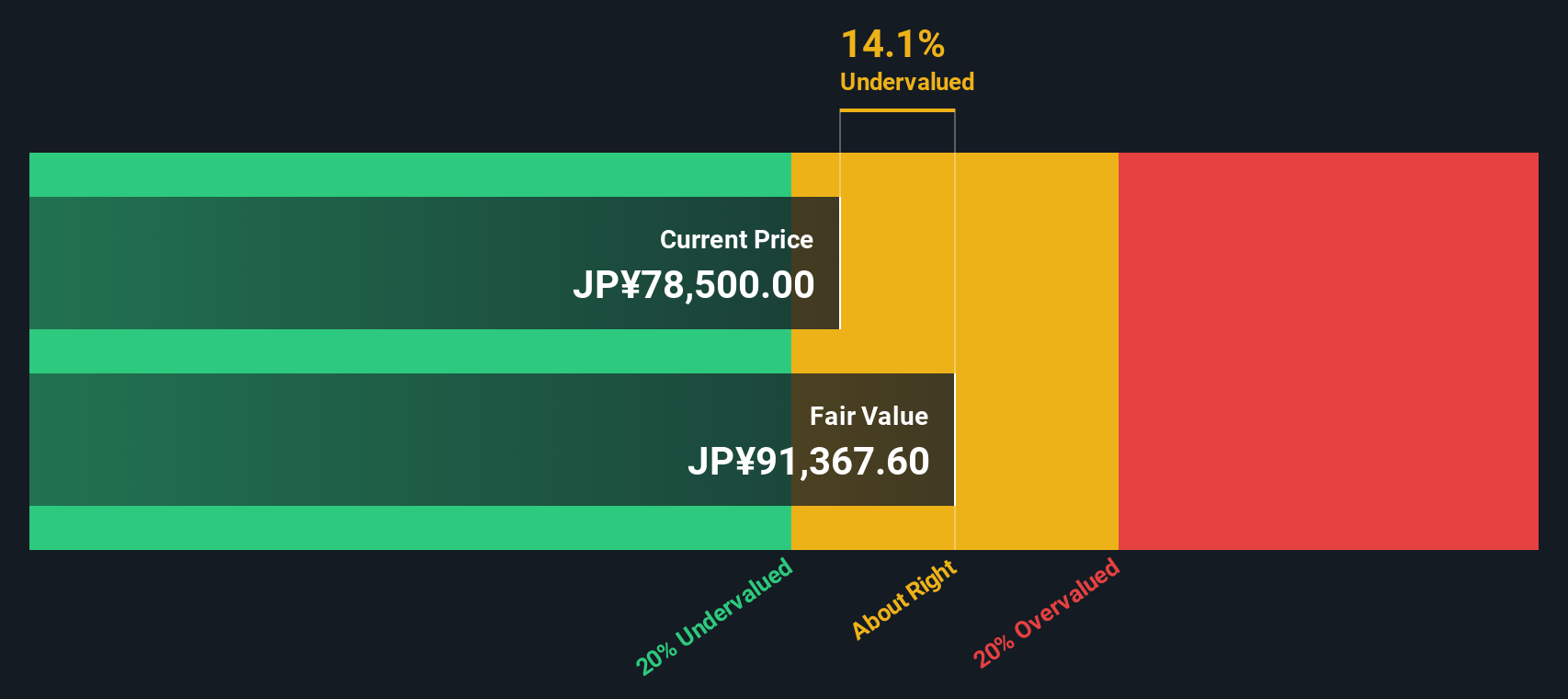

With shares outperforming despite softer earnings, the big question becomes whether MORI TRUST REIT is trading below its real value right now, or if markets are already factoring in any future hopes for growth.

Price-to-Earnings of 20.6x: Is it justified?

MORI TRUST REIT is currently valued at a price-to-earnings (P/E) ratio of 20.6x, only marginally below the estimated fair P/E of 21.6x. This places its valuation firmly within a reasonable range when compared to peers and the broader market.

The price-to-earnings ratio reflects how much investors are willing to pay for each yen of the REIT’s earnings. For property trusts like MORI TRUST REIT, the P/E ratio is a key reference that factors in both immediate income returns and the perceived reliability of ongoing cash flow.

This current multiple suggests that the market recognizes MORI TRUST REIT’s historical stability and its ability to deliver consistent distributions, even as earnings momentum slows. The fair ratio analysis implies that if market sentiment or earnings trends change, the valuation could shift toward this fair P/E level.

Compared with the Japanese REIT industry average of 20.4x, MORI TRUST REIT trades at a slight premium, which is largely justified by its past profit growth and high-quality earnings. However, the P/E is very close to the peer average, indicating the market has not significantly over or underpriced the stock relative to its direct competitors.

Explore the SWS fair ratio for MORI TRUST REIT

Result: Price-to-Earnings of 20.6x (ABOUT RIGHT)

However, softer annual net income growth and the stock trading above analyst price targets could prompt a reassessment of MORI TRUST REIT’s current valuation.

Find out about the key risks to this MORI TRUST REIT narrative.

Another View: What Does the SWS DCF Model Say?

While the market’s current price-to-earnings measure suggests MORI TRUST REIT is trading near its fair ratio, our SWS DCF model adds a fresh angle. According to this approach, the shares are valued at ¥78,900, which is about 2.5% below our fair value estimate of ¥80,918.62. This suggests a modest discount, but is it enough to sway the debate about value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MORI TRUST REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MORI TRUST REIT Narrative

Your perspective might differ, and sometimes the best way to reach your own conclusion is by diving into the numbers yourself and forming a view in just a few minutes. Do it your way

A great starting point for your MORI TRUST REIT research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for opportunity to come knocking. Take action now and see which stocks could strengthen your portfolio and help you stay ahead of the curve.

- Uncover standout companies shaking up healthcare innovation by checking out these 33 healthcare AI stocks that are changing the industry with AI-driven breakthroughs.

- Capitalize on powerful growth trends. Get started with these 876 undervalued stocks based on cash flows that show strong cash flow potential and attractive price points.

- Boost your income potential with these 17 dividend stocks with yields > 3% that offer solid yields above 3% and consistent payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8961

MORI TRUST REIT

MORI TRUST Reit, Inc. (“MTR”), a Japanese real estate investment corporation, was incorporated on October 2, 2001 under the Law Concerning Investment Trusts and Investment Corporations of Japan, or the Investment Trust Law.

Average dividend payer and fair value.

Market Insights

Community Narratives