- Japan

- /

- Real Estate

- /

- TSE:3289

Tokyu Fudosan Holdings (TSE:3289): Evaluating Valuation Following Strong Recent Share Price Gains

Reviewed by Simply Wall St

Tokyu Fudosan Holdings (TSE:3289) has seen its stock gaining momentum, with the share price climbing over 9% in the past week and about 14% over the past month. This uptick has caught investors’ attention, prompting renewed interest in the company’s recent trends and long-term prospects.

See our latest analysis for Tokyu Fudosan Holdings.

Tokyu Fudosan Holdings’ recent rally builds on an already strong run, with momentum accelerating as the share price return is up 42.6% year-to-date. Long-term investors have enjoyed a staggering 225.8% total shareholder return over five years. The latest gains suggest the market is warming to the company’s outlook, possibly reflecting shifting sentiment around its future earnings and assets.

If the sustained momentum in real estate stocks has you looking beyond Tokyu Fudosan Holdings, now’s a great moment to discover fast growing stocks with high insider ownership.

But with the share price rallying so quickly, is Tokyu Fudosan Holdings’ stock still undervalued? Or are investors already pricing in the company’s future growth, leaving little room for upside?

Price-to-Earnings of 9.4x: Is it justified?

Tokyu Fudosan Holdings currently trades at a price-to-earnings (P/E) ratio of 9.4x, noticeably lower than both the industry average and the broader Japanese market. At the recent closing price of ¥1,375.5, the company appears to offer investors value relative to peers.

The price-to-earnings multiple compares the company’s share price to its earnings per share, providing a snapshot of how much investors are willing to pay for each yen of earnings. In the real estate sector, a lower P/E can signal the market’s cautious outlook or, alternatively, a potential opportunity if fundamentals are strong.

Tokyu Fudosan Holdings stands out because its current P/E of 9.4x is cheaper than the peer average of 13.1x and the JP market average of 14.3x. In addition, the estimated fair P/E ratio is 14.8x. This indicates significant room for multiple expansion should sentiment shift. This favorable disparity suggests the market may be undervaluing the company’s sustained earnings growth and profit momentum.

Explore the SWS fair ratio for Tokyu Fudosan Holdings

Result: Price-to-Earnings of 9.4x (UNDERVALUED)

However, ongoing net income declines and a share price now above analyst targets could limit further gains if performance does not improve soon.

Find out about the key risks to this Tokyu Fudosan Holdings narrative.

Another View: What Does the DCF Model Say?

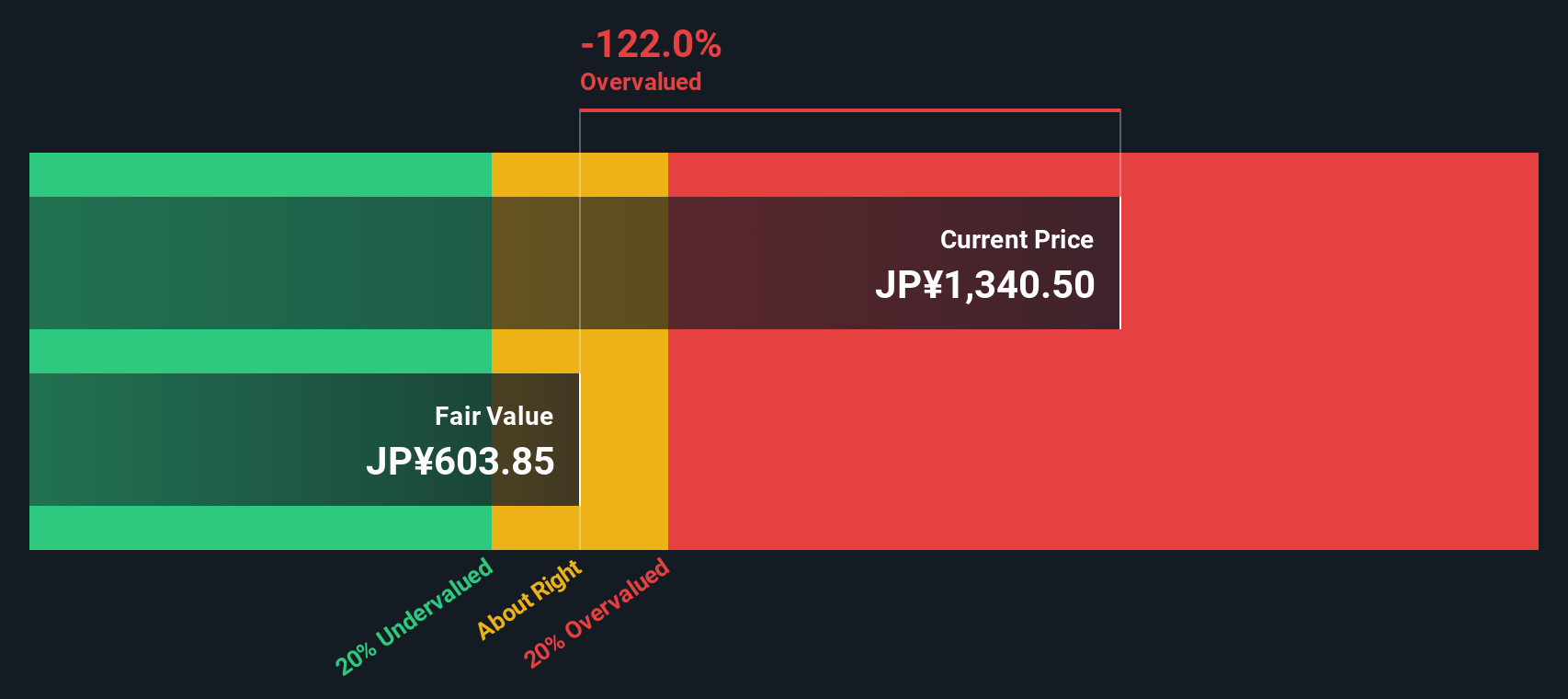

Looking from a different angle, our DCF model takes expected future cash flows into account rather than focusing on current earnings. This model suggests Tokyu Fudosan Holdings’ shares could actually be overvalued, trading well above its estimated fair value. Does that challenge the low multiple story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokyu Fudosan Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokyu Fudosan Holdings Narrative

If you want a fresh perspective or simply trust your own research, you can uncover the story yourself in just a few minutes, and Do it your way.

A great starting point for your Tokyu Fudosan Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your potential when you could uncover stocks set to redefine your portfolio? Act now and tap into opportunities that others will wish they found first.

- Maximize your passive income stream by checking out these 15 dividend stocks with yields > 3% offering strong yields and reliable payouts in today’s market.

- Ride the momentum of rapid innovation and see how you could benefit from these 27 AI penny stocks at the forefront of artificial intelligence breakthroughs.

- Seize the untapped potential in pioneering firms with these 27 quantum computing stocks shaping the future of computing and advanced technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyu Fudosan Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3289

Tokyu Fudosan Holdings

Engages in the real estate business in Japan and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives