- Japan

- /

- Entertainment

- /

- TSE:2432

Mitsui Fudosan (TSE:8801) Completes ¥39.9 Billion Buyback, Eyes 8.83% Earnings Growth Amid Debt Challenges

Reviewed by Simply Wall St

Mitsui Fudosan (TSE:8801) has recently completed a significant share buyback, totaling 29.53 million shares for ¥39,999.91 million, highlighting its commitment to enhancing shareholder value. Despite facing challenges such as decreased net profit margins and a high net debt to equity ratio, the company is poised for growth with an expected annual profit increase of 8.8% and expansion into new markets. Readers should anticipate a detailed analysis of Mitsui Fudosan's strategic initiatives, financial health, and market position in the following report.

Click here and access our complete analysis report to understand the dynamics of Mitsui Fudosan.

Competitive Advantages That Elevate Mitsui Fudosan

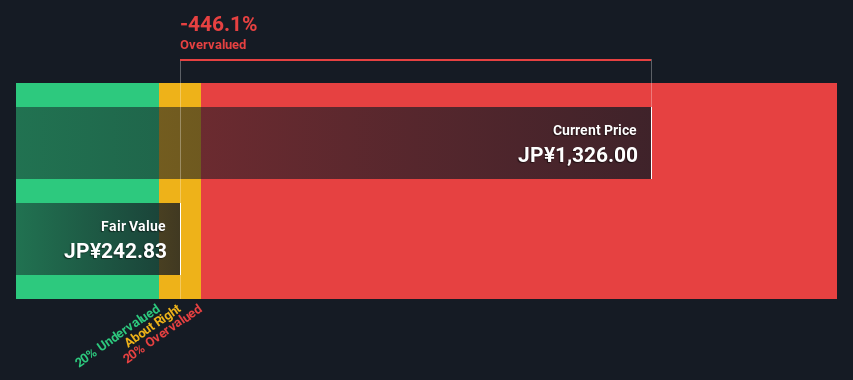

The company's earnings are set to grow at a healthy 8.83% annually, reflecting a strong market position and positive investor sentiment, with analysts forecasting a 34.3% rise in stock price. This optimism is bolstered by the experienced management team, averaging 2.5 years in tenure, which plays a crucial role in steering strategic goals and maintaining stable dividend payments over the past decade. The company's commitment to innovation, as highlighted by Executive Officer Atsuro Uchida, is evident in the positive reception of its new product lines. Furthermore, a solid balance sheet with a strong cash position supports future growth investments, enhancing its competitive edge. However, the company's share price is trading above the SWS fair ratio, indicating a potentially expensive valuation compared to industry peers.

Vulnerabilities Impacting Mitsui Fudosan

Current challenges are evident in the decreased net profit margins, now at 8.3% compared to the previous year's 10.2%, alongside a negative earnings growth of 11.4%. The high net debt to equity ratio of 136.4% signals financial strain, exacerbated by dividend payments not well-covered by earnings or cash flows, reflected in a high payout ratio of 115.5%. These financial hurdles are compounded by an inexperienced board of directors, with an average tenure of just 1.3 years, potentially affecting strategic decision-making. Additionally, operational costs have surged due to supply chain disruptions, as noted by Uchida, further impacting profitability and market competitiveness.

Growth Avenues Awaiting Mitsui Fudosan

The company is poised to capitalize on several growth opportunities. Expected annual profit growth of 8.8% surpasses the JP market average, offering a competitive advantage. Expansion into new markets and strategic partnerships are paving the way for new business opportunities, as highlighted in recent earnings calls. The growing demand for sustainable products presents another avenue for growth, with the company well-positioned to meet this trend. Moreover, recent share buybacks, totaling 29.53 million shares for ¥39,999.91 million, underscore a commitment to enhancing shareholder value through strategic financial maneuvers.

Market Volatility Affecting Mitsui Fudosan's Position

However, the company faces threats from slower revenue growth, forecasted at 2.6% annually, lagging behind the JP market average of 4.2%. This, coupled with increased competition from new entrants, poses a risk to market share. Economic uncertainties could further impact consumer spending, a concern closely monitored by the management. Regulatory changes also present potential operational challenges, as noted by Uchida. The company's debt coverage by operating cash flow remains inadequate, posing a financial risk, while the dividend yield of 2.25% is low compared to the top 25% of dividend payers in the JP market, potentially impacting investor appeal.

To gain deeper insights into Mitsui Fudosan's historical performance, explore our detailed analysis of past performance. To dive deeper into how Mitsui Fudosan's valuation metrics are shaping its market position, check out our detailed analysis of Mitsui Fudosan's Valuation.Conclusion

Mitsui Fudosan's anticipated earnings growth of 8.83% annually, supported by a strong management team and innovative product lines, reflects a positive outlook and investor confidence, with a projected 34.3% increase in stock price. However, the company's financial health is challenged by a high net debt to equity ratio of 136.4% and a dividend payout ratio of 115.5%, indicating financial strain that could hinder its strategic initiatives. The company is strategically positioned to leverage growth opportunities in new markets and sustainable products, although its share price is currently considered expensive based on its Price-To-Earnings Ratio compared to peers. This premium valuation suggests that while the market has high expectations for future performance, the company must address its financial vulnerabilities to sustain long-term growth and maintain investor appeal.

Seize The Opportunity

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:2432

Moderate growth potential with mediocre balance sheet.