- Japan

- /

- Entertainment

- /

- TSE:2432

AEON Mall (TSE:8905) Q2 Earnings Call Highlights Growth Potential and Strategic Initiatives

Reviewed by Simply Wall St

Click here to discover the nuances of AEON Mall with our detailed analytical report.

Unique Capabilities Enhancing AEON Mall's Market Position

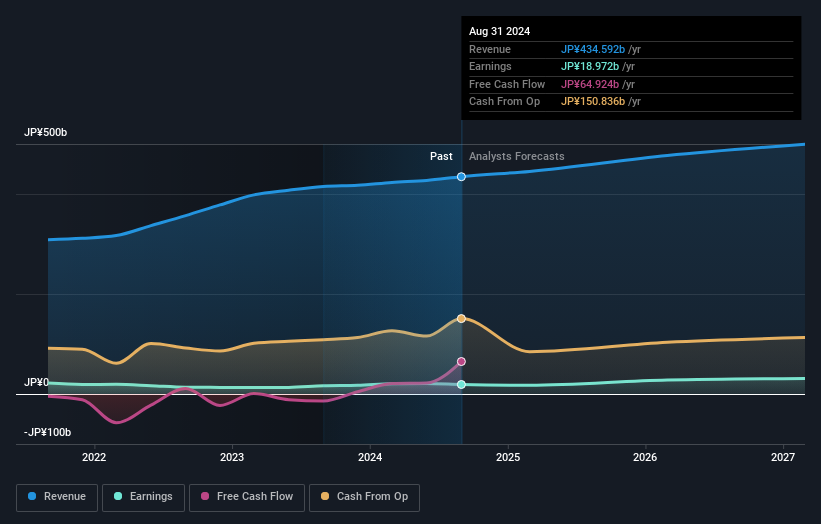

AEON Mall's impressive annual profit growth forecast of 19.6% per year is set to surpass the JP market average of 8.7%, showcasing its financial health. The company's revenue growth, expected at 5.1% annually, also exceeds the JP market's 4.2%, indicating strong market positioning. Recent earnings growth of 15.8% over the past year marks a significant improvement from the company's 5-year average of -7.2%, reflecting effective strategic initiatives. Notably, AEON Mall's net profit margins have improved to 4.4% from last year's 3.9%, demonstrating enhanced operational efficiency. The stability of its dividends, supported by a payout ratio of 90% and a cash payout ratio of 17.5%, further underscores the company's commitment to shareholder returns. The leadership's focus on innovative solutions, as highlighted by Keiji Ohno in the latest earnings call, reinforces AEON Mall's strong financial standing and strategic direction.

Challenges Constraining AEON Mall's Potential

AEON Mall faces several challenges that could constrain its growth potential. The company's Price-To-Earnings Ratio of 24x is significantly higher than the industry average of 11x and peer average of 14.1x, suggesting a potentially overvalued position. This concern is compounded by a low Return on Equity of 3.7%, which is expected to remain modest at 7% over the next three years. Additionally, AEON Mall's earnings growth, although positive, did not outperform the broader real estate industry's 17.4%. The company's high net debt to equity ratio of 107.6% poses further financial risks. Performance issues in the supply chain, as mentioned by Keiji Ohno, have also impacted the company's ability to meet demand, highlighting operational vulnerabilities.

Areas for Expansion and Innovation for AEON Mall

Opportunities for AEON Mall lie in its potential for significant earnings growth if forecasted profit increases materialize. The company is currently trading below its estimated fair value of ¥2002 compared to ¥10374.5, indicating substantial room for price appreciation. Expansion into new markets and alignment with emerging sustainability trends, as discussed in the latest earnings call, present avenues for future growth. By investing in new technologies to enhance product offerings, AEON Mall can strengthen its market position and capitalize on these emerging opportunities. Strategic alliances and product-related announcements could further bolster its competitive edge and drive long-term success.

External Factors Threatening AEON Mall

However, AEON Mall must navigate several external threats that could impact its market position. The intensifying competition within the real estate industry poses significant challenges, as noted in the earnings call. Economic factors such as inflation and interest rates may also affect consumer spending, potentially impacting the company's financial performance. Additionally, regulatory changes could introduce new compliance costs, affecting operational efficiency. The management's relative inexperience may further complicate strategic decision-making, potentially hindering the company's ability to adapt to these external pressures effectively.

To gain deeper insights into AEON Mall's historical performance, explore our detailed analysis of past performance. To dive deeper into how AEON Mall's valuation metrics are shaping its market position, check out our detailed analysis of AEON Mall's Valuation.Conclusion

AEON Mall's impressive projected profit growth and revenue expansion underscore its strong market positioning and operational efficiency, suggesting a promising future performance. However, the company's high Price-To-Earnings Ratio of 24x, compared to the industry average of 11x and peer average of 14.1x, indicates a premium valuation that may not be justified by its modest Return on Equity and high debt levels. While AEON Mall has opportunities for growth through market expansion and innovation, it must address supply chain vulnerabilities and navigate external economic pressures to maintain its competitive edge. The company's ability to capitalize on these opportunities while managing financial risks will be crucial in determining its long-term success.

Taking Advantage

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:2432

Moderate growth potential with mediocre balance sheet.