- Japan

- /

- Entertainment

- /

- TSE:2432

Fidelity National Financial (NYSE:FNF) to Present at Barclays Conference Highlighting Earnings Growth

Reviewed by Simply Wall St

Take a closer look at Fidelity National Financial's potential here.

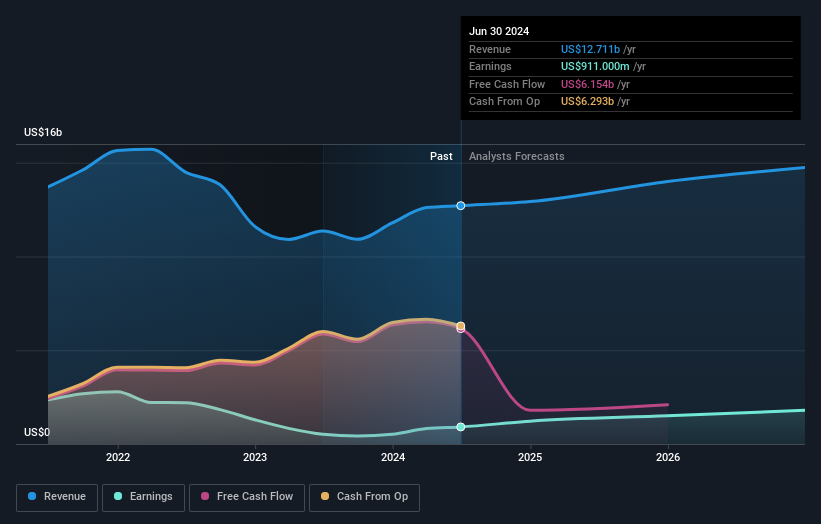

Innovative Factors Supporting Fidelity National Financial

Fidelity National Financial (FNF) demonstrates growth and profitability, with earnings forecasted to increase by 25.5% annually, surpassing the US market average. CEO Mike Nolan highlighted strong performance across core business segments, while CFO Lisa Foxworthy-Parker noted technological investments that have significantly boosted operational efficiency. These advancements, coupled with a 76.2% earnings growth over the past year, underscore FNF's high-quality earnings and improved net profit margins of 7.2%. The company's strategic initiatives are supported by a solid balance sheet, enabling continued dividend growth over the past decade. Despite being perceived as expensive with a Price-To-Earnings Ratio of 18x, higher than the industry average, FNF's trading below its SWS fair value suggests potential for future appreciation.

Critical Issues Affecting Fidelity National Financial's Performance and Areas for Growth

FNF faces challenges with its revenue growth forecasted at 6.4% annually, lagging behind the US market average. The company's Return on Equity stands at 12.2%, below the desired 20% threshold, indicating room for improvement. COO John Campbell acknowledged underperformance in certain segments, while VP of Operations Wendy Jane Young pointed to increased operational costs impacting margins. The competitive environment poses additional hurdles, as maintaining market share becomes increasingly difficult. The company's valuation, with a Price-To-Earnings Ratio of 18x, further highlights financial challenges, suggesting a need for strategic adjustments to enhance performance.

Emerging Markets Or Trends for Fidelity National Financial

FNF is well-positioned to capitalize on emerging market opportunities, as noted by CFO Lisa Foxworthy-Parker. The company is actively exploring expansion in these areas, which could significantly enhance its market position. The shift towards digital solutions presents a chance for innovation and customer acquisition, aligning with strategic initiatives aimed at boosting engagement and retention. Trading at 43% below estimated fair value, FNF's potential for price appreciation is promising, especially with anticipated significant earnings growth over the next three years. These factors could bolster investor confidence and drive long-term success.

External Factors Threatening Fidelity National Financial

FNF must navigate a competitive environment, as competitors aggressively target its market share. Economic uncertainties pose risks to growth projections, as highlighted by CFO Lisa Foxworthy-Parker. Regulatory changes could also impact operational strategies and cost structures, necessitating vigilance and adaptability. Insider selling over the past three months suggests potential concerns about internal confidence. Additionally, operational risks require careful management to ensure service delivery remains uninterrupted. These external factors, coupled with a high Price-To-Earnings Ratio, underscore the need for strategic foresight to mitigate threats and sustain growth.

To gain deeper insights into Fidelity National Financial's historical performance, explore our detailed analysis of past performance. To dive deeper into how Fidelity National Financial's valuation metrics are shaping its market position, check out our detailed analysis of Fidelity National Financial's Valuation.Conclusion

Fidelity National Financial's earnings growth and technological advancements have driven operational efficiency, positioning the company for continued profitability despite challenges. While its Price-To-Earnings Ratio of 18x is higher than the industry and peer averages, indicating a premium valuation, the stock's trading below its estimated fair value suggests room for price appreciation. However, the company must address its slower revenue growth and lower-than-desired Return on Equity by optimizing underperforming segments and managing operational costs. By capitalizing on emerging market opportunities and digital solutions, Fidelity National Financial can enhance market position and investor confidence, ensuring sustainable growth amid competitive pressures and economic uncertainties.

Turning Ideas Into Actions

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:2432

Moderate growth potential with mediocre balance sheet.