- Japan

- /

- Real Estate

- /

- TSE:3495

Are Koryojyuhan's (TYO:3495) Statutory Earnings A Good Guide To Its Underlying Profitability?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding Koryojyuhan (TYO:3495).

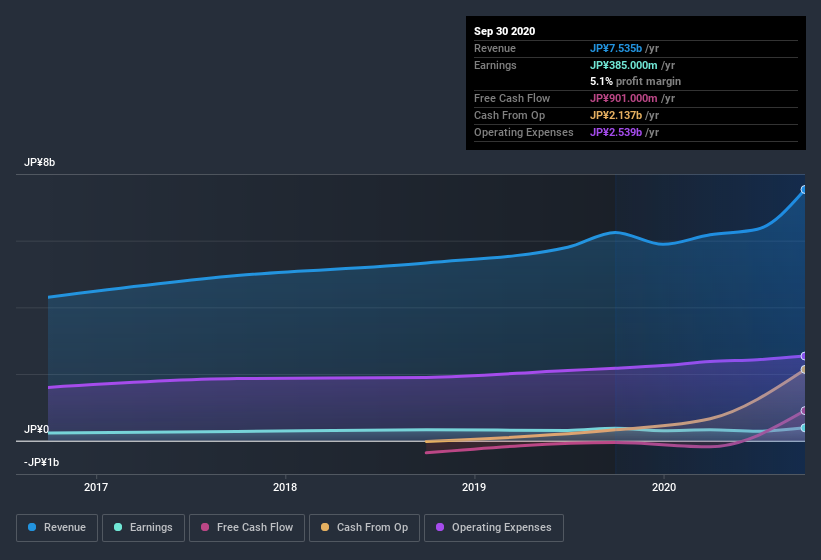

It's good to see that over the last twelve months Koryojyuhan made a profit of JP¥385.0m on revenue of JP¥7.54b. One positive is that it has grown both its profit and its revenue, over the last few years.

View our latest analysis for Koryojyuhan

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. So today we'll look at what Koryojyuhan's cashflow tells us about the quality of its earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

A Closer Look At Koryojyuhan's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

For the year to September 2020, Koryojyuhan had an accrual ratio of -0.10. Therefore, its statutory earnings were quite a lot less than its free cashflow. In fact, it had free cash flow of JP¥901m in the last year, which was a lot more than its statutory profit of JP¥385.0m. Given that Koryojyuhan had negative free cash flow in the prior corresponding period, the trailing twelve month resul of JP¥901m would seem to be a step in the right direction.

Our Take On Koryojyuhan's Profit Performance

Koryojyuhan's accrual ratio is solid, and indicates strong free cash flow, as we discussed, above. Based on this observation, we consider it likely that Koryojyuhan's statutory profit actually understates its earnings potential! And the EPS is up 5.1% annually, over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So while earnings quality is important, it's equally important to consider the risks facing Koryojyuhan at this point in time. For example, we've discovered 3 warning signs that you should run your eye over to get a better picture of Koryojyuhan.

This note has only looked at a single factor that sheds light on the nature of Koryojyuhan's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Koryojyuhan, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Koryojyuhan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSE:3495

Proven track record with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026