- Japan

- /

- Real Estate

- /

- TSE:8804

Why Tokyo Tatemono (TSE:8804) Is Up 13.4% After Reviewing Dividend and Share Cancellation Plans

Reviewed by Sasha Jovanovic

- Tokyo Tatemono recently held a board meeting on November 13, 2025, to consider revisions to its full-year consolidated financial results forecast, dividend forecast, and the possible cancellation of its own shares under Article 178 of the Companies Act.

- This agenda signals the company's intent to actively manage its capital structure and shareholder returns, reflecting significant decisions that may shape future corporate direction and investor expectations.

- We'll examine how the review of dividend policy and potential share cancellation could influence Tokyo Tatemono's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Tokyo Tatemono's Investment Narrative?

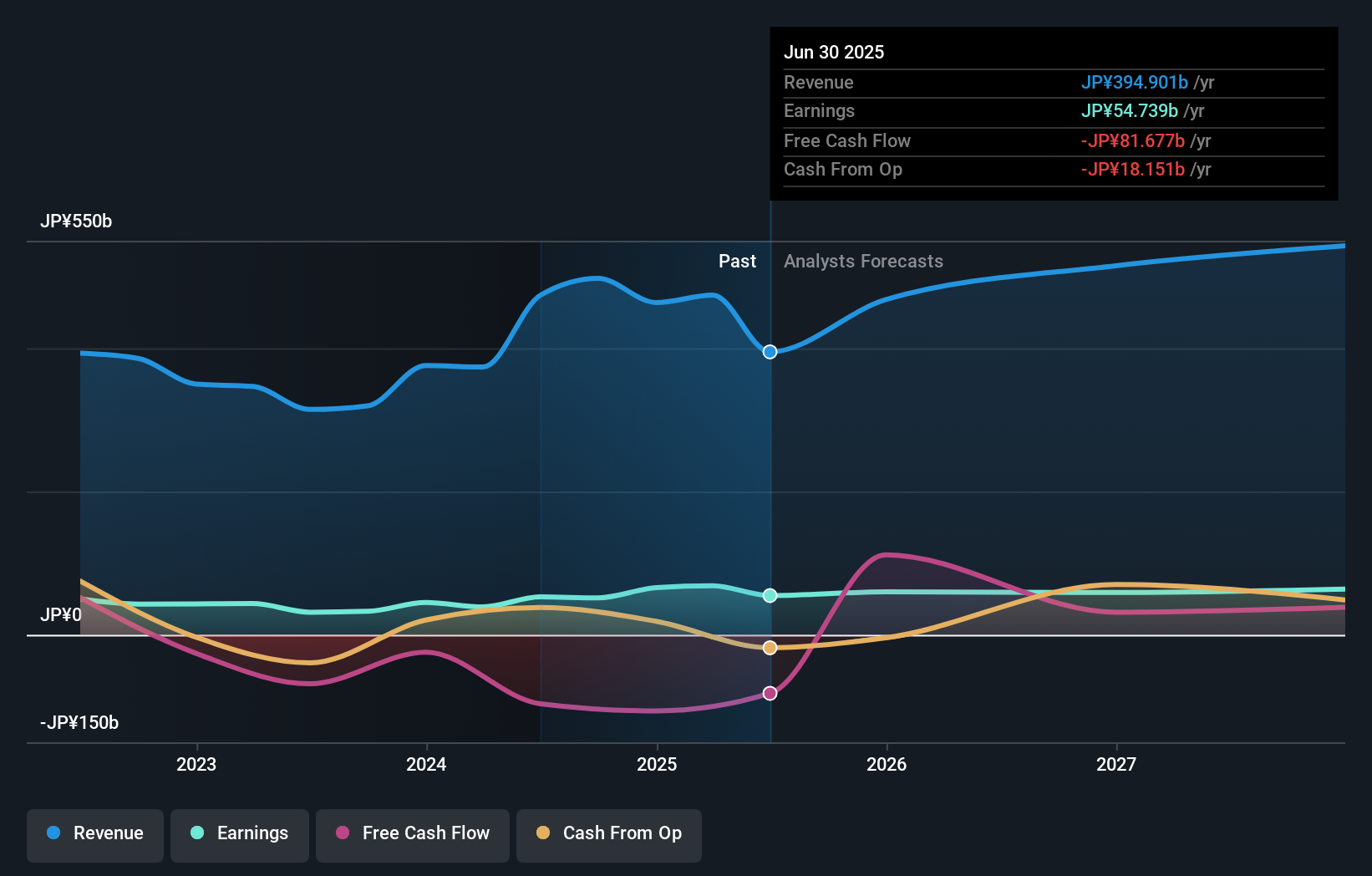

For shareholders in Tokyo Tatemono, the big picture story is a mix of ongoing earnings momentum, frequent dividends, and tangible buybacks that reflect active stewardship. The board’s latest move to review forecasts, dividend policy, and the possible cancellation of shares is significant because it suggests the company may adjust its near-term outlook or capital return policy. This could have real implications for short-term catalysts such as dividend growth and share price performance, especially given strong price gains and sustained dividend hikes announced prior to this news. However, the headline risk remains: large one-off earnings items have recently impacted results, so revised forecasts could recalibrate growth expectations or highlight the need for further balance sheet discipline. For now, this board decision is a catalyst that might influence both perceived opportunity and risk in holding the stock, and it’s vital to watch how these board measures play out in upcoming disclosures.

But, beneath the company’s capital return moves, one-off earnings items remain a key risk that investors should watch. Tokyo Tatemono's shares are on the way up, but they could be overextended by 46%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Tokyo Tatemono - why the stock might be worth 5% less than the current price!

Build Your Own Tokyo Tatemono Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tokyo Tatemono research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Tokyo Tatemono research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tokyo Tatemono's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Tatemono might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8804

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives