- Japan

- /

- Real Estate

- /

- TSE:8938

GLOME Holdings,Inc.'s (TSE:8938) Business Is Trailing The Industry But Its Shares Aren't

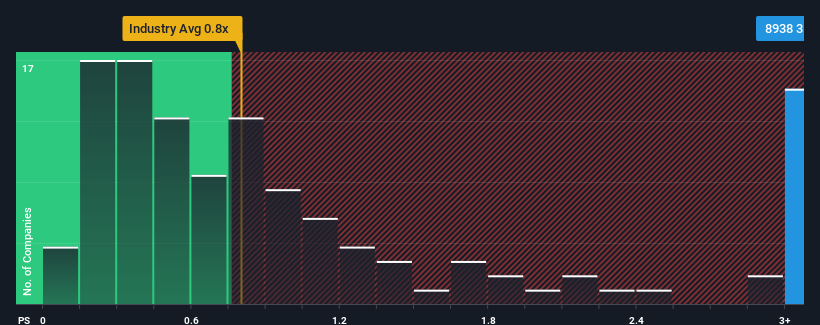

When you see that almost half of the companies in the Real Estate industry in Japan have price-to-sales ratios (or "P/S") below 0.8x, GLOME Holdings,Inc. (TSE:8938) looks to be giving off strong sell signals with its 3.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for GLOME HoldingsInc

How GLOME HoldingsInc Has Been Performing

GLOME HoldingsInc certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for GLOME HoldingsInc, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For GLOME HoldingsInc?

In order to justify its P/S ratio, GLOME HoldingsInc would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 80% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 36% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 6.6% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that GLOME HoldingsInc is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On GLOME HoldingsInc's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of GLOME HoldingsInc revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with GLOME HoldingsInc, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on GLOME HoldingsInc, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8938

GLOME HoldingsInc

Engages in the medical-related and real estate businesses in Japan and internationally.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives