Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that LAND Co., Ltd. (TSE:8918) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for LAND

What Is LAND's Net Debt?

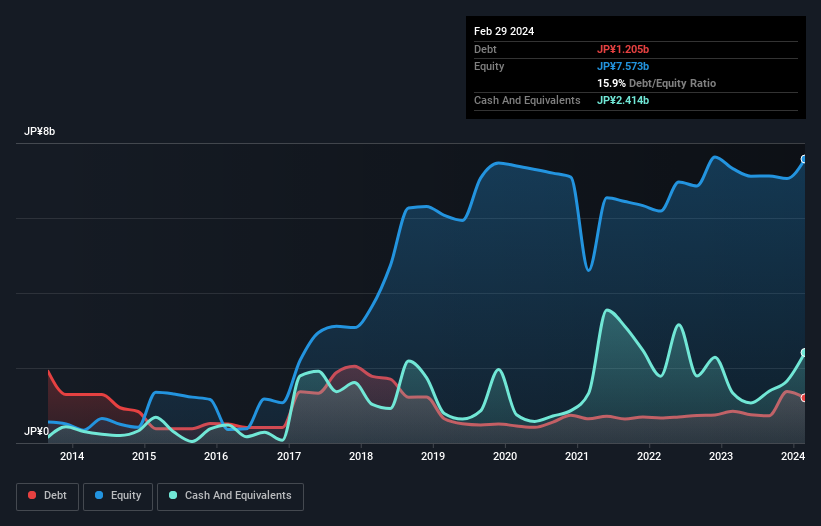

The image below, which you can click on for greater detail, shows that at February 2024 LAND had debt of JP¥1.21b, up from JP¥848.0m in one year. However, it does have JP¥2.41b in cash offsetting this, leading to net cash of JP¥1.21b.

How Healthy Is LAND's Balance Sheet?

According to the last reported balance sheet, LAND had liabilities of JP¥1.53b due within 12 months, and liabilities of JP¥748.0m due beyond 12 months. Offsetting these obligations, it had cash of JP¥2.41b as well as receivables valued at JP¥6.42b due within 12 months. So it actually has JP¥6.56b more liquid assets than total liabilities.

This luscious liquidity implies that LAND's balance sheet is sturdy like a giant sequoia tree. Having regard to this fact, we think its balance sheet is as strong as an ox. Succinctly put, LAND boasts net cash, so it's fair to say it does not have a heavy debt load!

The modesty of its debt load may become crucial for LAND if management cannot prevent a repeat of the 82% cut to EBIT over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. The balance sheet is clearly the area to focus on when you are analysing debt. But it is LAND's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. LAND may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Looking at the most recent three years, LAND recorded free cash flow of 21% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing Up

While it is always sensible to investigate a company's debt, in this case LAND has JP¥1.21b in net cash and a decent-looking balance sheet. So we don't have any problem with LAND's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with LAND (including 2 which can't be ignored) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8918

LAND

Engages in the real estate and renewable energy investment businesses.

Excellent balance sheet with low risk.

Market Insights

Community Narratives