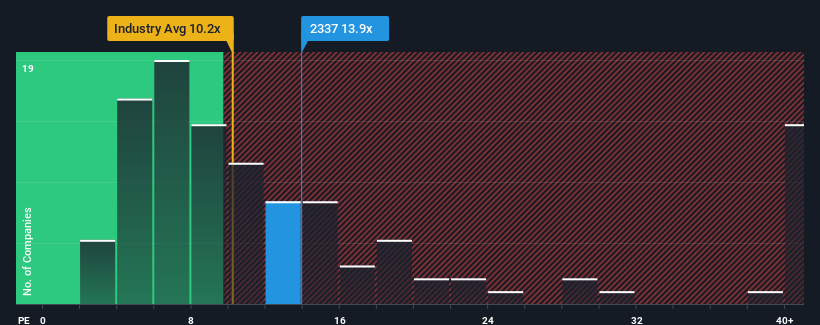

With a median price-to-earnings (or "P/E") ratio of close to 12x in Japan, you could be forgiven for feeling indifferent about Ichigo Inc.'s (TSE:2337) P/E ratio of 13.9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Ichigo's earnings growth of late has been pretty similar to most other companies. It seems that many are expecting the mediocre earnings performance to persist, which has held the P/E back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Check out our latest analysis for Ichigo

Is There Some Growth For Ichigo?

The only time you'd be comfortable seeing a P/E like Ichigo's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 12% last year. The latest three year period has also seen an excellent 359% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 17% per annum over the next three years. That's shaping up to be materially higher than the 9.7% per annum growth forecast for the broader market.

In light of this, it's curious that Ichigo's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Ichigo's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 4 warning signs for Ichigo (1 is concerning!) that you need to take into consideration.

You might be able to find a better investment than Ichigo. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2337

Proven track record average dividend payer.

Market Insights

Community Narratives