- Japan

- /

- Residential REITs

- /

- TSE:3282

Comforia Residential REIT (TSE:3282): Evaluating Valuation Following Recent Share Buyback Completion

Reviewed by Simply Wall St

Comforia Residential REIT (TSE:3282) has wrapped up its recent share repurchase program and closed the buyback plan on October 15, 2025. This move adjusts the available share supply and has sparked conversation among investors.

See our latest analysis for Comforia Residential REIT.

Momentum has certainly been building for Comforia Residential REIT lately, with its recent buyback coinciding with a robust 17.34% share price return year-to-date and a healthy 14.71% total shareholder return over the past year. While a boost in buyback activity often signals management’s optimism, investors seem to be factoring in both sustained income potential and tighter share supply as key drivers behind the stock’s positive longer-term performance.

If the latest buyback got you thinking about where value meets growth, it might be the perfect moment to expand your search and discover fast growing stocks with high insider ownership

With the buyback now behind us and the stock up strongly this year, the real question is whether Comforia Residential REIT shares remain attractively priced, or if the market is already factoring in all the future growth.

Price-to-Earnings of 27.5x: Is it justified?

Comforia Residential REIT is trading at a price-to-earnings (P/E) ratio of 27.5x, while its last closing price stands at ¥329,500. This figure is not only above the peer average of 24.7x, but it also surpasses the global residential REITs industry average of 20.2x. This suggests a premium valuation relative to its sector.

The P/E ratio measures how much investors are willing to pay per yen of earnings. For a real estate investment trust, this multiple often reflects future growth expectations and perceived income stability. A higher multiple can indicate the market is pricing in growth or a lower risk profile, but it may also signal over-optimism if earnings growth does not materialize.

In Comforia Residential REIT’s case, the stock’s premium P/E ratio implies significant confidence in its earnings potential. However, with earnings growth over the past year just outpacing both its five-year average and the industry, and no clear evidence of strong forward projections, the elevated multiple may be hard to justify. The absence of a calculated fair value benchmark for comparison further complicates the picture. This makes it harder to assess if today’s market price reflects likely future results, especially given the limited visibility on revenue or profit expansion.

Compared to its industry peers, Comforia’s valuation looks expensive, trading well above both local and global averages. If the market expectations embedded in this multiple do not play out, there could be limited room for further upside.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 27.5x (OVERVALUED)

However, shifts in Japan's real estate market or lackluster earnings growth could quickly challenge the optimism behind Comforia Residential REIT’s current valuation.

Find out about the key risks to this Comforia Residential REIT narrative.

Another View: Discounted Cash Flow Perspective

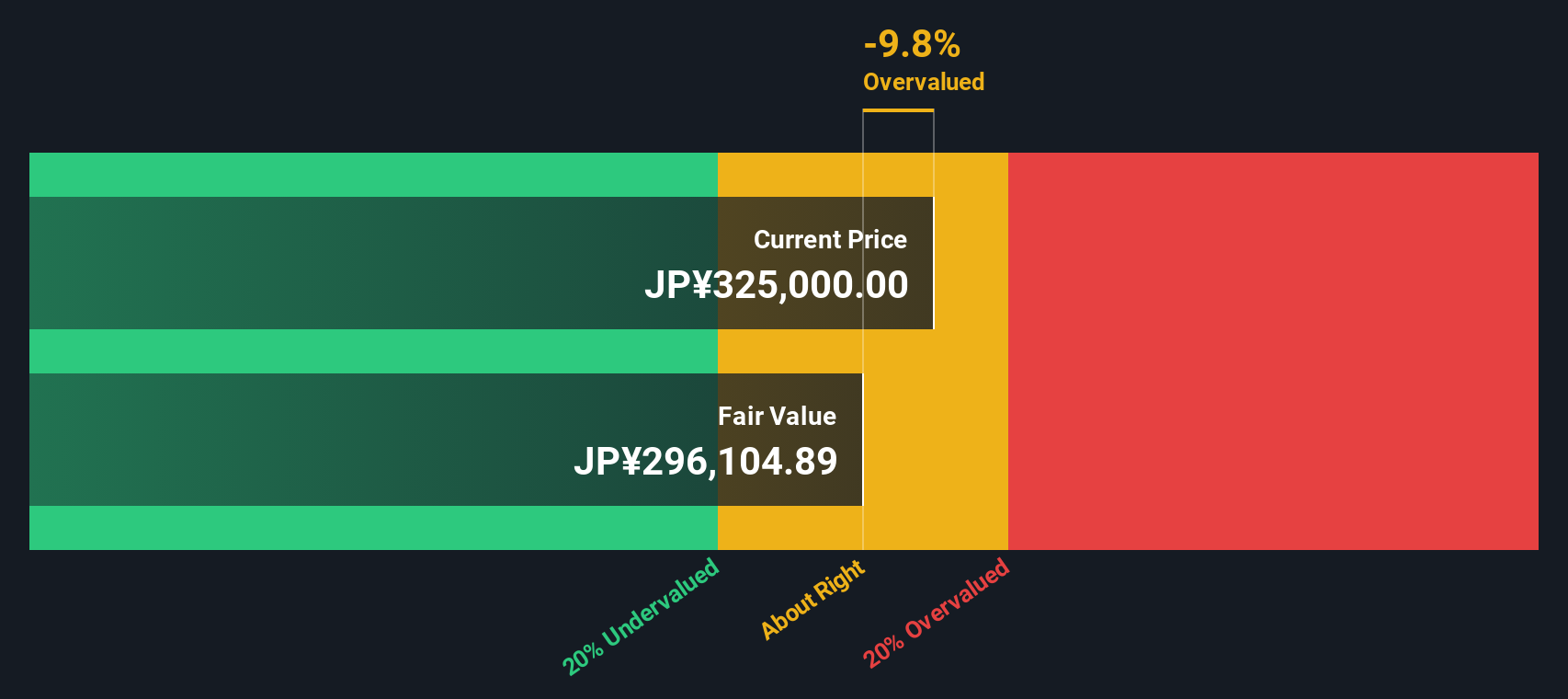

Looking at Comforia Residential REIT through the lens of our DCF model, a contrasting picture emerges. The shares are currently trading above our estimate of fair value (¥329,500 vs. ¥294,756), which indicates that the market may be pricing in more optimism than underlying cash flows suggest. This leaves investors to consider whether expectations have outpaced fundamentals, or if the business can grow to justify this premium.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Comforia Residential REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Comforia Residential REIT Narrative

If you have a different perspective or want to dive into the numbers yourself, it's easy to build your own view of the story in just a few minutes. Do it your way

A great starting point for your Comforia Residential REIT research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for More Opportunities?

There’s no need to stop your search here. Let the Simply Wall Street Screener open new doors to fresh investment ideas with real potential for growth.

- Spot high-yield opportunities by tapping into these 17 dividend stocks with yields > 3% with strong potential for stable income and attractive yields above 3%.

- Seize the edge in tomorrow’s tech with these 27 AI penny stocks that are shaping industries with artificial intelligence advancements.

- Jump on underappreciated market gems with these 876 undervalued stocks based on cash flows that may be trading below their true worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3282

Comforia Residential REIT

Comforia Residential Investment Corporation (the "Investment Corporation") was established on June 8, 2010, as an investment corporation under the Act on Investment Trusts and Investment Corporations (Act No.

Proven track record average dividend payer.

Market Insights

Community Narratives