How Investors Are Reacting To Nomura Real Estate Master Fund (TSE:3462) Forecasting Lower Distributions for 2026

Reviewed by Sasha Jovanovic

- On October 16, 2025, Nomura Real Estate Master Fund announced lower distribution per unit for the coming periods and issued new earnings guidance, including an expected distribution of ¥3,124 per unit for both the periods ending February and August 2026, down from the previous year's payouts.

- This combination of reduced forecasted distributions and moderated profit expectations signals potential challenges in sustaining previous levels of investor returns.

- We’ll explore how the anticipated decrease in future distributions informs the evolving investment narrative around Nomura Real Estate Master Fund.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Nomura Real Estate Master Fund's Investment Narrative?

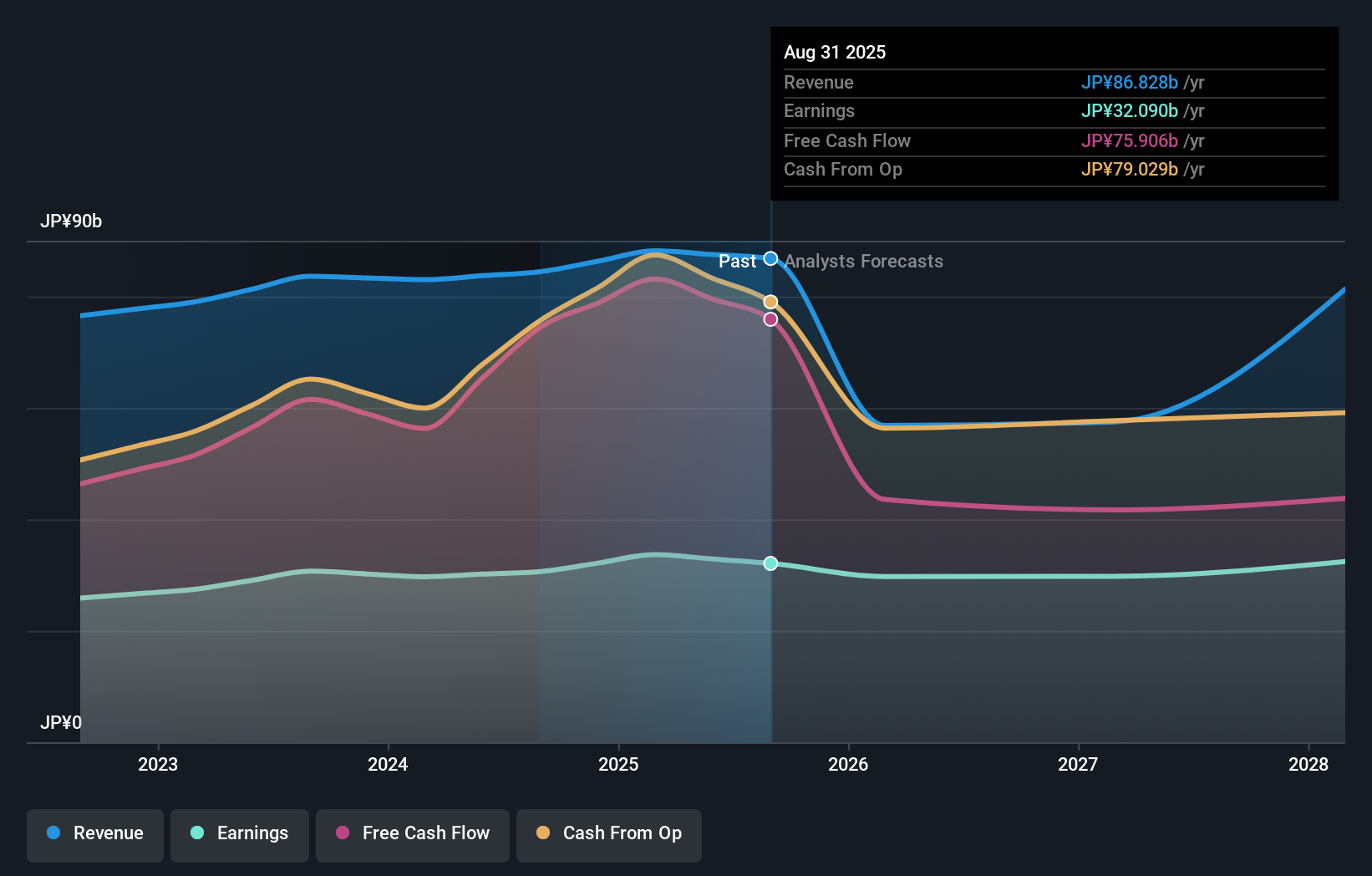

To be comfortable as a shareholder in Nomura Real Estate Master Fund right now, an investor needs to see appeal in relatively stable but modest earnings growth and continued exposure to the Japanese REITs sector, despite a higher price-to-earnings ratio compared to peers. The story here is typically about reliable dividends and solid past returns, but the October 16 announcement of lower future distributions and revised earnings guidance suggests that the outlook may be shifting. With forecasts indicating both a decline in per-unit payouts and a slight softening of net income, the immediate catalyst of income stability is weaker than before. This is a material change, as recent share price gains and steady financials had offered some reassurance. Going forward, debt coverage and the ability to uphold asset quality become even more important risks, as subdued earnings and reduced distributions may limit flexibility in responding to market changes.

On the other hand, debt coverage remains a potential pressure point that investors should keep in mind.

Exploring Other Perspectives

Explore another fair value estimate on Nomura Real Estate Master Fund - why the stock might be worth as much as ¥169367!

Build Your Own Nomura Real Estate Master Fund Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nomura Real Estate Master Fund research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nomura Real Estate Master Fund research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nomura Real Estate Master Fund's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nomura Real Estate Master Fund might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3462

Nomura Real Estate Master Fund

Nomura Real Estate Master Fund, Inc. (NMF) is a wholly owned subsidiary of the former Nomura Real Estate Master Fund Corporation (hereinafter referred to as the "Former NMF") and Nomura Real Estate Office Fund Investment Corporation (hereinafter referred to as "NOF") and Nomura Real Estate Residential Investment Corporation (hereinafter referred to as "NRF") will be the dissolved corporations in the consolidation-type merger.

6 star dividend payer with acceptable track record.

Market Insights

Community Narratives