- Japan

- /

- Real Estate

- /

- TSE:2337

Ichigo (TSE:2337): Evaluating Valuation Potential as Shares Hold Steady After Recent Gains

Reviewed by Simply Wall St

Ichigo (TSE:2337) shares have moved little in recent days, with the stock holding steady after a period of moderate gains over the past month. Investors are watching closely to see whether positive momentum can push the stock further.

See our latest analysis for Ichigo.

Ichigo’s steadier share price recently sits on the back of moderate gains for the year, with a 5.6% 30-day share price return and a 6.4% gain year-to-date reflecting growing investor optimism. Over the past three years, Ichigo has delivered a total shareholder return of 36%, suggesting longer-term momentum has a firm foundation.

If you’re keen to explore what else is gaining traction, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares holding steady after recent gains, the real question for investors is whether Ichigo is trading at a discount to its true value or if the current price already reflects its growth potential. This could leave little room for upside.

Most Popular Narrative: 5% Undervalued

Ichigo’s narrative-backed fair value stands higher than the last close, pointing to a moderate valuation gap that has caught market attention. What’s behind this perceived upside? Let’s look at what analysts see as the key catalyst.

Ichigo's ability to leverage real estate inflation by delivering higher-value real estate at lower costs is enhancing its competitiveness, which will positively impact future revenue and profit margins.

Curious why the valuation isn’t higher? It all comes down to the interplay of consistent earnings growth and margin dynamics baked into this fair value. The most striking element is that analysts are making some bold foundational projections about Ichigo’s future. Want to know what they’re really expecting? Uncover the numbers driving this narrative’s price target.

Result: Fair Value of ¥420 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising interest rates or continued underperformance in Ichigo’s clean energy segment could also present significant challenges to the current optimism reflected in the valuation.

Find out about the key risks to this Ichigo narrative.

Another View: Relative Value Signals

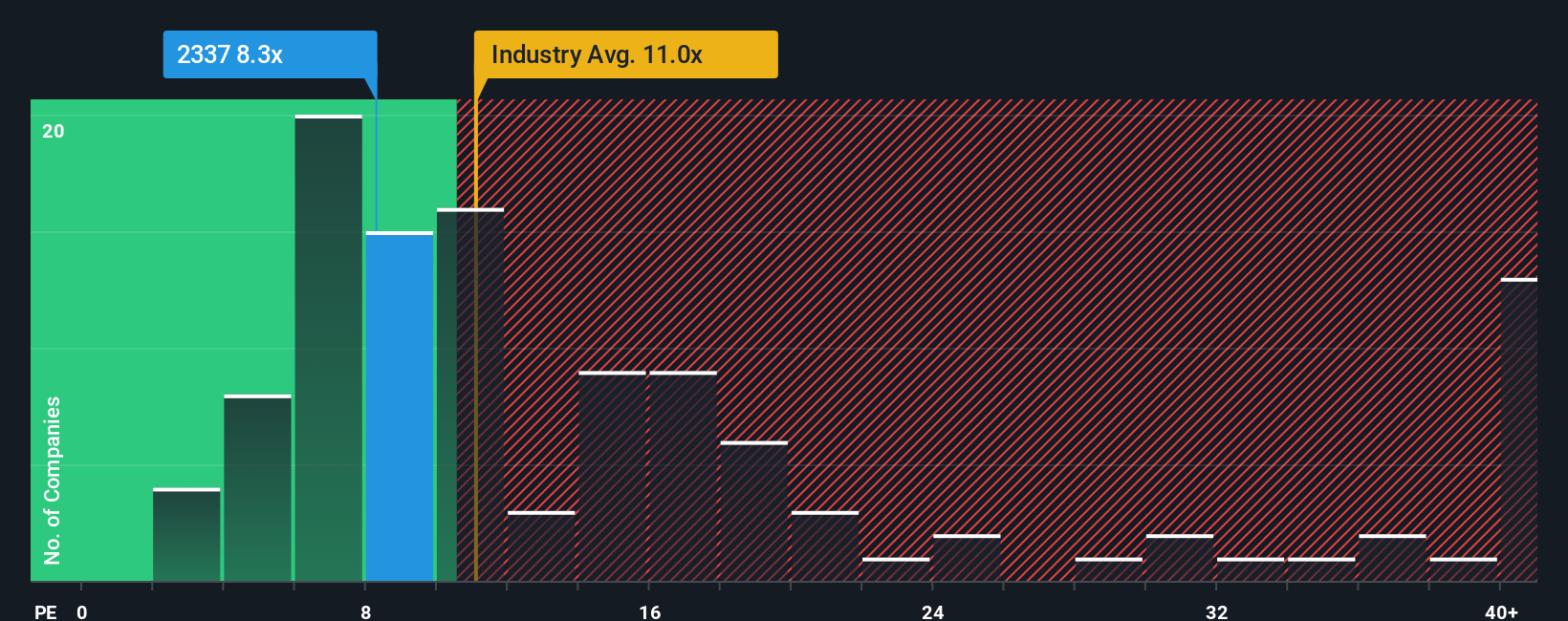

Looking from an earnings multiple perspective, Ichigo’s ratio of 8.9x is well below the industry average of 11.4x and its peer average of 21.5x. It is also beneath the estimated fair ratio of 12.1x, which may indicate both undervaluation and potential opportunity. But will the market ever re-rate Ichigo closer to these benchmarks?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ichigo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 921 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ichigo Narrative

If you think there’s a different story, or enjoy digging into the data firsthand, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your Ichigo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great investors never settle for the obvious. Right now, some of the market’s best opportunities are flying just under the radar, waiting for you to take action.

- Target stronger cash flows by evaluating these 921 undervalued stocks based on cash flows, which are positioned for long-term upside due to compelling valuations and robust fundamentals.

- Uncover future dividend potential and stable income streams with these 15 dividend stocks with yields > 3%, which offer yields above 3% and solid payout histories.

- Be among the first to identify the surge in artificial intelligence by reviewing these 26 AI penny stocks, which are set to benefit from rapid advances and sector demand.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2337

Proven track record average dividend payer.

Market Insights

Community Narratives