- Japan

- /

- Residential REITs

- /

- TSE:3282

Assessing Comforia Residential REIT (TSE:3282) Valuation Following Repurchased Unit Cancellation Announcement

Reviewed by Simply Wall St

Comforia Residential REIT (TSE:3282) is drawing investor interest after announcing it will cancel around 0.4% of its previously repurchased investment units. The move, approved by the board, is seen as a reflection of active balance sheet management.

See our latest analysis for Comforia Residential REIT.

Comforia Residential REIT's move to cancel a portion of its repurchased units comes after a year of steady performance, with momentum clearly building. Its year-to-date share price return stands at a robust 18.06%, while the total return over the past year is 18.16%. Combined with a recent dividend increase and consistent capital management, these signals have caught the attention of investors looking for stable growth potential.

If proactive moves like Comforia's have you thinking about what else is gaining steam, it's a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares up more than 18% this year and trading just below analyst price targets, the key question now is whether Comforia Residential REIT still offers upside or if the market has already priced in its future growth.

Price-to-Earnings of 27.7x: Is it justified?

Comforia Residential REIT trades at a price-to-earnings (P/E) ratio of 27.7x, noticeably higher than both its direct peers and the global sector average. At a last close price of ¥331,500, this valuation suggests investors are paying a premium for future earnings compared to similar companies.

The P/E ratio represents how much investors are willing to pay today for each yen of current earnings. For real estate investment trusts, it is a widely used gauge because profits tend to be stable, making comparisons across companies and markets straightforward.

The market is assigning Comforia a steeper premium than its Japanese peers, which average 24.8x, and even more so over the global residential REITs average at 20.1x. This forward-leaning valuation implies the market either expects higher-than-average future growth or is rewarding the company for recent momentum and capital management actions. If the fair ratio were available, it would be a useful benchmark to judge whether such optimism is truly warranted or excessive.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 27.7x (OVERVALUED)

However, rising valuations and any unexpected weakness in rental demand could spark volatility. This may potentially challenge the sustained growth narrative for Comforia Residential REIT.

Find out about the key risks to this Comforia Residential REIT narrative.

Another View: Discounted Cash Flow Paints a Different Picture

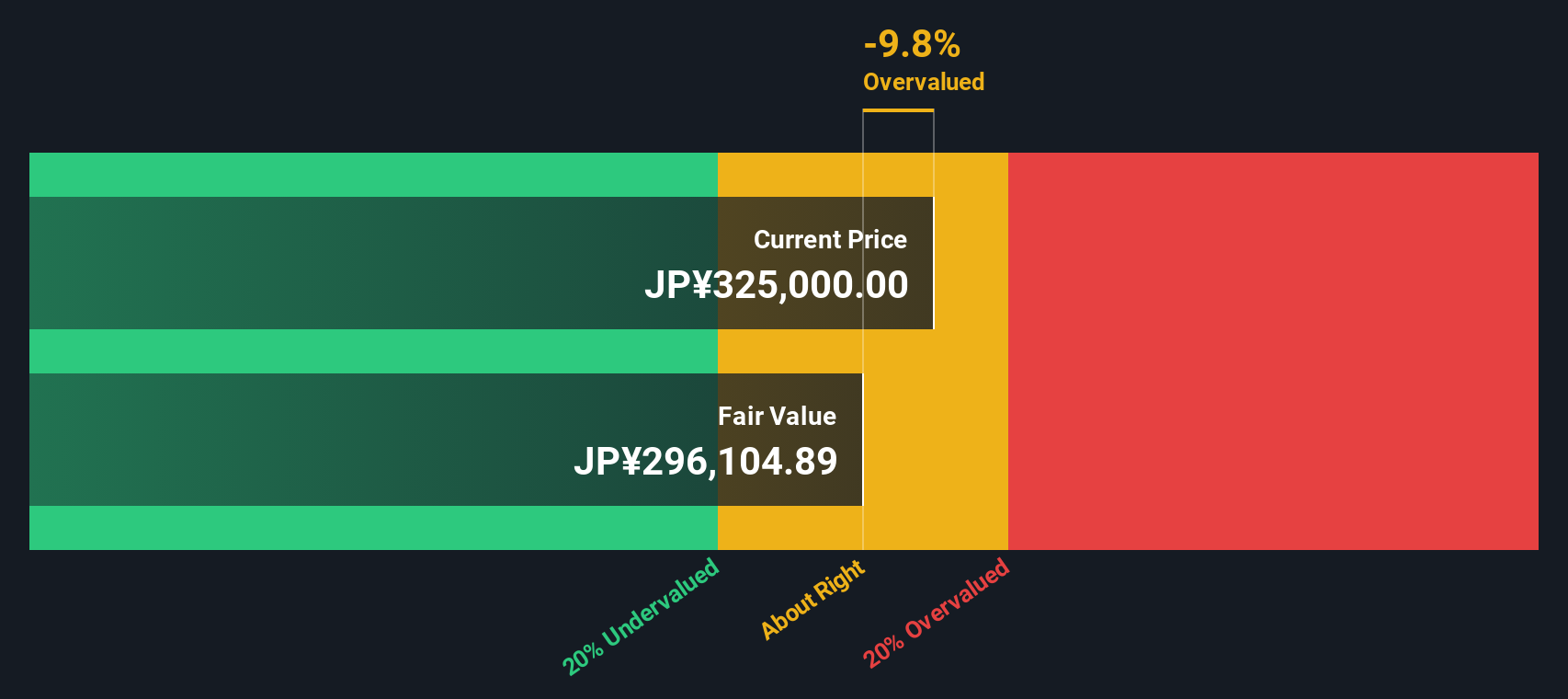

While the market’s pricing suggests confidence in Comforia Residential REIT’s growth, our DCF model tells a different story. At ¥331,500, shares are trading above our DCF estimate of fair value at ¥306,624. This indicates a notable premium, raising questions about the stock’s margin for error if expectations are not met.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Comforia Residential REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Comforia Residential REIT Narrative

If you see things differently, or want to dive deeper into the data on your own terms, crafting a personal narrative only takes a few minutes. Do it your way

A great starting point for your Comforia Residential REIT research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their radar up for the next big opportunity. Use the Simply Wall Street Screener to target your strategy and stay ahead of the crowd.

- Spot income-generating opportunities by checking out these 17 dividend stocks with yields > 3%, featuring payouts exceeding 3% and strong underlying fundamentals.

- Ride the momentum of artificial intelligence by tapping into these 25 AI penny stocks, where innovation is turning tech companies into potential leaders.

- Capitalize on mispriced gems by focusing on real value among these 918 undervalued stocks based on cash flows, helping you find stocks the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3282

Comforia Residential REIT

Comforia Residential Investment Corporation (the "Investment Corporation") was established on June 8, 2010, as an investment corporation under the Act on Investment Trusts and Investment Corporations (Act No.

Proven track record average dividend payer.

Market Insights

Community Narratives