Stock Analysis

- Japan

- /

- Semiconductors

- /

- TSE:6920

Exploring Three Japanese Growth Companies With High Insider Ownership On The Tokyo Stock Exchange

Reviewed by Simply Wall St

Amidst a backdrop of mixed weekly returns and a strengthening yen posing challenges for Japanese exporters, the Tokyo Stock Exchange presents a unique landscape for investors. In this context, exploring growth companies with high insider ownership could offer an intriguing opportunity, as these firms often demonstrate alignment between management's interests and those of their shareholders, potentially fostering resilience and long-term value creation in fluctuating markets.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.4% | 26.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| Hottolink (TSE:3680) | 27% | 57.3% |

| Medley (TSE:4480) | 34% | 28.7% |

| Micronics Japan (TSE:6871) | 15.3% | 39.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

| ExaWizards (TSE:4259) | 24.8% | 91.1% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

| Soracom (TSE:147A) | 17.2% | 54.1% |

| freee K.K (TSE:4478) | 24% | 80.9% |

Let's dive into some prime choices out of from the screener.

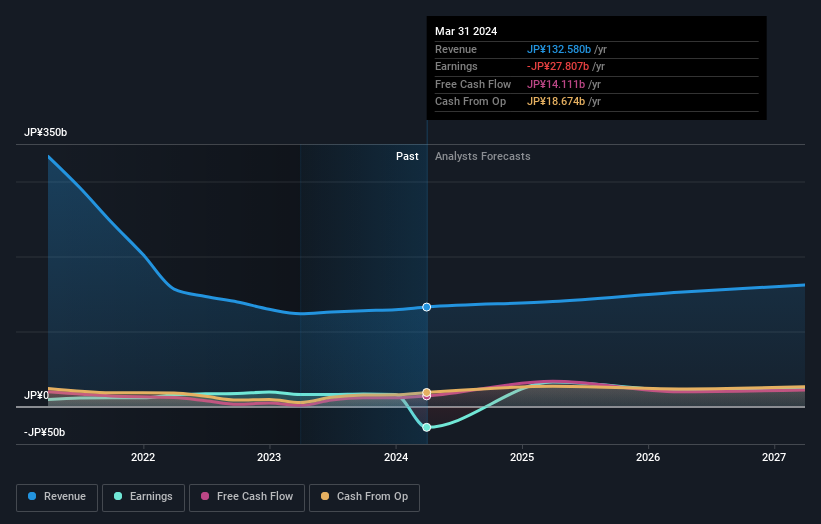

Micronics Japan (TSE:6871)

Simply Wall St Growth Rating: ★★★★★★

Overview: Micronics Japan Co., Ltd. operates globally, developing, manufacturing, and selling testing and measurement equipment primarily for semiconductors and LCD systems, with a market capitalization of approximately ¥235.34 billion.

Operations: The company's revenue is primarily derived from the development, manufacture, and sale of semiconductor and LCD testing and measurement equipment.

Insider Ownership: 15.3%

Earnings Growth Forecast: 39.7% p.a.

Micronics Japan is trading at 41.3% below its estimated fair value, signaling potential undervaluation. The company's earnings are forecasted to grow by 39.73% annually, outpacing the Japanese market average significantly. Despite a highly volatile share price recently, its projected revenue growth rate stands at 23.3% per year, also well above the market trend. However, it's important to note a decline in profit margins from last year and no recent insider buying activity has been reported.

- Dive into the specifics of Micronics Japan here with our thorough growth forecast report.

- Our expertly prepared valuation report Micronics Japan implies its share price may be too high.

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★★☆

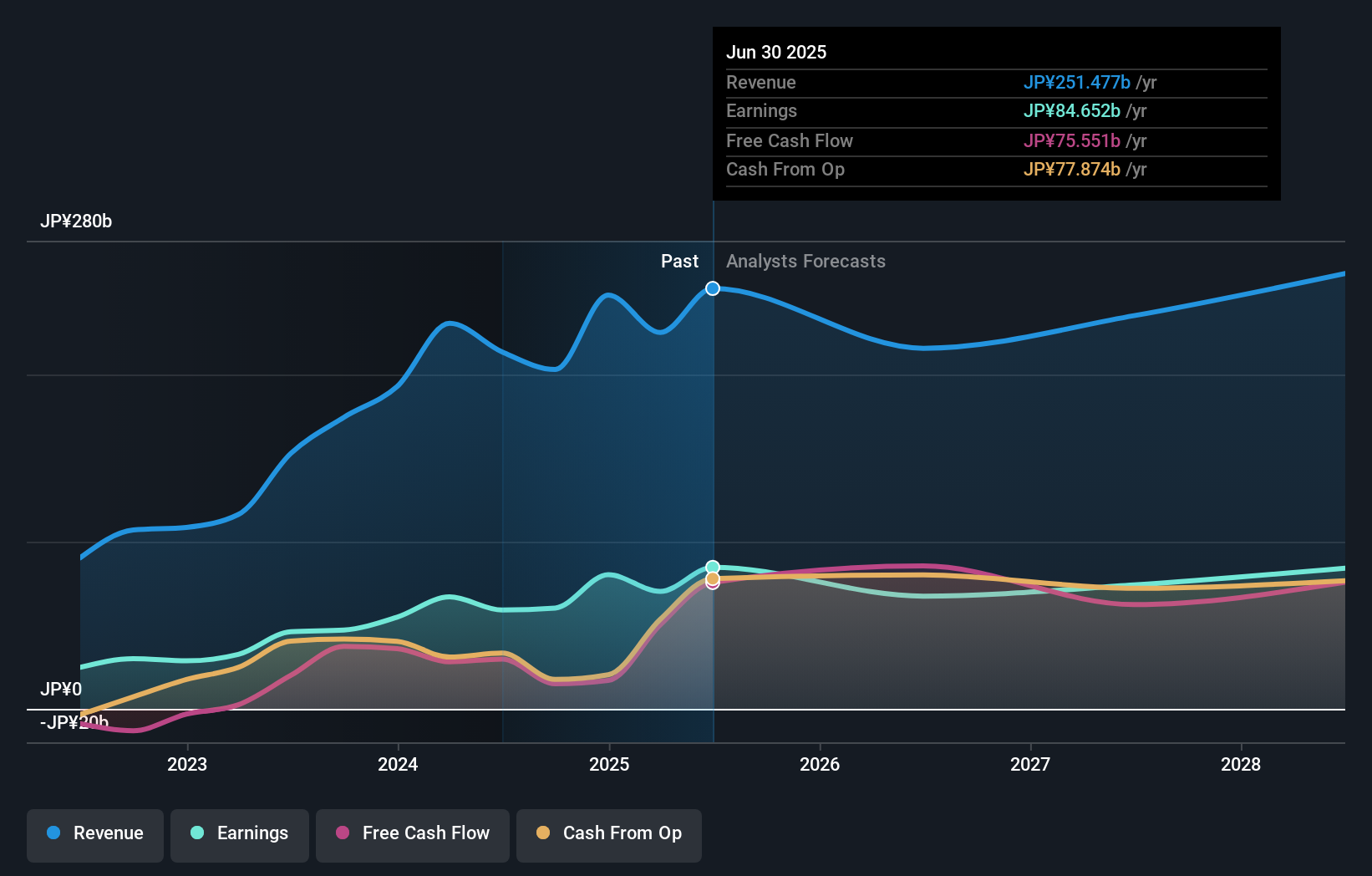

Overview: Lasertec Corporation, which designs, manufactures, and sells inspection and measurement equipment both in Japan and internationally, has a market capitalization of approximately ¥3.39 trillion.

Operations: The company generates its revenue from the design, manufacture, and sale of inspection and measurement equipment globally.

Insider Ownership: 12.1%

Earnings Growth Forecast: 20.1% p.a.

Lasertec Corporation, a Japanese firm with significant insider leadership changes, reported robust sales growth, with JPY 157.2 billion in the first three quarters of FY2024, doubling the previous year's total for its ACTIS Series. Despite a highly volatile share price, Lasertec is expected to see substantial earnings growth over the next three years at an annual rate of 20.12%, outpacing the Japanese market significantly. However, there's no recent data on insider trading activities post-executive reshuffle.

- Click here to discover the nuances of Lasertec with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Lasertec's share price might be too optimistic.

Relo Group (TSE:8876)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Relo Group, Inc. operates in Japan, offering property management services with a market capitalization of approximately ¥253.26 billion.

Operations: Relo Group's revenue is primarily generated from its relocation business (¥92.67 billion), welfare services (¥25.32 billion), and tourism activities (¥14.16 billion).

Insider Ownership: 27.5%

Earnings Growth Forecast: 45.7% p.a.

Relo Group, a Japanese company with significant insider ownership, is navigating a transformative phase aimed at enhancing corporate governance by proposing amendments to its Articles of Incorporation. Despite trading 34.1% below its estimated fair value and possessing a volatile share price, Relo Group forecasts revenue growth at 7% per year, outpacing the Japanese market's 4.1%. However, it carries high debt levels and its dividends are not well-covered by earnings. The firm expects substantial profit growth in the coming years with forecasted earnings growth of 45.65% annually.

- Navigate through the intricacies of Relo Group with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Relo Group implies its share price may be lower than expected.

Taking Advantage

- Reveal the 104 hidden gems among our Fast Growing Japanese Companies With High Insider Ownership screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Lasertec is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Flawless balance sheet with high growth potential.